Answered step by step

Verified Expert Solution

Question

1 Approved Answer

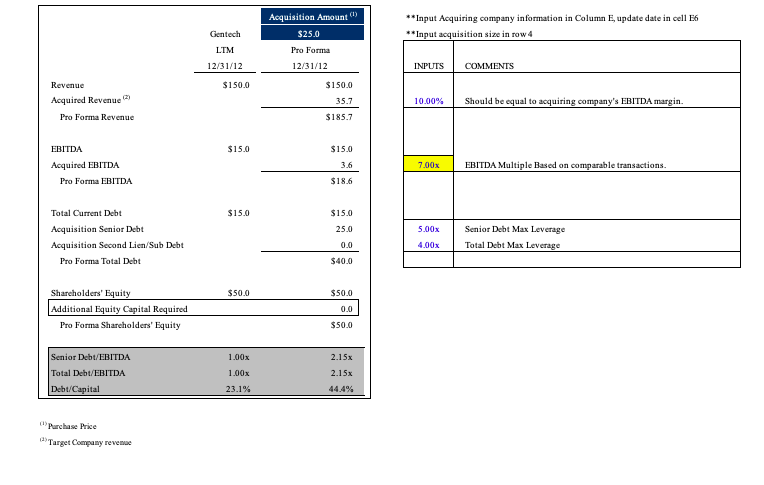

Consider Gentech, a company that is evaluating how large of an acquisition it could make without raising additional equity capital. By modifying the assumed purchase

Consider Gentech, a company that is evaluating how large of an acquisition it could make without raising additional equity capital. By modifying the assumed purchase price and the acquisition multiple, answer the questions below:

- Using the assumptions below, determine based on revenue, the largest company that Gentech can acquire without raising additional equity. Modify the dollar value of the acquisition to determine the resulting revenue size of the prospective acquisition.

- If the acquisition multiple rises to 8.0Xs EBITDA, determine, based on revenue, the largest company that Gentech can acquire without raising additional equity.

| Financial information | Data |

|---|---|

| EBITDA margin | 10.00% |

| Transaction multiple | 7.00x |

| Senior debt limit as multiple of EBITDA | 3.00x |

| Total debt max leverage | 4.00x |

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started