Answered step by step

Verified Expert Solution

Question

1 Approved Answer

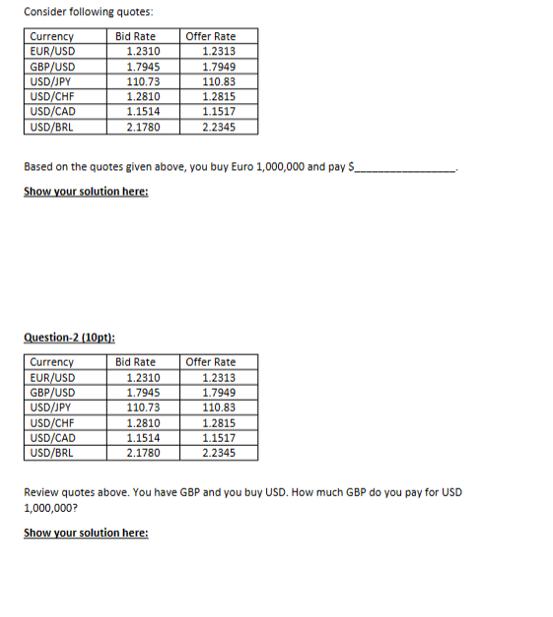

Consider following quotes: Currency EUR/USD GBP/USD USD/JPY USD/CHF USD/CAD USD/BRL Bid Rate 1.2310 1.7945 110.73 1.2810 1.1514 2.1780 Question-2 (10pt): Currency EUR/USD GBP/USD USD/JPY

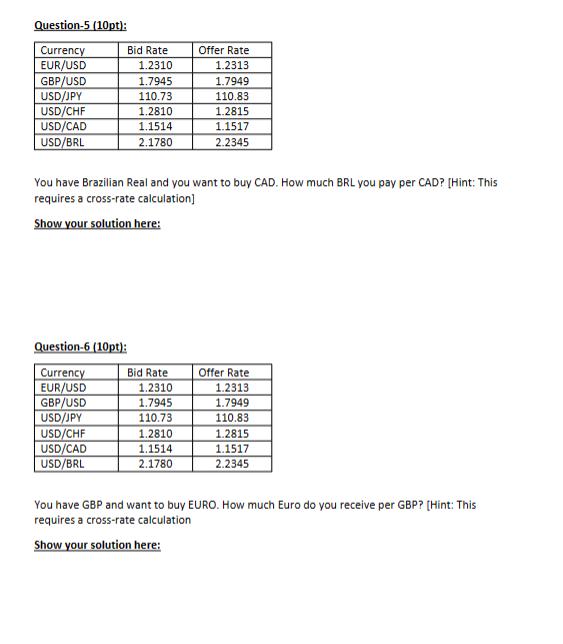

Consider following quotes: Currency EUR/USD GBP/USD USD/JPY USD/CHF USD/CAD USD/BRL Bid Rate 1.2310 1.7945 110.73 1.2810 1.1514 2.1780 Question-2 (10pt): Currency EUR/USD GBP/USD USD/JPY USD/CHF USD/CAD USD/BRL Based on the quotes given above, you buy Euro 1,000,000 and pay $ Show your solution here: Bid Rate 1.2310 1.7945 110.73 Offer Rate 1.2313 1.2810 1.1514 2.1780 1.7949 110.83 1.2815 1.1517 2.2345 Offer Rate 1.2313 1.7949 110.83 1.2815 1.1517 2.2345 Review quotes above. You have GBP and you buy USD. How much GBP do you pay for USD 1,000,000? Show your solution here: Question-5 (10pt): Currency EUR/USD GBP/USD USD/JPY USD/CHF USD/CAD USD/BRL Bid Rate 1.2310 Question-6 (10pt): Currency EUR/USD GBP/USD USD/JPY USD/CHF USD/CAD USD/BRL 1.7945 110.73 1.2810 1.1514 2.1780 You have Brazilian Real and you want to buy CAD. How much BRL you pay per CAD? [Hint: This requires a cross-rate calculation] Show your solution here: Bid Rate Offer Rate 1.2313 1.7949 110.83 1.2815 1.1517 2.2345 1.2310 1.7945 110.73 1.2810 1.1514 2.1780 Offer Rate 1.2313 1.7949 110.83 1.2815 1.1517 2.2345 You have GBP and want to buy EURO. How much Euro do you receive per GBP? [Hint: This requires a cross-rate calculation Show your solution here:

Step by Step Solution

★★★★★

3.45 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Question2 To buy USD with GBP we need to use the GBPUSD offer rate which is 17949 So to buy USD 1000...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started