Question

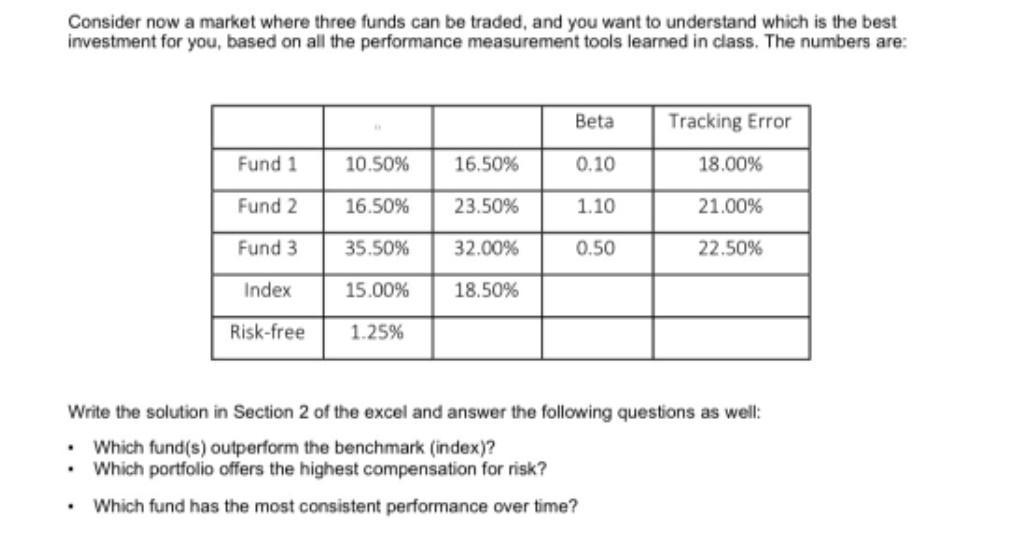

Consider now a market where three funds can be traded, and you want to understand which is the best investment for you, based on

Consider now a market where three funds can be traded, and you want to understand which is the best investment for you, based on all the performance measurement tools learned in class. The numbers are: Fund 1 Fund 2 Fund 3 Index Risk-free . 10.50% 16.50% 35.50% 15.00% 1.25% 16.50% 23.50% 32.00% 18.50% Beta 0.10 1.10 0.50 Tracking Error 18.00% 21.00% 22.50% Write the solution in Section 2 of the excel and answer the following questions as well: Which fund(s) outperform the benchmark (index)? Which portfolio offers the highest compensation for risk? Which fund has the most consistent performance over time?

Step by Step Solution

3.43 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Based on the information provided in the image 1 Which funds outperform the benchmark index The inde...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamentals of Investments, Valuation and Management

Authors: Bradford Jordan, Thomas Miller, Steve Dolvin

8th edition

1259720697, 1259720691, 1260109437, 9781260109436, 978-1259720697

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App