Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Consider four risky assets. Security A is a two-year default-free bond with a face value of $100, a coupon rate of 5% and a

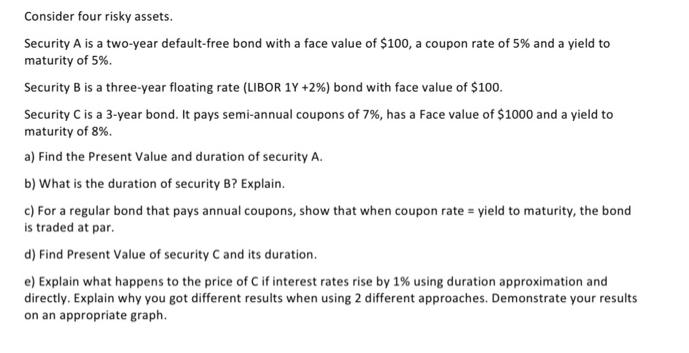

Consider four risky assets. Security A is a two-year default-free bond with a face value of $100, a coupon rate of 5% and a yield to maturity of 5%. Security B is a three-year floating rate (LIBOR 1Y +2%) bond with face value of $100. Security C is a 3-year bond. It pays semi-annual coupons of 7%, has a Face value of $1000 and a yield to maturity of 8%. a) Find the Present Value and duration of security A. b) What is the duration of security B? Explain. c) For a regular bond that pays annual coupons, show that when coupon rate = yield to maturity, the bond is traded at par. d) Find Present Value of security C and its duration. e) Explain what happens to the price of C if interest rates rise by 1% using duration approximation and directly. Explain why you got different results when using 2 different approaches. Demonstrate your results on an appropriate graph.

Step by Step Solution

★★★★★

3.42 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Answer a Present Value 10010052 907097 Duration 20 b The duration of security B is 25 yea...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started