Answered step by step

Verified Expert Solution

Question

1 Approved Answer

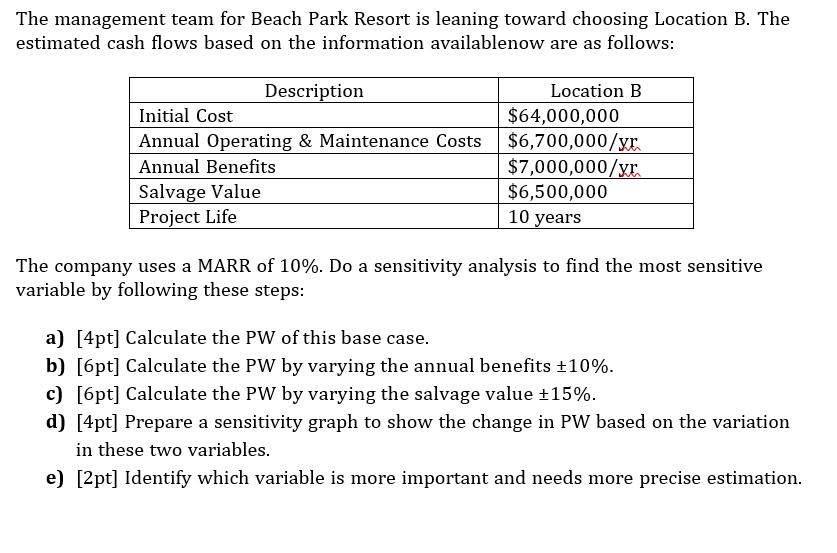

The management team for Beach Park Resort is leaning toward choosing Location B. The estimated cash flows based on the information availablenow are as

The management team for Beach Park Resort is leaning toward choosing Location B. The estimated cash flows based on the information availablenow are as follows: Description Initial Cost Annual Operating & Maintenance Costs Annual Benefits Salvage Value Project Life Location B $64,000,000 $6,700,000/xx. $7,000,000/xx $6,500,000 10 years The company uses a MARR of 10%. Do a sensitivity analysis to find the most sensitive variable by following these steps: a) [4pt] Calculate the PW of this base case. b) [6pt] Calculate the PW by varying the annual benefits +10%. c) [6pt] Calculate the PW by varying the salvage value 15%. d) [4pt] Prepare a sensitivity graph to show the change in PW based on the variation in these two variables. e) [2pt] Identify which variable is more important and needs more precise estimation.

Step by Step Solution

★★★★★

3.50 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Answer a PW of cash flow Year Cashflow PVF10 PV 0 64000000 1 64000000 1 300000 09091 272727 2 300000 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started