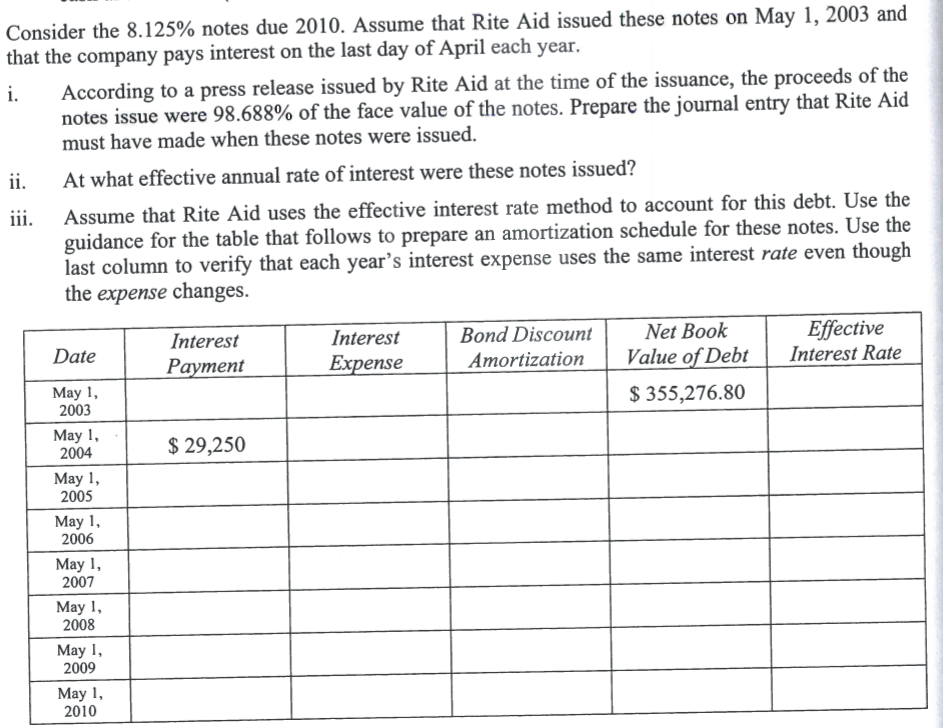

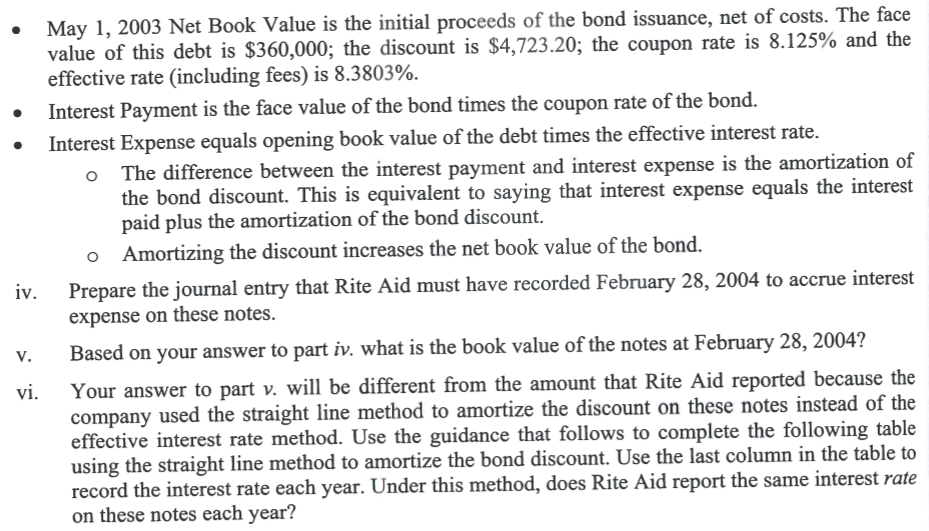

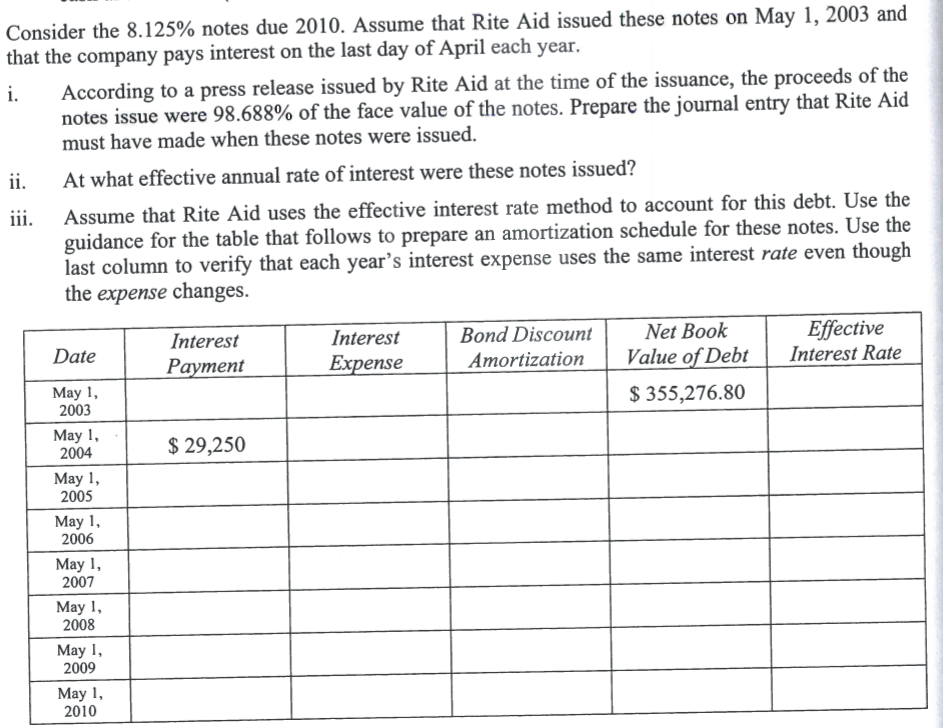

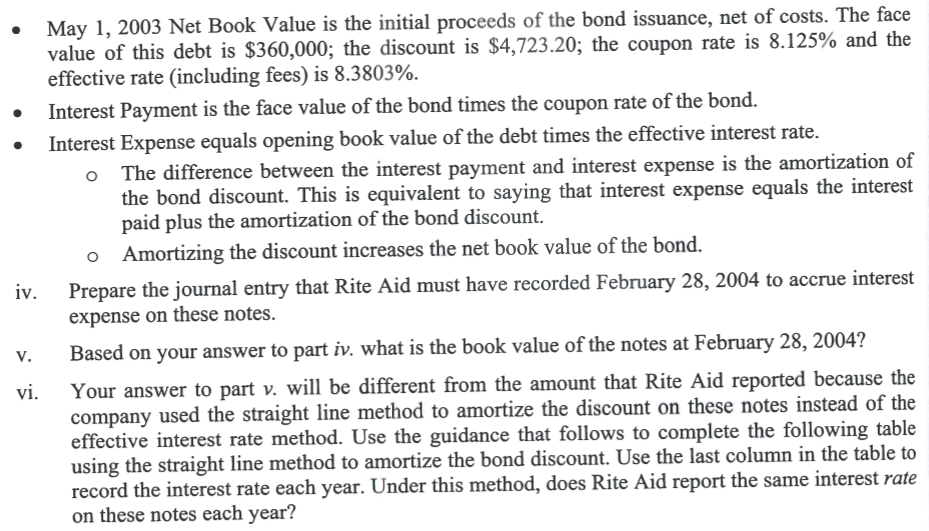

Consider the 8.125% notes due 2010. Assume that Rite Aid issued these notes on May 1, 2003 and that the company pays interest on the last day of April each year. i. According to a press release issued by Rite Aid at the time of the issuance, the proceeds of the notes issue were 98.688% of the face value of the notes. Prepare the journal entry that Rite Aid must have made when these notes were issued. ii. At what effective annual rate of interest were these notes issued? Assume that Rite Aid uses the effective interest rate method to account for this debt. Use the guidance for the table that follows to prepare an amortization schedule for these notes. Use the last column to verify that each year's interest expense uses the same interest rate even though the expense changes. Date Interest Payment Interest Expense Bond Discount Amortization Net Book Value of Debt $ 355,276.80 Effective Interest Rate $ 29,250 May 1, 2003 May 1, 2004 May 1, 2005 May 1, 2006 May 1, 2007 May 1, 2008 May 1, 2009 May 1, 2010 May 1, 2003 Net Book Value is the initial proceeds of the bond issuance, net of costs. The face value of this debt is $360,000; the discount is $4,723.20; the coupon rate is 8.125% and the effective rate (including fees) is 8.3803%. Interest Payment is the face value of the bond times the coupon rate of the bond. Interest Expense equals opening book value of the debt times the effective interest rate. O The difference between the interest payment and interest expense is the amortization of