Answered step by step

Verified Expert Solution

Question

1 Approved Answer

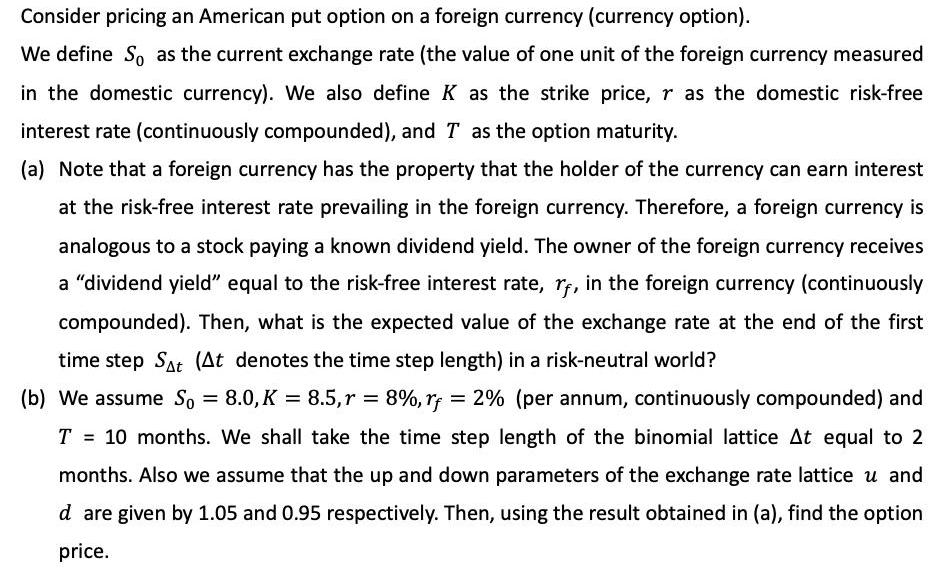

Consider pricing an American put option on a foreign currency (currency option). We define So as the current exchange rate (the value of one

Consider pricing an American put option on a foreign currency (currency option). We define So as the current exchange rate (the value of one unit of the foreign currency measured in the domestic currency). We also define K as the strike price, r as the domestic risk-free interest rate (continuously compounded), and T as the option maturity. (a) Note that a foreign currency has the property that the holder of the currency can earn interest at the risk-free interest rate prevailing in the foreign currency. Therefore, a foreign currency is analogous to a stock paying a known dividend yield. The owner of the foreign currency receives a "dividend yield" equal to the risk-free interest rate, rf, in the foreign currency (continuously compounded). Then, what is the expected value of the exchange rate at the end of the first time step St (At denotes the time step length) in a risk-neutral world? (b) We assume So = 8.0, K = 8.5, r = 8%, rf = 2% (per annum, continuously compounded) and T = 10 months. We shall take the time step length of the binomial lattice At equal to 2 months. Also we assume that the up and down parameters of the exchange rate lattice u and d are given by 1.05 and 0.95 respectively. Then, using the result obtained in (a), find the option price.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a In a riskneutral world the expected value of the exchange rate at the end of the first time step S ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started