Question

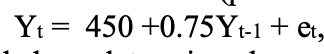

Consider that the weekly price of gold (per ounce) can be modeled with the following stochastic process (price of gold per ounce is $1,800): where,

Consider that the weekly price of gold (per ounce) can be modeled with the following stochastic process (price of gold per ounce is $1,800):

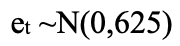

where,

where,

and  is independent of

is independent of  for

for

a. If t is today, determine the expected price of gold for the following week and determine the standard deviation of the price of gold for the following week, and interpret your results. b. If t is today, determine the expected price of gold two weeks from now and determine the standard deviation of the price of gold two weeks from now, and interpret your results. c. Find the variance for week t of the price of gold.

Yt = 450 +0.75 Yt-1 + et, et ~N(0,625) et ek t #k. Yt = 450 +0.75 Yt-1 + et, et ~N(0,625) et ek t #kStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started