the bond discount. This is equivalent to saying that interest expense equals the interest paid plus the amortization of the bond discount. O Amortizing the discount increases the net book value of the bond. iv. Prepare the journal entry that Rite Aid must have recorded February 28, 2004 to accrue interest expense on these notes. Based on your answer to part iv. what is the book value of the notes at February 28, 2004? Your answer to part v. will be different from the amount that Rite Aid reported because the company used the straight line method to amortize the discount on these notes instead of the effective interest rate method. Use the guidance that follows to complete the following table using the straight line method to amortize the bond discount. Use the last column in the table to record the interest rate each year. Under this method, does Rite Aid report the same interest rate on these notes each year? Consider the 8.125% notes due 2010. Assume that Rite Aid issued these notes on May 1, 2003 and that the company pays interest on the last day of April each year. i. According to a press release issued by Rite Aid at the time of the issuance, the proceeds of the notes issue were 98.688% of the face value of the notes. Prepare the journal entry that Rite Aid must have made when these notes were issued. ii. At what effective annual rate of interest were these notes issued? Assume that Rite Aid uses the effective interest rate method to account for this debt. Use the guidance for the table that follows to prepare an amortization schedule for these notes. Use the last column to verify that each year's interest expense uses the same interest rate even though the expense changes. Date Interest Payment Interest Expense Bond Discount Amortization Net Book Value of Debt $ 355,276.80 Effective Interest Rate $ 29,250 May 1, 2003 May 1, 2004 May 1, 2005 May 1, 2006 May 1, 2007 May 1, 2008 May 1, 2009 May 1, 2010 May 1, 2003 Net Book Value is the initial proceeds of the bond issuance, net of costs. The face value of this debt is $360,000; the discount is $4,723.20; the coupon rate is 8.125% and the effective rate (including fees) is 8.3803%. Interest Payment is the face value of the bond times the coupon rate of the bond. Interest Expense equals opening book value of the debt times the effective interest rate. O The difference between the interest payment and interest expense is the amortization of the bond discount. This is equivalent to saying that interest expense equals the interest paid plus the amortization of the bond discount. O Amortizing the discount increases the net book value of the bond. iv. Prepare the journal entry that Rite Aid must have recorded February 28, 2004 to accrue interest expense on these notes. Based on your answer to part iv. what is the book value of the notes at February 28, 2004? Your answer to part v. will be different from the amount that Rite Aid reported because the company used the straight line method to amortize the discount on these notes instead of the effective interest rate method. Use the guidance that follows to complete the following table using the straight line method to amortize the bond discount. Use the last column in the table to record the interest rate each year. Under this method, does Rite Aid report the same interest rate on these notes each year