Answered step by step

Verified Expert Solution

Question

1 Approved Answer

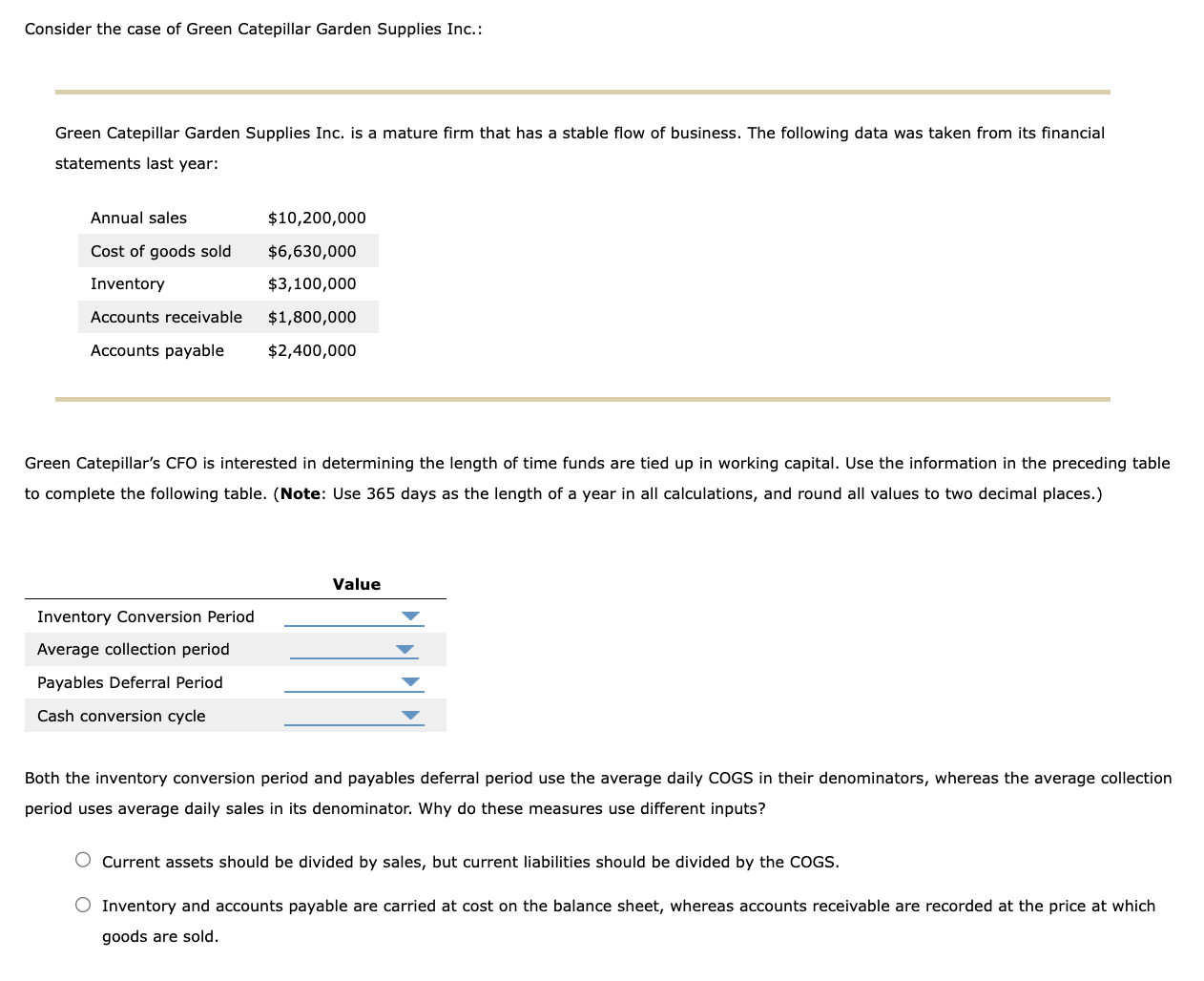

Consider the case of Green Catepillar Garden Supplies Inc.: Green Catepillar Garden Supplies Inc. is a mature firm that has a stable flow of business.

Consider the case of Green Catepillar Garden Supplies Inc.:

Green Catepillar Garden Supplies Inc. is a mature firm that has a stable flow of business. The following data was taken from its financial

statements last year:

Green Catepillar's CFO is interested in determining the length of time funds are tied up in working capital. Use the information in the preceding table

to complete the following table. Note: Use days as the length of a year in all calculations, and round all values to two decimal places.

Both the inventory conversion period and payables deferral period use the average daily COGS in their denominators, whereas the average collection

period uses average daily sales in its denominator. Why do these measures use different inputs?

Current assets should be divided by sales, but current liabilities should be divided by the COGS.

Inventory and accounts payable are carried at cost on the balance sheet, whereas accounts receivable are recorded at the price at which

goods are sold.Consider the case of Green Catepillar Garden Supplies Inc.:

Green Catepillar Garden Supplies Inc. is a mature firm that has a stable flow of business. The following data was taken from its financial statements last year:

Annual sales $

Cost of goods sold $

Inventory $

Accounts receivable $

Accounts payable $

Green Catepillars CFO is interested in determining the length of time funds are tied up in working capital. Use the information in the preceding table to complete the following table. Note: Use days as the length of a year in all calculations, and round all values to two decimal places.

Value

Inventory Conversion Period

Average collection period

Payables Deferral Period

Cash conversion cycle

Both the inventory conversion period and payables deferral period use the average daily COGS in their denominators, whereas the average collection period uses average daily sales in its denominator. Why do these measures use different inputs?

Current assets should be divided by sales, but current liabilities should be divided by the COGS.

Inventory and accounts payable are carried at cost on the balance sheet, whereas accounts receivable are recorded at the price at which goods are sold.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started