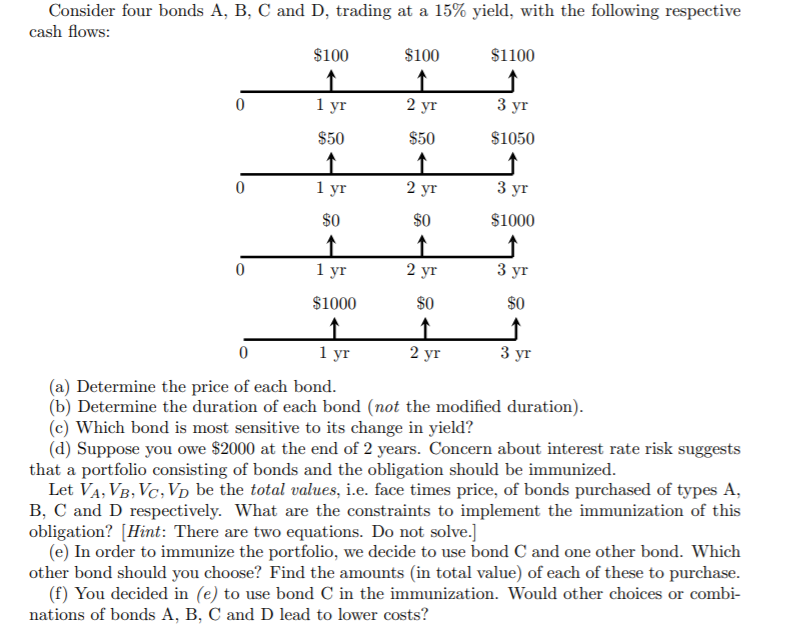

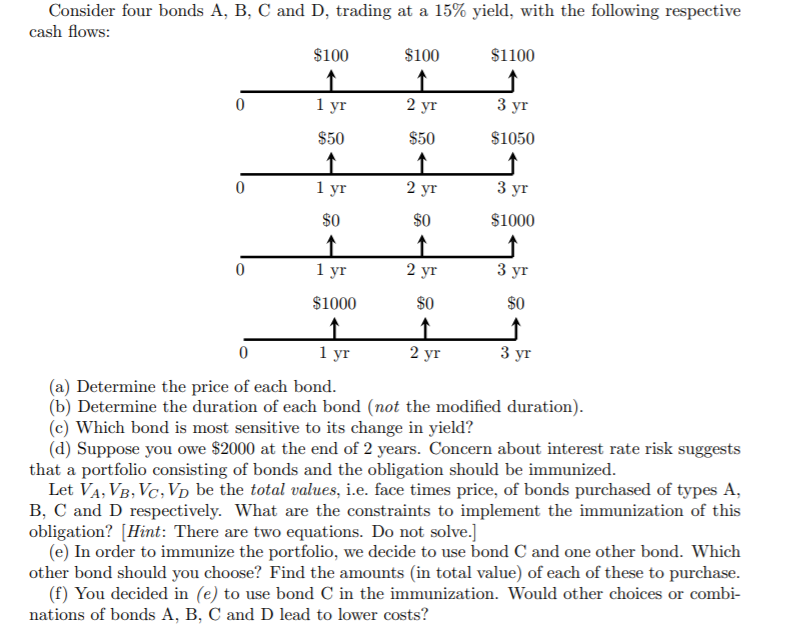

Consider four bonds A, B, C and D, trading at a 15% yield, with the following respective cash flows: $100 $100 $1100 0 1 yr 2 yr 3 yr $1050 $50 1 $50 1 0 1 yr 2 yr 3 yr $1000 $0 1 $0 1 2 yr 0 1 yr 3 yr $0 $1000 $0 0 1 yr 2 yr 3 yr (a) Determine the price of each bond. (b) Determine the duration of each bond (not the modified duration). (e) Which bond is most sensitive to its change in yield? (d) Suppose you owe $2000 at the end of 2 years. Concern about interest rate risk suggests that a portfolio consisting of bonds and the obligation should be immunized. Let VA, VB, Vc, Vy be the total values, i.e. face times price, of bonds purchased of types A, B, C and D respectively. What are the constraints to implement the immunization of this obligation? (Hint: There are two equations. Do not solve. (e) In order to immunize the portfolio, we decide to use bond C and one other bond. Which other bond should you choose? Find the amounts (in total value) of each of these to purchase. (f) You decided in (e) to use bond C in the immunization. Would other choices or combi- nations of bonds A, B, C and D lead to lower costs? Consider four bonds A, B, C and D, trading at a 15% yield, with the following respective cash flows: $100 $100 $1100 0 1 yr 2 yr 3 yr $1050 $50 1 $50 1 0 1 yr 2 yr 3 yr $1000 $0 1 $0 1 2 yr 0 1 yr 3 yr $0 $1000 $0 0 1 yr 2 yr 3 yr (a) Determine the price of each bond. (b) Determine the duration of each bond (not the modified duration). (e) Which bond is most sensitive to its change in yield? (d) Suppose you owe $2000 at the end of 2 years. Concern about interest rate risk suggests that a portfolio consisting of bonds and the obligation should be immunized. Let VA, VB, Vc, Vy be the total values, i.e. face times price, of bonds purchased of types A, B, C and D respectively. What are the constraints to implement the immunization of this obligation? (Hint: There are two equations. Do not solve. (e) In order to immunize the portfolio, we decide to use bond C and one other bond. Which other bond should you choose? Find the amounts (in total value) of each of these to purchase. (f) You decided in (e) to use bond C in the immunization. Would other choices or combi- nations of bonds A, B, C and D lead to lower costs