Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Consider that you have in your portfolio a 3-year 3% coupon bond with face value of $100. The coupons of this bond are paid

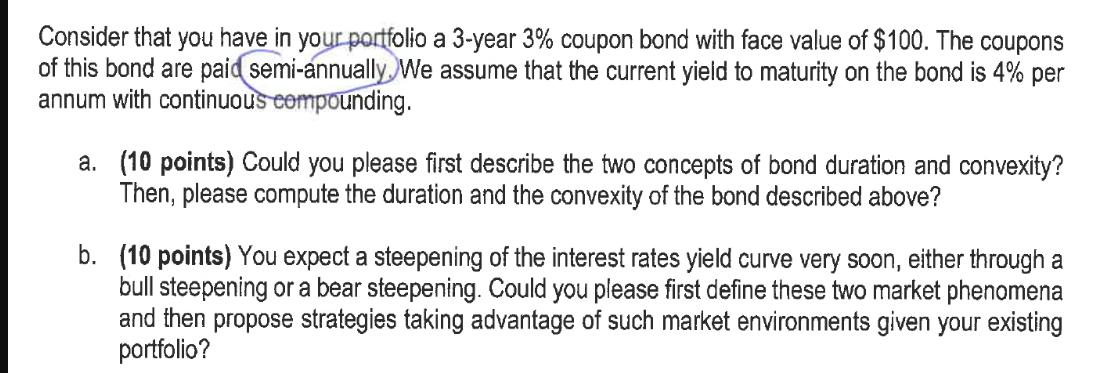

Consider that you have in your portfolio a 3-year 3% coupon bond with face value of $100. The coupons of this bond are paid semi-annually. We assume that the current yield to maturity on the bond is 4% per annum with continuous compounding. a. (10 points) Could you please first describe the two concepts of bond duration and convexity? Then, please compute the duration and the convexity of the bond described above? b. (10 points) You expect a steepening of the interest rates yield curve very soon, either through a bull steepening or a bear steepening. Could you please first define these two market phenomena and then propose strategies taking advantage of such market environments given your existing portfolio?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Solution a Duration and Convexity Duration is a measure of the sensitivity of a bonds price to changes in interest rates It is the weighted average of the time to maturity of the bonds cash flows wher...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started