Answered step by step

Verified Expert Solution

Question

1 Approved Answer

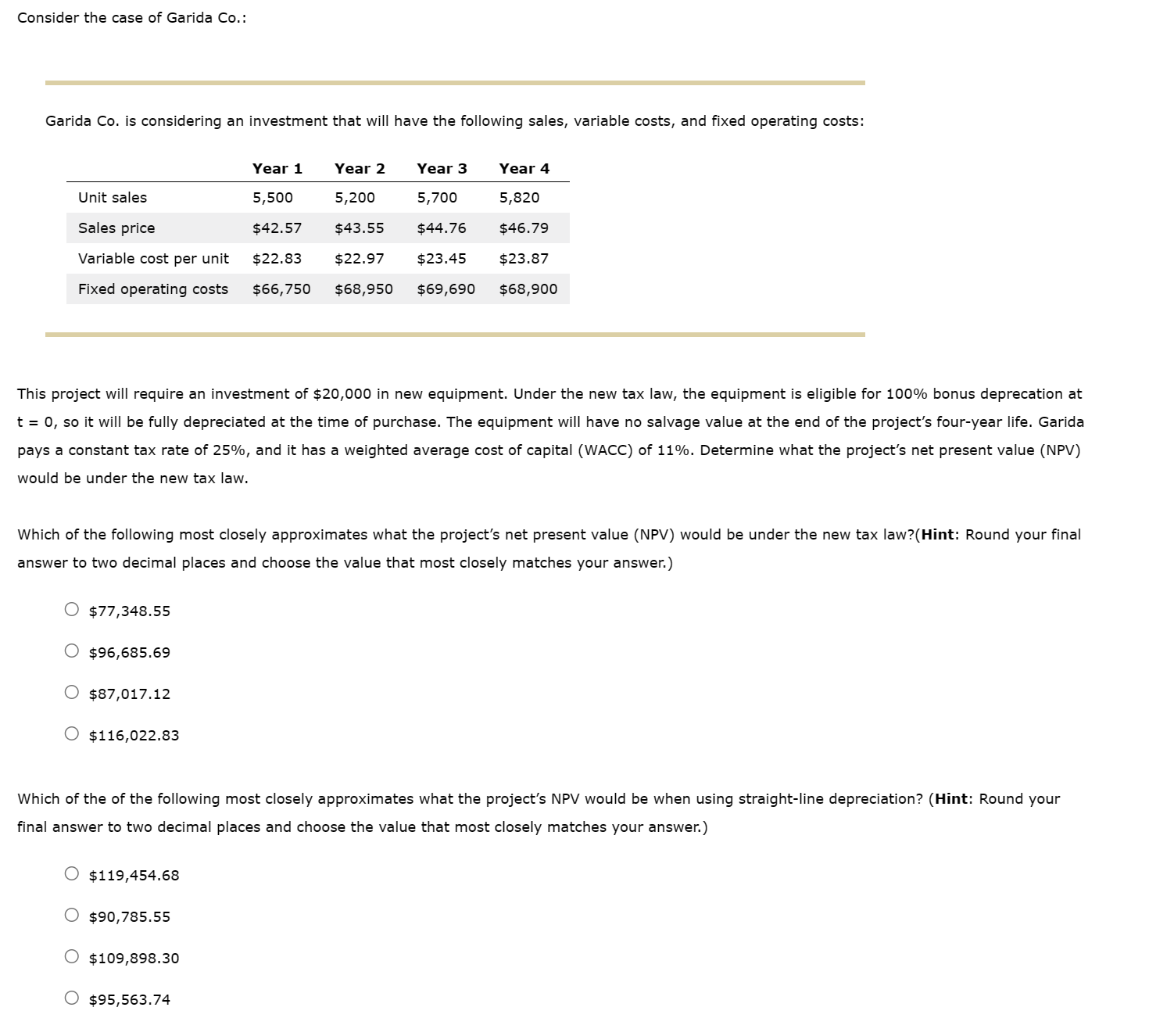

Consider the case of Garida Co.: Garida Co. is considering an investment that will have the following sales, variable costs, and fixed operating costs: This

Consider the case of Garida Co.: Garida Co. is considering an investment that will have the following sales, variable costs, and fixed operating costs: This project will require an investment of $20,000 in new equipment. Under the new tax law, the equipment is eligible for 100% bonus deprecation at t=0, so it will be fully depreciated at the time of purchase. The equipment will have no salvage value at the end of the project's four-year life. Garida pays a constant tax rate of 25%, and it has a weighted average cost of capital (WACC) of 11%. Determine what the project's net present value (NPV) would be under the new tax law. Which of the following most closely approximates what the project's net present value (NPV) would be under the new tax law?(Hint: Round your final answer to two decimal places and choose the value that most closely matches your answer.) $77,348.55 $96,685.69 $87,017.12 $116,022.83 Which of the of the following most closely approximates what the project's NPV would be when using straight-line depreciation? (Hint: Round your final answer to two decimal places and choose the value that most closely matches your answer.) $119,454.68 $90,785.55 $109,898.30 $95,563.74

Consider the case of Garida Co.: Garida Co. is considering an investment that will have the following sales, variable costs, and fixed operating costs: This project will require an investment of $20,000 in new equipment. Under the new tax law, the equipment is eligible for 100% bonus deprecation at t=0, so it will be fully depreciated at the time of purchase. The equipment will have no salvage value at the end of the project's four-year life. Garida pays a constant tax rate of 25%, and it has a weighted average cost of capital (WACC) of 11%. Determine what the project's net present value (NPV) would be under the new tax law. Which of the following most closely approximates what the project's net present value (NPV) would be under the new tax law?(Hint: Round your final answer to two decimal places and choose the value that most closely matches your answer.) $77,348.55 $96,685.69 $87,017.12 $116,022.83 Which of the of the following most closely approximates what the project's NPV would be when using straight-line depreciation? (Hint: Round your final answer to two decimal places and choose the value that most closely matches your answer.) $119,454.68 $90,785.55 $109,898.30 $95,563.74 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started