Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Consider the 3 bonds below. All coupon rates are annually compounded. The face value, coupon rate, yield, maturity and market price are given. Based

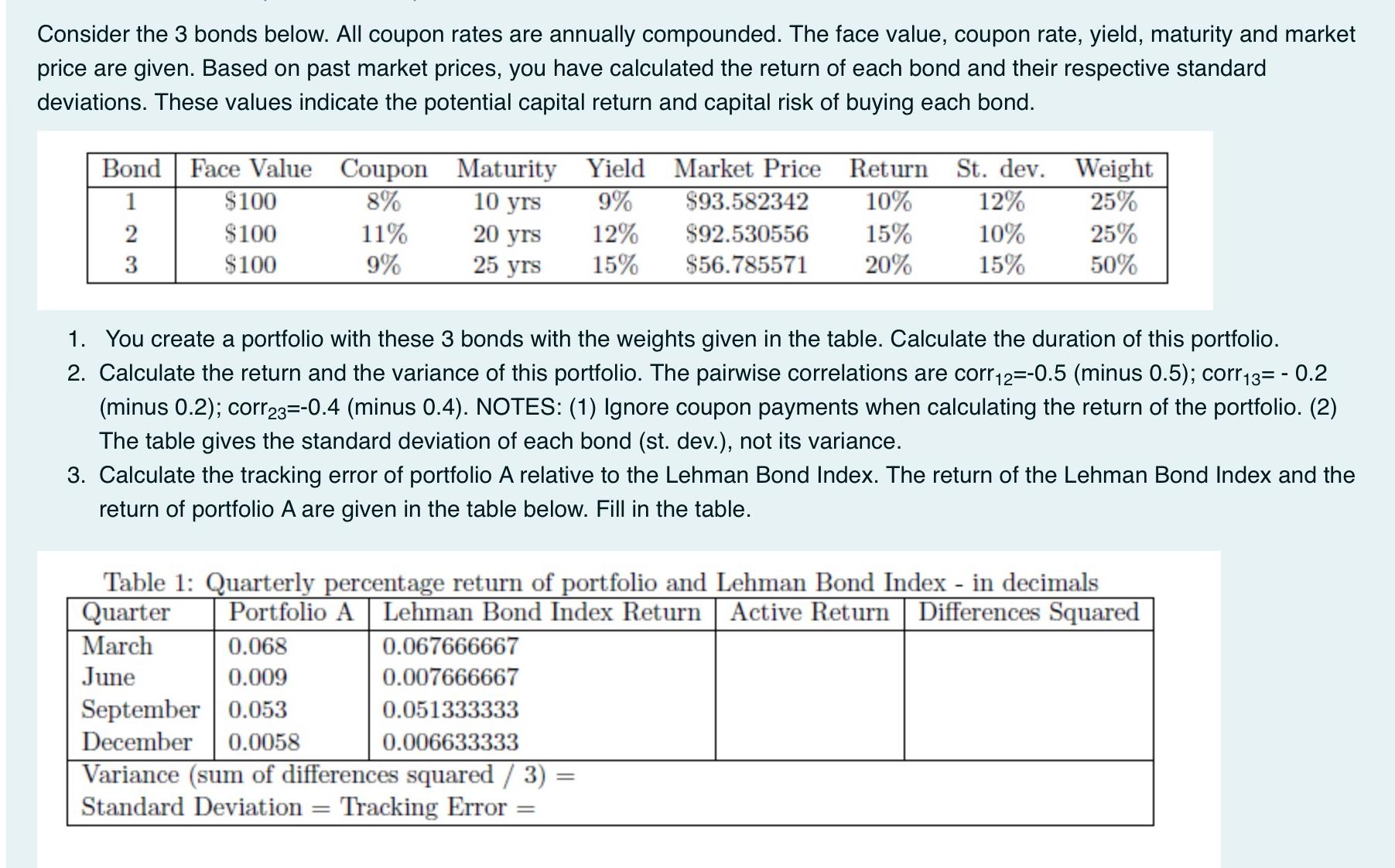

Consider the 3 bonds below. All coupon rates are annually compounded. The face value, coupon rate, yield, maturity and market price are given. Based on past market prices, you have calculated the return of each bond and their respective standard deviations. These values indicate the potential capital return and capital risk of buying each bond. Bond Face Value Coupon 1 8% 2 3 $100 $100 $100 11% 9% March June Maturity Yield 10 yrs 9% 20 yrs 12% 25 yrs 15% Market Price Return St. dev. 10% $93.582342 $92.530556 $56.785571 = 15% 20% 12% 10% 15% Weight 25% 1. You create a portfolio with these 3 bonds with the weights given in the table. Calculate the duration of this portfolio. 2. Calculate the return and the variance of this portfolio. The pairwise correlations are corr2=-0.5 (minus 0.5); corr3= -0.2 (minus 0.2); corr23=-0.4 (minus 0.4). NOTES: (1) Ignore coupon payments when calculating the return of the portfolio. (2) The table gives the standard deviation of each bond (st. dev.), not its variance. 3. Calculate the tracking error of portfolio A relative to the Lehman Bond Index. The return of the Lehman Bond Index and the return of portfolio A are given in the table below. Fill in the table. 25% 50% Table 1: Quarterly percentage return of portfolio and Lehman Bond Index - in decimals Quarter Portfolio A Lehman Bond Index Return | Active Return | Differences Squared 0.068 0.067666667 0.009 0.007666667 September 0.053 0.051333333 December 0.0058 0.006633333 = Variance (sum of differences squared / 3) Standard Deviation = Tracking Error

Step by Step Solution

★★★★★

3.34 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

1 To calculate the duration of a portfolio we need to calculate the weighted average duration of the individual bonds based on their weights in the po...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started