Question

Consider how Kyler Valley Stream Park Lodge could use capital budgeting to decide whether the $11,500,000 Stream Park Lodge expansion would be a good investment.

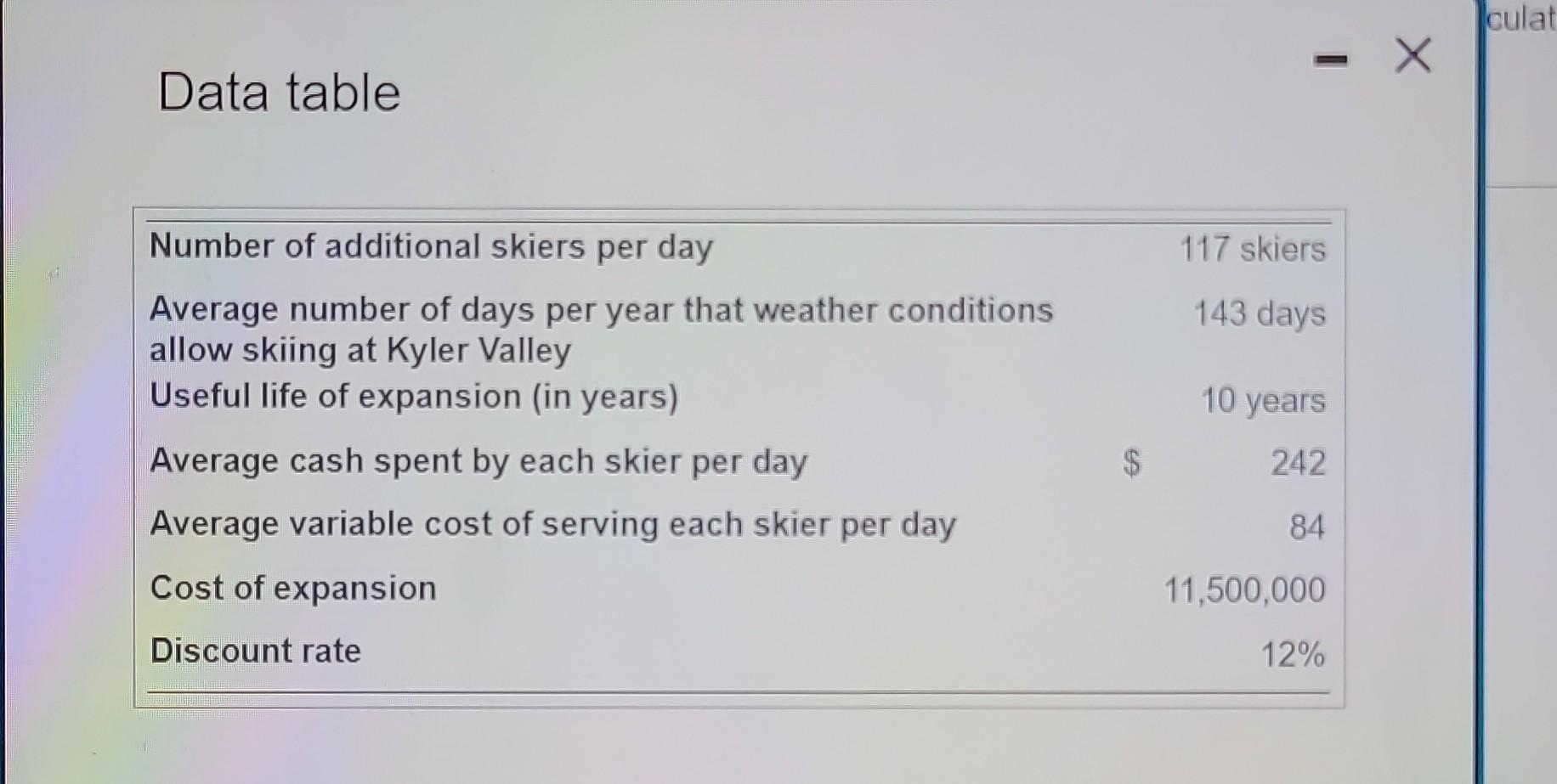

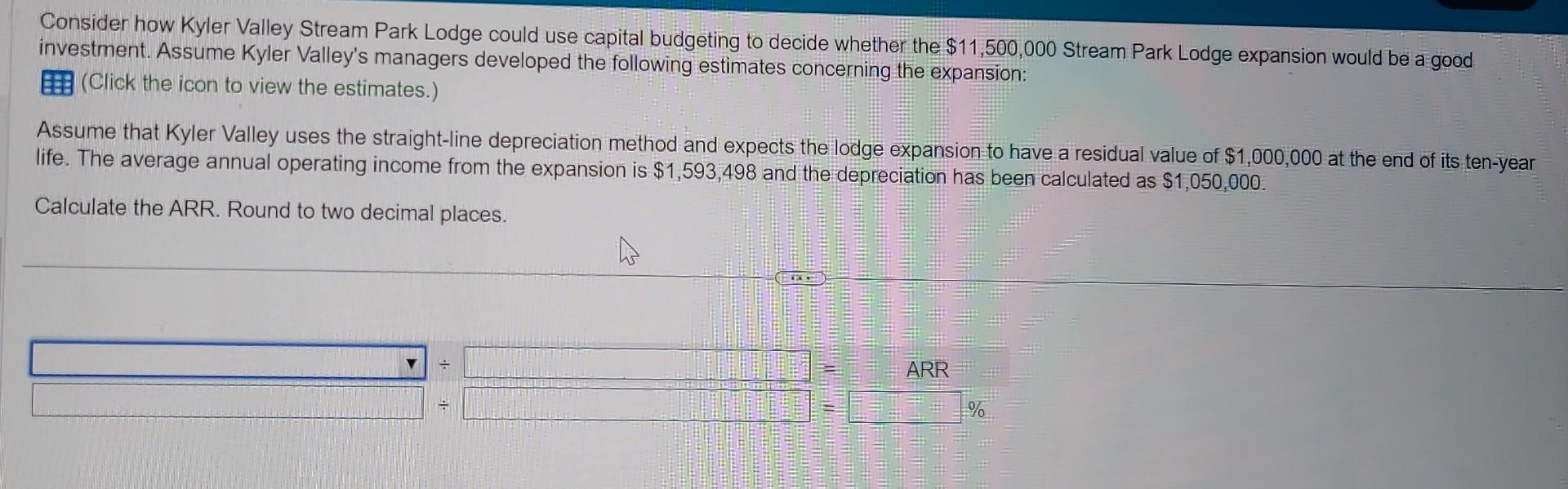

Consider how Kyler Valley Stream Park Lodge could use capital budgeting to decide whether the $11,500,000 Stream Park Lodge expansion would be a good investment. Assume Kyler Valley's managers developed the following estimates concerning the expansion: (Click the icon to view the estimates.) Assume that Kyler Valley uses the straight-line depreciation method and expects the lodge expansion to have a residual value of $1,000,000 at the end of its ten-year life. The average annual operating income from the expansion is $1,593,498 and the depreciation has been calculated as $1,050,000. Calculate the ARR. Round to two decimal places. FOX ARR %

Data table Consider how Kyler Valley Stream Park Lodge could use capital budgeting to decide whether the $11,500,000 Stream Park Lodge expansion would be a good investment. Assume Kyler Valley's managers developed the following estimates concerning the expansion: (Click the icon to view the estimates.) Assume that Kyler Valley uses the straight-line depreciation method and expects the lodge expansion to have a residual value of $1,000,000 at the end of its ten-year life. The average annual operating income from the expansion is $1,593,498 and the depreciation has been calculated as $1,050,000. Calculate the ARR. Round to two decimal places

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started