Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Consider One Year Left (OYL) Corporation. OYL will be closed down in one year from today after all available cash flows from its assets

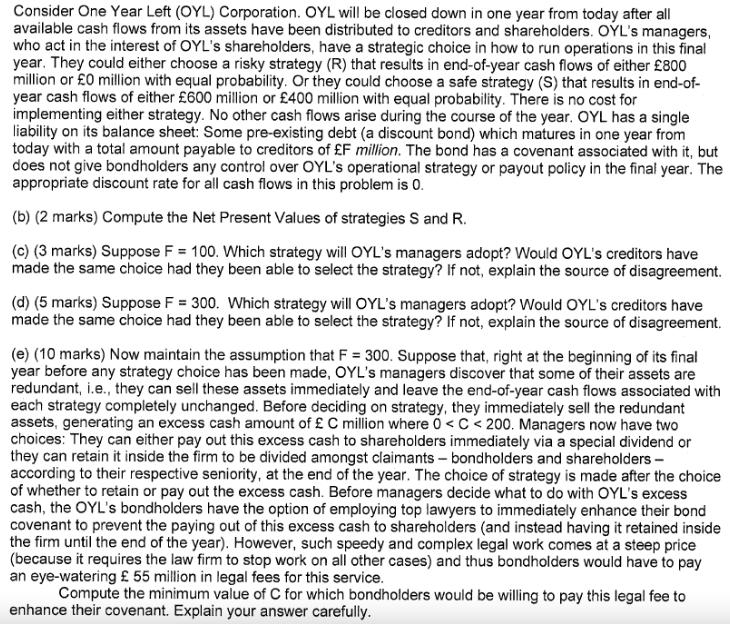

Consider One Year Left (OYL) Corporation. OYL will be closed down in one year from today after all available cash flows from its assets have been distributed to creditors and shareholders. OYL's managers, who act in the interest of OYL's shareholders, have a strategic choice in how to run operations in this final year. They could either choose a risky strategy (R) that results in end-of-year cash flows of either 800 million or 0 million with equal probability. Or they could choose a safe strategy (S) that results in end-of- year cash flows of either 600 million or 400 million with equal probability. There is no cost for implementing either strategy. No other cash flows arise during the course of the year. OYL has a single liability on its balance sheet: Some pre-existing debt (a discount bond) which matures in one year from today with a total amount payable to creditors of F million. The bond has a covenant associated with it, but does not give bondholders any control over OYL's operational strategy or payout policy in the final year. The appropriate discount rate for all cash flows in this problem is 0. (b) (2 marks) Compute the Net Present Values of strategies S and R. (c) (3 marks) Suppose F = 100. Which strategy will OYL's managers adopt? Would OYL's creditors have made the same choice had they been able to select the strategy? If not, explain the source of disagreement. (d) (5 marks) Suppose F = 300. Which strategy will OYL's managers adopt? Would OYL's creditors have made the same choice had they been able to select the strategy? If not, explain the source of disagreement. (e) (10 marks) Now maintain the assumption that F = 300. Suppose that, right at the beginning of its final year before any strategy choice has been made, OYL's managers discover that some of their assets are redundant, i.e., they can sell these assets immediately and leave the end-of-year cash flows associated with each strategy completely unchanged. Before deciding on strategy, they immediately sell the redundant assets, generating an excess cash amount of C million where 0

Step by Step Solution

★★★★★

3.35 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

b The Net Present Value NPV of strategy S can be computed as follows NPVS 05 600 million 1 0 05 400 million 1 0 500 million The NPV of strategy R can ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started