Question

Consider the below representation of a three-asset portfolio space with iso-expected return and iso-variance curves depicted as dashed lines. Note that each lettered dot corresponds

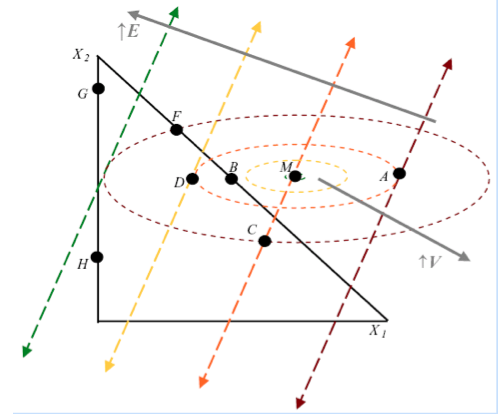

Consider the below representation of a three-asset portfolio space with iso-expected return and iso-variance curves depicted as dashed lines. Note that each lettered dot corresponds to a portfolio. Note also that Asset 2 has the highest expected return, followed by Asset 3, with Asset 1 having the lowest expected return.

If investors are able to take arbitrary short positions, what point in the above graph represents the minimum variance portfolio? (1 points)

If investors are able to take arbitrary short positions, what portfolios lie on the efficient frontier? (2 points)

For an investor restricted by Non-Negativity constraints, what point in the above graph represents the minimum variance portfolio? (1 points)

For an investor restricted by Non-Negativity constraints, identify two portfolios that investor would strictly prefer to portfolio C. (2 points)

$1 C X H 1 1 1-4- ITH-IT- 1 1 1 1 -0 /-.----- GStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started