Answered step by step

Verified Expert Solution

Question

1 Approved Answer

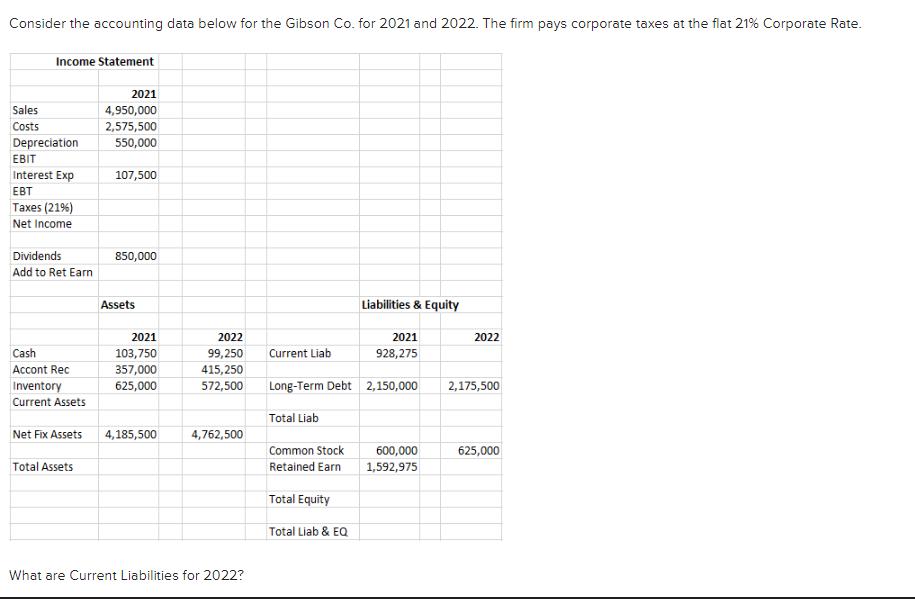

Consider the accounting data below for the Gibson Co. for 2021 and 2022. The firm pays corporate taxes at the flat 21% Corporate Rate.

Consider the accounting data below for the Gibson Co. for 2021 and 2022. The firm pays corporate taxes at the flat 21% Corporate Rate. Income Statement Sales Costs Depreciation EBIT Interest Exp EBT Taxes (21%) Net Income Dividends Add to Ret Earn Cash Accont Rec Inventory Current Assets Net Fix Assets Total Assets 2021 4,950,000 2,575,500 550,000 107,500 850,000 Assets 2021 103,750 357,000 625,000 4,185,500 2022 99,250 415,250 572,500 4,762,500 What are Current Liabilities for 2022? 2021 928,275 Long-Term Debt 2,150,000 Current Liab Total Liab Common Stock Retained Earn Total Equity Liabilities & Equity Total Liab & EQ 600,000 1,592,975 2022 2,175,500 625,000

Step by Step Solution

★★★★★

3.29 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Based on the given accounting data for the Gibson Co the Current Liabilities for 2022 can be determi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started