Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Consider the annual reports of Ferrari for 2 0 2 2 uploaded. Using financial ratios, you are required to compare them and answer the following

Consider the annual reports of Ferrari for uploaded. Using financial ratios, you are required to compare them and answer the following questions:

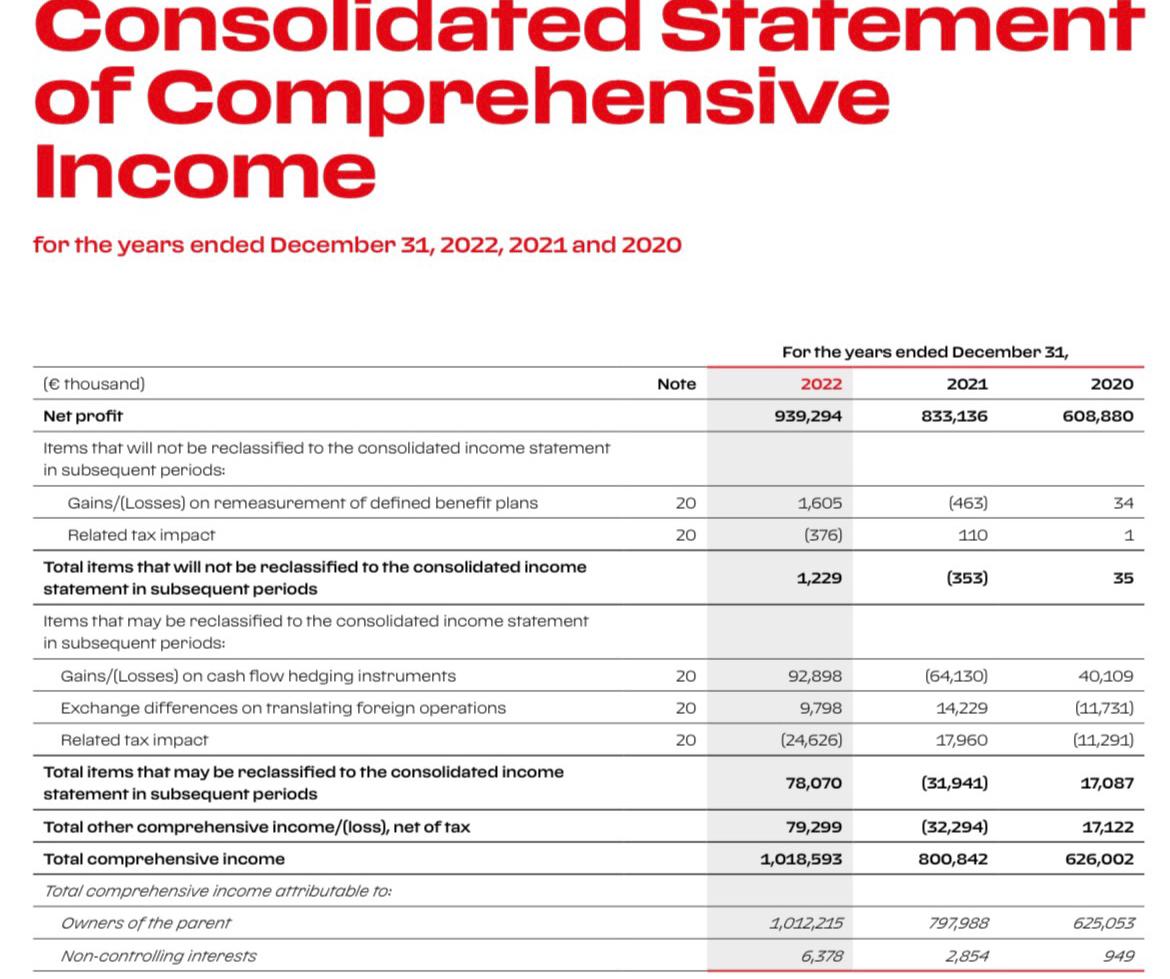

Consolidated Statement of Comprehensive Income for the years ended December 31, 2022, 2021 and 2020 ( thousand) Net profit Items that will not be reclassified to the consolidated income statement in subsequent periods: Gains/(Losses) on remeasurement of defined benefit plans Related tax impact Total items that will not be reclassified to the consolidated income statement in subsequent periods Items that may be reclassified to the consolidated income statement in subsequent periods: Gains/(Losses) on cash flow hedging instruments Exchange differences on translating foreign operations Related tax impact Total items that may be reclassified to the consolidated income statement in subsequent periods Total other comprehensive income/(loss), net of tax Total comprehensive income Total comprehensive income attributable to: Owners of the parent Non-controlling interests Note 20 20 20 20 20 For the years ended December 31, 2022 939,294 1,605 (376) 1,229 92,898 9,798 (24,626) 78,070 79,299 1,018,593 1,012,215 6,378 2021 833,136 (463) 110 (353) (64,130) 14,229 17,960 (31,941) (32,294) 800,842 797,988 2,854 2020 608,880 34 1 35 40,109 (11,731) (11,291) 17,087 17,122 626,002 625,053 949

Step by Step Solution

★★★★★

3.39 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started