Answered step by step

Verified Expert Solution

Question

1 Approved Answer

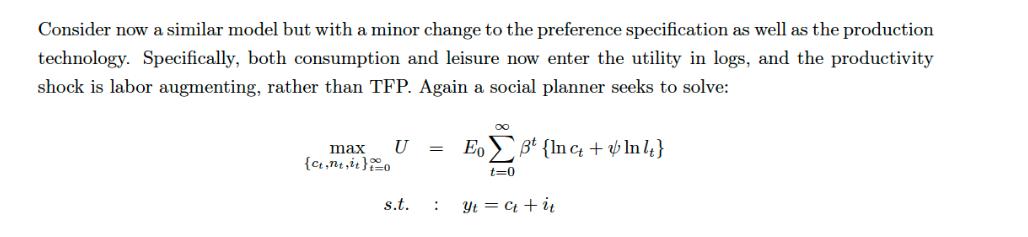

Consider now a similar model but with a minor change to the preference specification as well as the production technology. Specifically, both consumption and

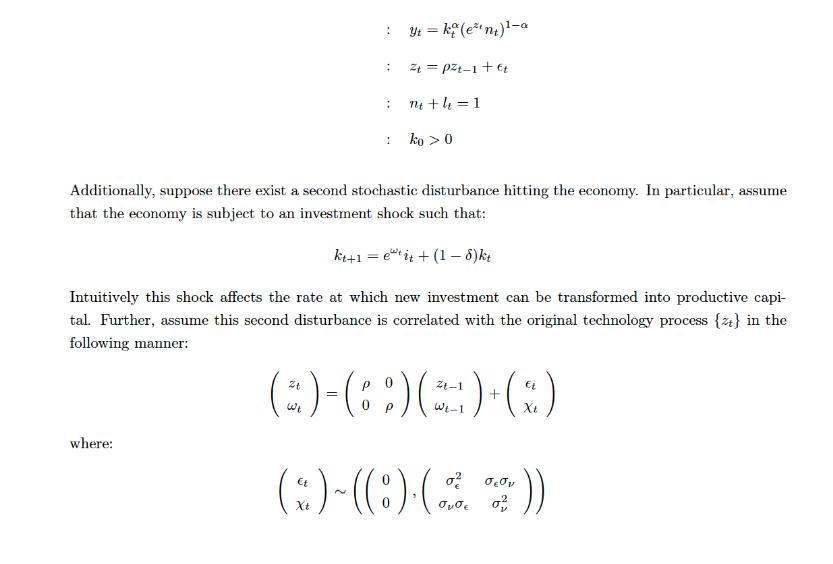

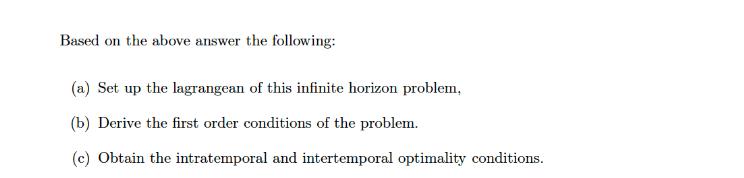

Consider now a similar model but with a minor change to the preference specification as well as the production technology. Specifically, both consumption and leisure now enter the utility in logs, and the productivity shock is labor augmenting, rather than TFP. Again a social planner seeks to solve: max U = {ct,ne,ito s.t. : EoB {Inc+In It} Bt t=0 Yt = c + it where: :yt = kt (ent) -a : = Xt : 1 Zt=pt-1+t Additionally, suppose there exist a second stochastic disturbance hitting the economy. In particular, assume that the economy is subject to an investment shock such that: kt+1=et+ (1-6) kt Intuitively this shock affects the rate at which new investment can be transformed into productive capi- tal. Further, assume this second disturbance is correlated with the original technology process {} in the following manner: n+4=1 ko > 0 21-1 (5)-(83)(C)-(3) P Et (3)-((8)-(2, 2)) Based on the above answer the following: (a) Set up the lagrangean of this infinite horizon problem, (b) Derive the first order conditions of the problem. (c) Obtain the intratemporal and intertemporal optimality conditions.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Based on the provided information we are dealing with a dynamic optimization problem with an infinite horizon The social planner is maximizing the exp...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started