Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Consider onl heelchair acc Found level it to all floors. Al Company & Wheelchair Ground leve A private equity investor is valuing the listed

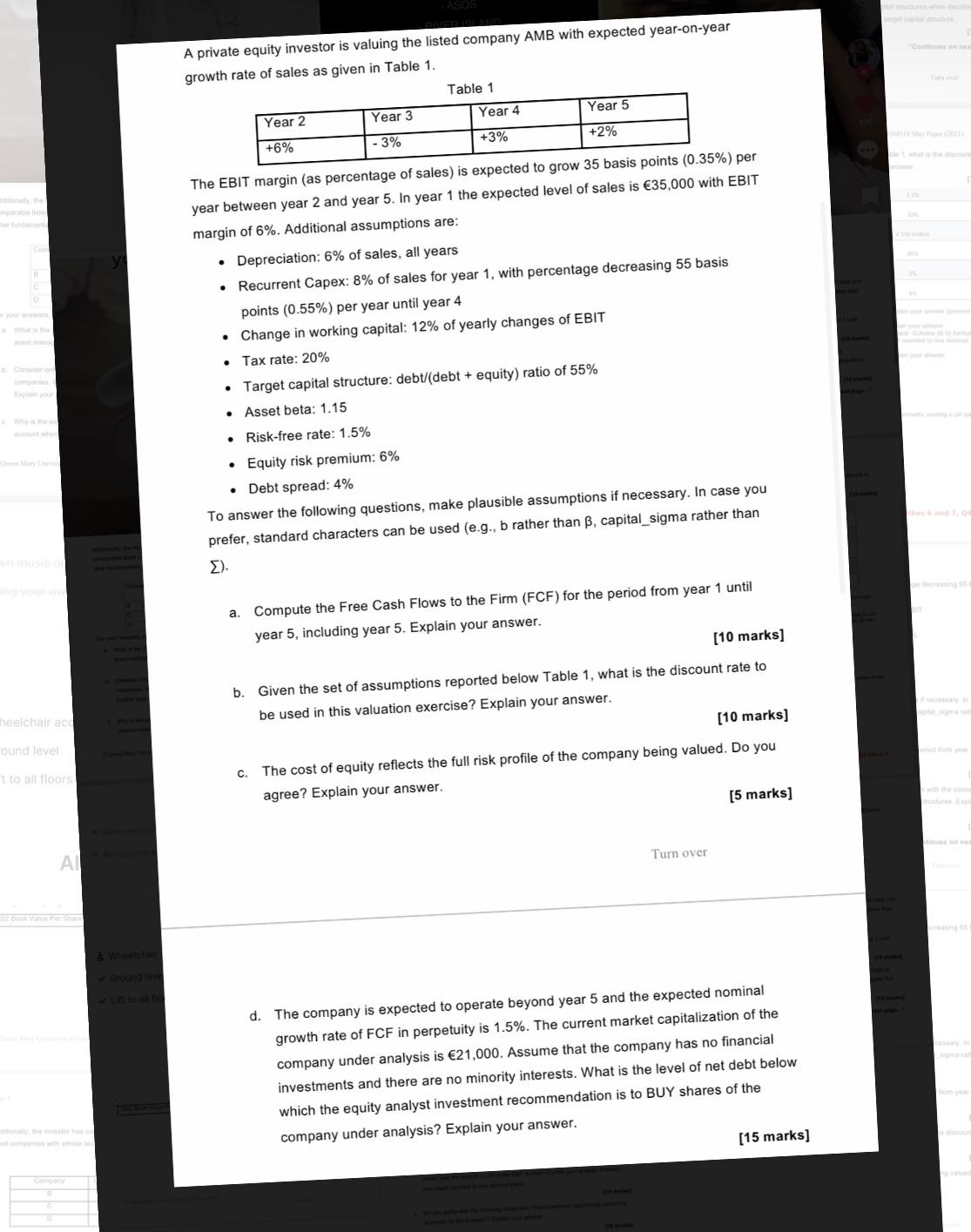

Consider onl heelchair acc Found level it to all floors. Al Company & Wheelchair Ground leve A private equity investor is valuing the listed company AMB with expected year-on-year growth rate of sales as given in Table 1. . . Year 2 +6% Year 3 - 3% The EBIT margin (as percentage of sales) is expected to grow 35 basis points (0.35%) per year between year 2 and year 5. In year 1 the expected level of sales is 35,000 with EBIT margin of 6%. Additional assumptions are: Depreciation: 6% of sales, all years Recurrent Capex: 8% of sales for year 1, with percentage decreasing 55 basis points (0.55%) per year until year 4 Change in working capital: 12% of yearly changes of EBIT Tax rate: 20% Target capital structure: debt/(debt + equity) ratio of 55% Asset beta: 1.15 . Table 1 Year 4 +3% Risk-free rate: 1.5% Equity risk premium: 6% Debt spread: 4% Year 5 +2% To answer the following questions, make plausible assumptions if necessary. In case you prefer, standard characters can be used (e.g., b rather than , capital_sigma rather than ). a. Compute the Free Cash Flows to the Firm (FCF) for the period from year 1 until year 5, including year 5. Explain your answer. [10 marks] b. Given the set of assumptions reported below Table 1, what is the discount rate to be used in this valuation exercise? Explain your answer. [10 marks] C. The cost of equity reflects the full risk profile of the company being valued. Do you agree? Explain your answer. Turn over [5 marks] d. The company is expected to operate beyond year 5 and the expected nominal growth rate of FCF in perpetuity is 1.5%. The current market capitalization of the company under analysis is 21,000. Assume that the company has no financial investments and there are no minority interests. What is the level of net debt below which the equity analyst investment recommendation is to BUY shares of the company under analysis? Explain your answer. [15 marks] decreasing 65 HT aptal sigma rath tructures Expl cessary, in from year ng valusid

Step by Step Solution

★★★★★

3.55 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

a To compute the Free Cash Flows to the Firm FCF for the period from year 1 until year 5 including year 5 we need to calculate the following components Year 1 Sales 35000 EBIT margin 6 of sales 006 35...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started