Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Consider the annual reports of bmw for 2 0 2 2 uploaded. Using financial ratios, you are required to compare them and answer the following

Consider the annual reports of bmw for uploaded. Using financial ratios, you are required to compare them and answer the following questions:

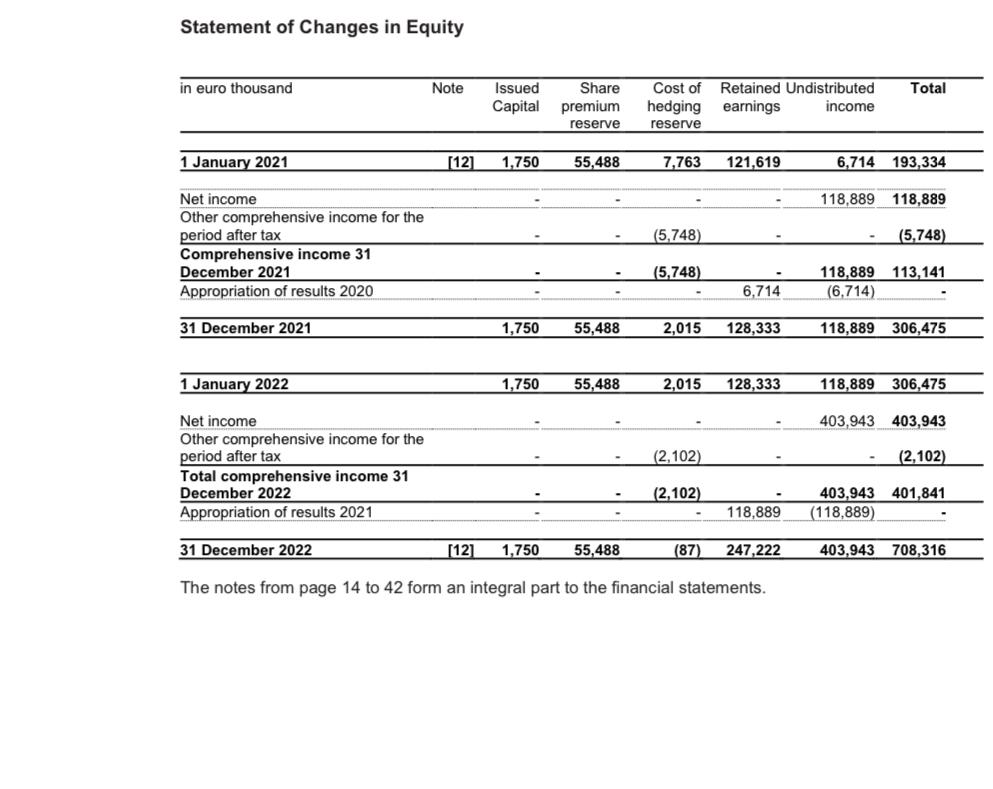

Statement of Changes in Equity in euro thousand 1 January 2021 Net income Other comprehensive income for the period after tax Comprehensive income 31 December 2021 Appropriation of results 2020 31 December 2021 1 January 2022 Net income Other comprehensive income for the period after tax Note [12] Issued Capital 1,750 1,750 1,750 Share premium reserve 55,488 55,488 55,488 Cost of Retained Undistributed hedging earnings income reserve [12] 1,750 55,488 7,763 (5,748) (5,748) 121,619 6,714 2,015 128,333 (2,102) (2,102) 2,015 128,333 Total comprehensive income 31 December 2022 Appropriation of results 2021 31 December 2022 The notes from page 14 to 42 form an integral part to the financial statements. 118,889 (87) 247,222 Total 6,714 193,334 118,889 118,889 (5,748) 118,889 113,141 (6,714) - 118,889 306,475 118,889 306,475 403,943 403,943 (2,102) 403,943 401,841 (118,889) 403,943 708,316

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To determine the percentage change of total assets total liabilities and total equity as requested w...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started