Question

Consider investment in three STRIPS (M-100), the first STRIPS matures in six months, the second STRIPS matures in 12 months, the third STRIPS matures

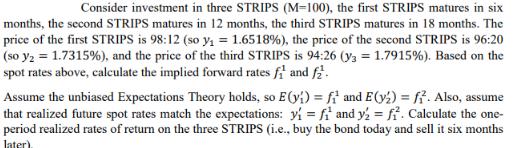

Consider investment in three STRIPS (M-100), the first STRIPS matures in six months, the second STRIPS matures in 12 months, the third STRIPS matures in 18 months. The price of the first STRIPS is 98:12 (so y = 1.6518 %), the price of the second STRIPS is 96:20 (so y = 1.7315%), and the price of the third STRIPS is 94:26 (y3 = 1.7915%). Based on the spot rates above, calculate the implied forward rates fit and f Assume the unbiased Expectations Theory holds, so E(y) = fit and E(y2) = ff. Also, assume that realized future spot rates match the expectations: y = fit and y2 = ft. Calculate the one- period realized rates of return on the three STRIPS (i.e., buy the bond today and sell it six months later)

Step by Step Solution

3.48 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Managerial Accounting

Authors: Ronald W Hilton

7th Edition

0073022853, 978-0073022857

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App