Question: Consider the following fixed-for-fixed currency swap in U.S. dollars and Swiss francs. The notional principals are CHF76,824,000 and USD72,000,000, and the CHF rate is

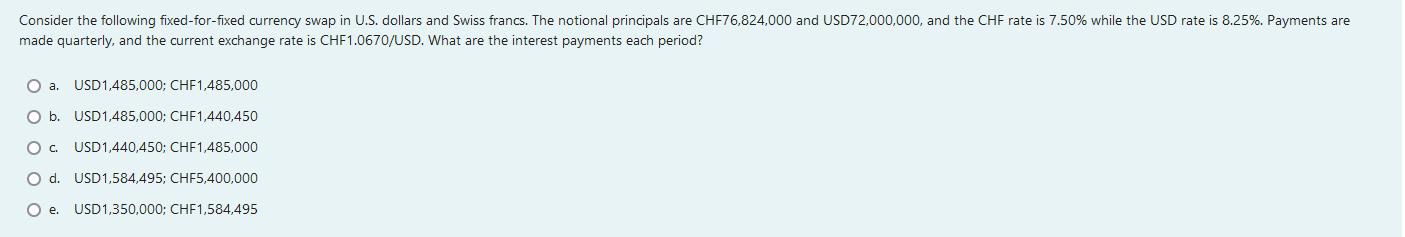

Consider the following fixed-for-fixed currency swap in U.S. dollars and Swiss francs. The notional principals are CHF76,824,000 and USD72,000,000, and the CHF rate is 7.50% while the USD rate is 8.25%. Payments are made quarterly, and the current exchange rate is CHF1.0670/USD. What are the interest payments each period? Oa. USD1,485,000; CHF1,485,000 O b. USD1,485,000; CHF1,440,450 O c. USD1,440,450; CHF1,485,000 O d. USD1,584,495; CHF5,400,000 Oe. USD1,350,000; CHF1,584,495

Step by Step Solution

3.39 Rating (161 Votes )

There are 3 Steps involved in it

CHF 7682 4000 Rate 75 Interest Pay... View full answer

Get step-by-step solutions from verified subject matter experts