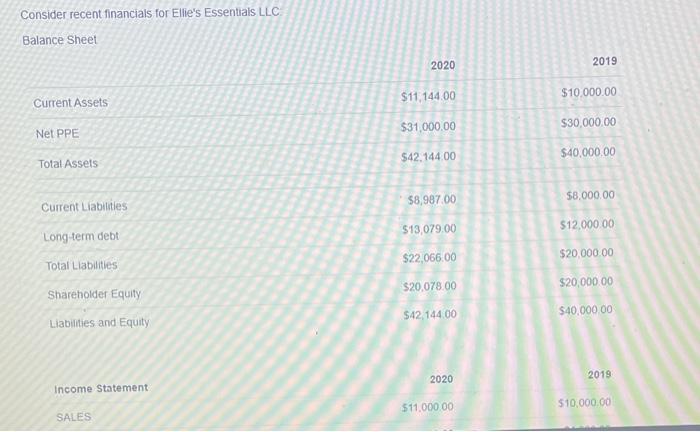

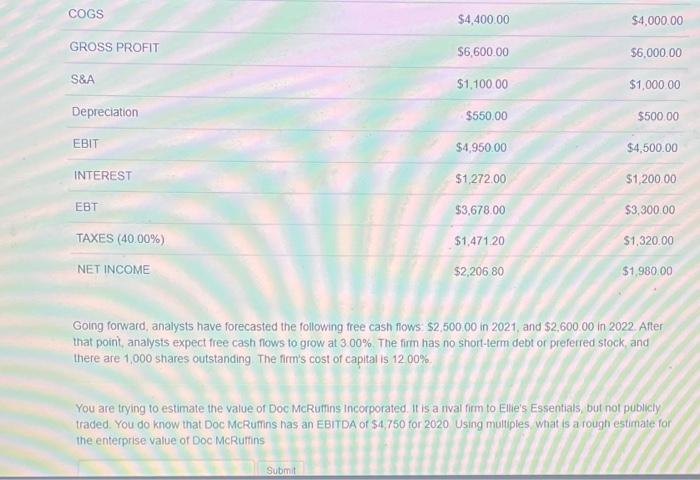

Consider recent financials for Ellie's Essentials LLC Balance Sheet 2020 2019 $10,000.00 Current Assets $11,144.00 $31,000.00 $42.144.00 $30,000.00 Net PPE $40,000.00 Total Assets $8,000.00 Current Liabilities $8,987.00 513,079.00 $12,000.00 Long-term debt $20,000.00 Total Liabilities $22,066.00 $20,078.00 $42,144.00 Shareholder Equity $20,000.00 $40.000.00 Liabilities and Equity 2020 2019 Income Statement $11,000.00 $10,000.00 SALES COGS $4,400.00 $4,000.00 GROSS PROFIT $6,600.00 $6,000.00 S&A $1,100 00 $1,000.00 Depreciation $550.00 $500.00 EBIT $4,950.00 $4,500.00 INTEREST $1,272.00 $1,200.00 EBT $3,678.00 $3,300.00 TAXES (40.00%) $1,471 20 $1,320,00 NET INCOME $2,206 80 $1.980.00 Going forward analysts have forecasted the following free cash flows $2,500.00 in 2021, and $2,600 00 in 2022. After that point, analysts expect free cash flows to grow at 300%. The firm has no short-term debt or preferred stock, and there are 1,000 shares outstanding. The firm's cost of capital is 1200% You are trying to estimate the value of Doc McRutins Incorporated. It is a rival firm to Ellie's Essentials, but not publicly traded. You do know that Doc McRuffins has an EBITDA of $4,750 for 2020 Using multiples what is a rough estimate for the enterprise value of Doc McRutins Submit Consider recent financials for Ellie's Essentials LLC Balance Sheet 2020 2019 $10,000.00 Current Assets $11,144.00 $31,000.00 $42.144.00 $30,000.00 Net PPE $40,000.00 Total Assets $8,000.00 Current Liabilities $8,987.00 513,079.00 $12,000.00 Long-term debt $20,000.00 Total Liabilities $22,066.00 $20,078.00 $42,144.00 Shareholder Equity $20,000.00 $40.000.00 Liabilities and Equity 2020 2019 Income Statement $11,000.00 $10,000.00 SALES COGS $4,400.00 $4,000.00 GROSS PROFIT $6,600.00 $6,000.00 S&A $1,100 00 $1,000.00 Depreciation $550.00 $500.00 EBIT $4,950.00 $4,500.00 INTEREST $1,272.00 $1,200.00 EBT $3,678.00 $3,300.00 TAXES (40.00%) $1,471 20 $1,320,00 NET INCOME $2,206 80 $1.980.00 Going forward analysts have forecasted the following free cash flows $2,500.00 in 2021, and $2,600 00 in 2022. After that point, analysts expect free cash flows to grow at 300%. The firm has no short-term debt or preferred stock, and there are 1,000 shares outstanding. The firm's cost of capital is 1200% You are trying to estimate the value of Doc McRutins Incorporated. It is a rival firm to Ellie's Essentials, but not publicly traded. You do know that Doc McRuffins has an EBITDA of $4,750 for 2020 Using multiples what is a rough estimate for the enterprise value of Doc McRutins Submit