Question

Consider five-month European call and put options on British pounds with an exercise price of $1.1700. The current price of the put option is

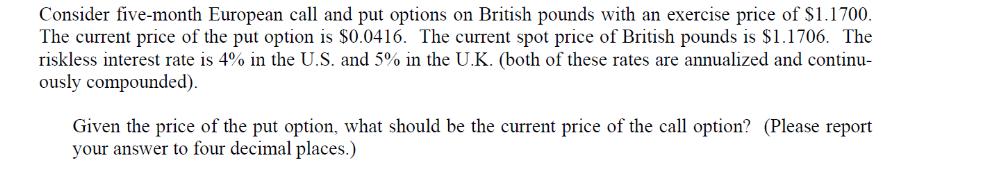

Consider five-month European call and put options on British pounds with an exercise price of $1.1700. The current price of the put option is $0.0416. The current spot price of British pounds is $1.1706. The riskless interest rate is 4% in the U.S. and 5% in the U.K. (both of these rates are annualized and continu- ously compounded). Given the price of the put option, what should be the current price of the call option? (Please report your answer to four decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To find the current price of the European call option we can use the putcall parity relationship whi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Practical Management Science

Authors: Wayne L. Winston, Christian Albright

5th Edition

1305631540, 1305631544, 1305250907, 978-1305250901

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App