Question

Consider that the value of the firm is as follows: 1 1 + R where R is the risk adjusted return on stock prices

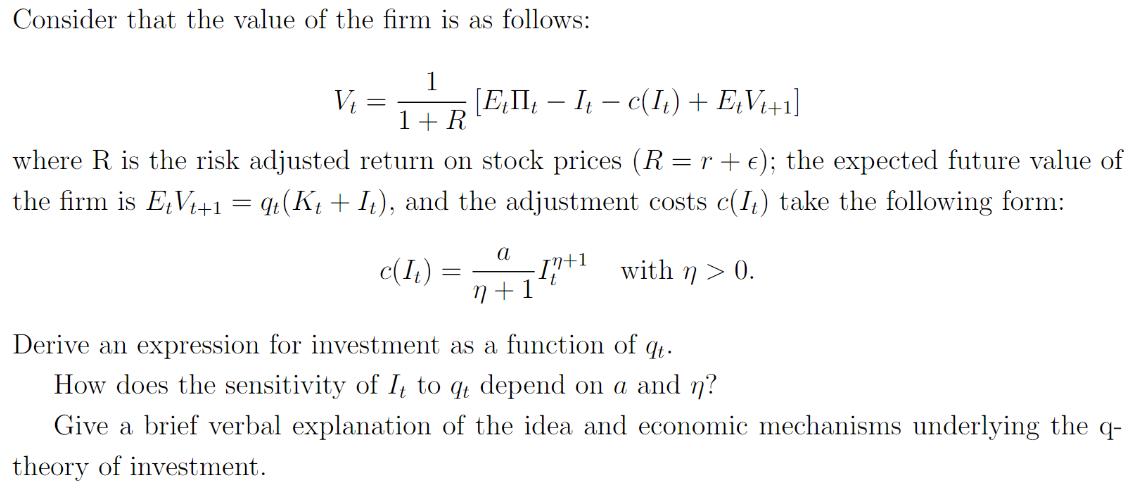

Consider that the value of the firm is as follows: 1 1 + R where R is the risk adjusted return on stock prices (R = r + ); the expected future value of the firm is EtVt+1 = qt (Kt + It), and the adjustment costs c(It) take the following form: c(It) -In+1 with n>0. Vt = [EII - It c(It) + EtV+1] a n+1 Derive an expression for investment as a function of qt. How does the sensitivity of It to qt depend on a and n? Give a brief verbal explanation of the idea and economic mechanisms underlying the q- theory of investment.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

SOLUTION To derive an expression for investment as a function of qt lets start by rearranging the firm value equation V EIIt It cIt EiVi1 1 R We can s...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Managerial Economics

Authors: Mark Hirschey

12th edition

9780324584844, 324588860, 324584849, 978-0324588866

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App