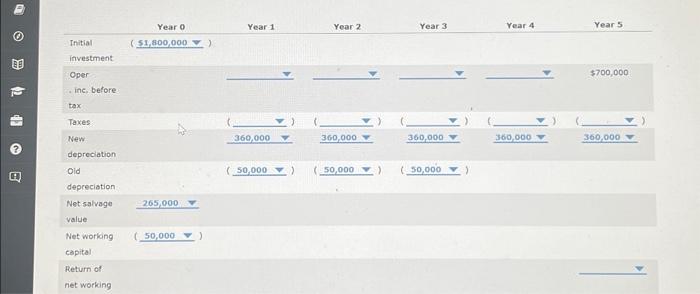

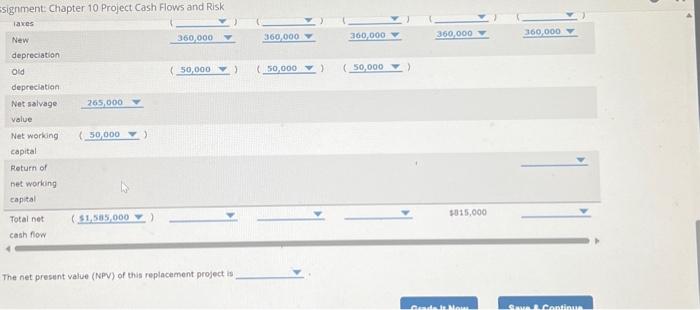

Consider the case of Jones Company: The managers of Jones company are considering repiacitig an existing piece of equipment, and have collected the folioning information: - The new piece of equipment will have a cost of $1,800,000, and it will be depreciated on a straight-line basis over a period of fivo years - The old machine is also being depreciated on a straight-iine basis. It has a book value of s200,000 (at year 0 ) and three more years of depreciation left {550,000 per year }. - The new equipment willwiave a salvage value of $0 at the end of the project's life (year 5 ). The old machine hat a current salvage value ( ot year o) of 5300,000 - Peplacing the old machine wiff require an investment in net working capitat (WWc) of 350,000 that will be recovered at the end of the project's life ( year 5 ). - The new machine is more efricient, so the incremental increase in operating incoma betore taxes will increase by a total of s7og,o00 in each of the next five years (yeara 1-5). (Hint: This value represents the difference between the revenves and operating costs (inciuding depreciation expense) generated using the new equipenent and that earned using the old equipmenti) - The project's required rate of retum is 94 i - The company's ancuat tax rate is 35\%. The net present value (NPV) of this replacement project is Consider the case of Jones Company: The managers of Jones company are considering repiacitig an existing piece of equipment, and have collected the folioning information: - The new piece of equipment will have a cost of $1,800,000, and it will be depreciated on a straight-line basis over a period of fivo years - The old machine is also being depreciated on a straight-iine basis. It has a book value of s200,000 (at year 0 ) and three more years of depreciation left {550,000 per year }. - The new equipment willwiave a salvage value of $0 at the end of the project's life (year 5 ). The old machine hat a current salvage value ( ot year o) of 5300,000 - Peplacing the old machine wiff require an investment in net working capitat (WWc) of 350,000 that will be recovered at the end of the project's life ( year 5 ). - The new machine is more efricient, so the incremental increase in operating incoma betore taxes will increase by a total of s7og,o00 in each of the next five years (yeara 1-5). (Hint: This value represents the difference between the revenves and operating costs (inciuding depreciation expense) generated using the new equipenent and that earned using the old equipmenti) - The project's required rate of retum is 94 i - The company's ancuat tax rate is 35\%. The net present value (NPV) of this replacement project is