Question

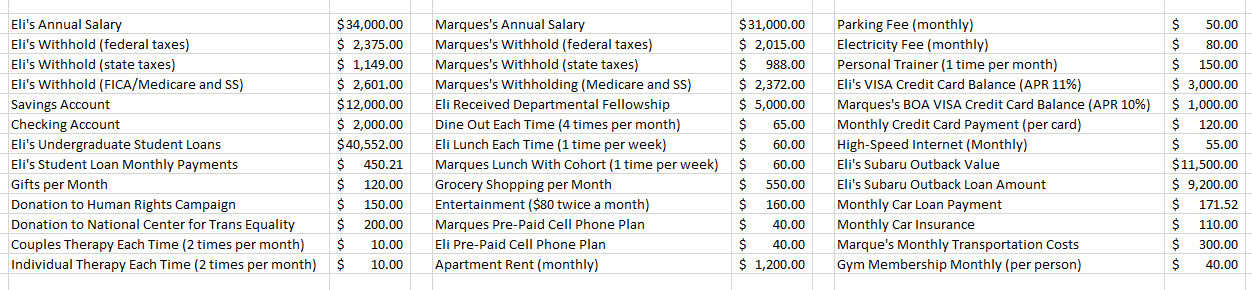

Consider Eli and Marques's financial information below as you create a balance sheet, and cash flow statement, and analyze their CURRENT financial rations. Make sure

Consider Eli and Marques's financial information below as you create a balance sheet, and cash flow statement, and analyze their CURRENT financial rations. Make sure you double-check the amounts given in the case study to see if any were mistakenly left off this list.

4. Financial Goals (6 points) Based on what you know about Eli and Marques develop three financial goals (one short-term, one mid-range, and one long-term) that you would recommend they work toward. Write out these goals and explain why each is important for Eli and Marquess financial health. You will need to write 3 SMART Goals. Use the example in Week 3s course module.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started