Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Consider each of the following independent situations. Situation 1: As part of your audit of Case Ltd, a manufacturer of outdoor furniture, you attended

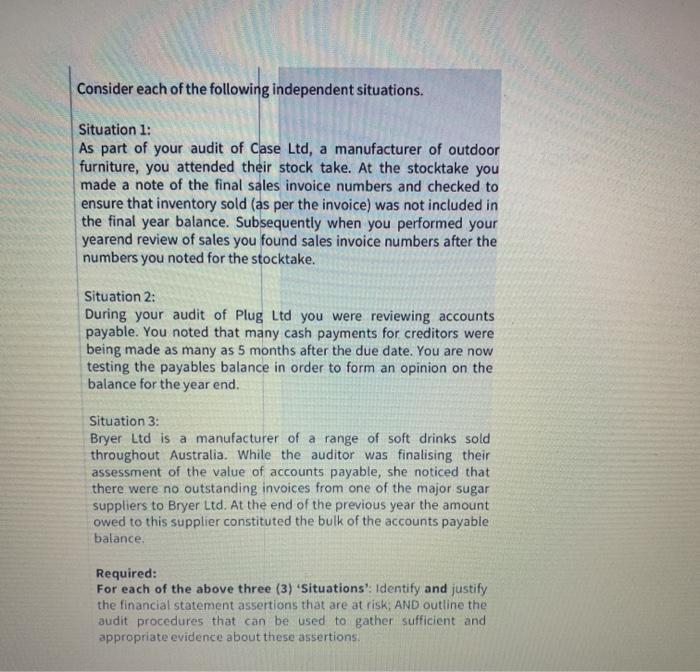

Consider each of the following independent situations. Situation 1: As part of your audit of Case Ltd, a manufacturer of outdoor furniture, you attended their stock take. At the stocktake you made a note of the final sales invoice numbers and checked to ensure that inventory sold (as per the invoice) was not included in the final year balance. Subsequently when you performed your yearend review of sales you found sales invoice numbers after the numbers you noted for the stocktake. Situation 2: During your audit of Plug Ltd you were reviewing accounts payable. You noted that many cash payments for creditors were being made as many as 5 months after the due date. You are now testing the payables balance in order to form an opinion on the balance for the year end. Situation 3: Bryer Ltd is a manufacturer of a range of soft drinks sold throughout Australia. While the auditor was finalising their assessment of the value of accounts payable, she noticed that there were no outstanding invoices from one of the major sugar suppliers to Bryer Ltd. At the end of the previous year the amount owed to this supplier constituted the bulk of the accounts payable balance. Required: For each of the above three (3) 'Situations': Identify and justify the financial statement assertions that are at risk; AND outline the audit procedures that can be used to gather sufficient and appropriate evidence about these assertions.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Situation1 As per the given case there are misstatements in the Inventory As we can see from the cas...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started