Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Consider the case study described below. TESSERA SA owns a warehouse building with a surface of 3 square kilometers. On top of this building there

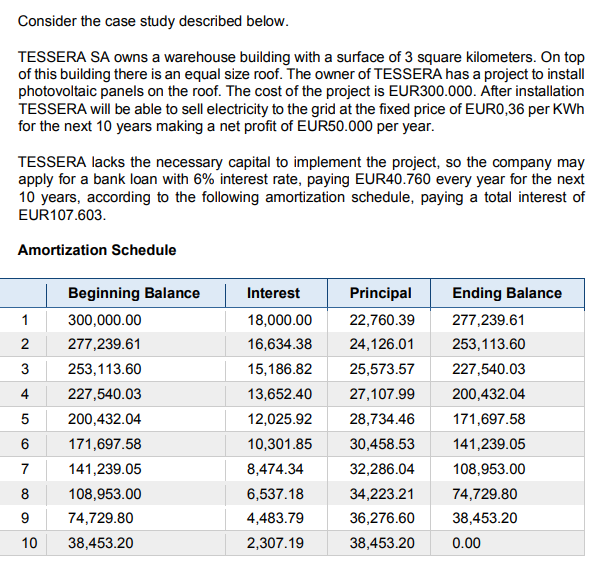

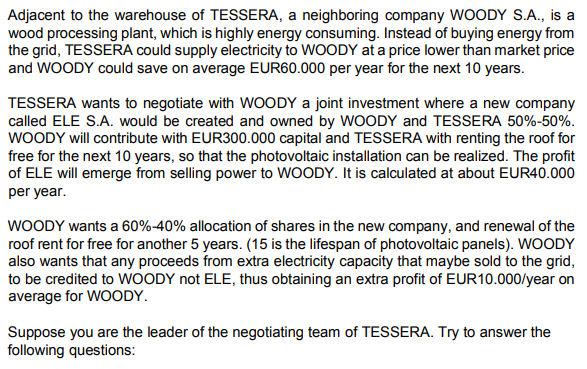

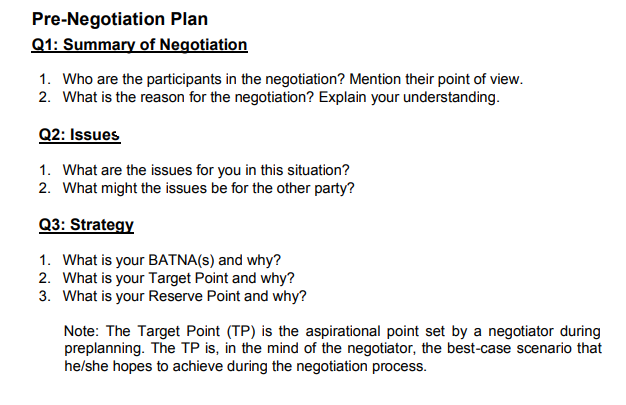

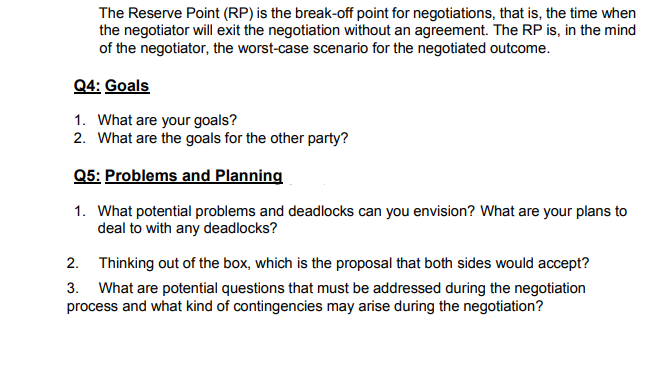

Consider the case study described below. TESSERA SA owns a warehouse building with a surface of 3 square kilometers. On top of this building there is an equal size roof. The owner of TESSERA has a project to install photovoltaic panels on the roof. The cost of the project is EUR300.000. After installation TESSERA will be able to sell electricity to the grid at the fixed price of EUR0,36 per KWh for the next 10 years making a net profit of EUR50.000 per year. TESSERA lacks the necessary capital to implement the project, so the company may apply for a bank loan with 6% interest rate, paying EUR40.760 every year for the next 10 years, according to the following amortization schedule, paying a total interest of EUR107.603. Amortization Schedule Adjacent to the warehouse of TESSERA, a neighboring company WOODY S.A., is a wood processing plant, which is highly energy consuming. Instead of buying energy from the grid, TESSERA could supply electricity to WOODY at a price lower than market price and WOODY could save on average EUR60.000 per year for the next 10 years. TESSERA wants to negotiate with WOODY a joint investment where a new company called ELE S.A. would be created and owned by WOODY and TESSERA 50%50%. WOODY will contribute with EUR300.000 capital and TESSERA with renting the roof for free for the next 10 years, so that the photovoltaic installation can be realized. The profit of ELE will emerge from selling power to WOODY. It is calculated at about EUR40.000 per year. WOODY wants a 60%40% allocation of shares in the new company, and renewal of the roof rent for free for another 5 years. ( 15 is the lifespan of photovoltaic panels). WOODY also wants that any proceeds from extra electricity capacity that maybe sold to the grid, to be credited to WOODY not ELE, thus obtaining an extra profit of EUR10.000/year on average for WOODY. Suppose you are the leader of the negotiating team of TESSERA. Try to answer the following questions: Pre-Negotiation Plan Q1: Summary of Negotiation 1. Who are the participants in the negotiation? Mention their point of view. 2. What is the reason for the negotiation? Explain your understanding. Q2: Issues 1. What are the issues for you in this situation? 2. What might the issues be for the other party? Q3: Strategy 1. What is your BATNA(s) and why? 2. What is your Target Point and why? 3. What is your Reserve Point and why? Note: The Target Point (TP) is the aspirational point set by a negotiator during preplanning. The TP is, in the mind of the negotiator, the best-case scenario that he/she hopes to achieve during the negotiation process. The Reserve Point (RP) is the break-off point for negotiations, that is, the time when the negotiator will exit the negotiation without an agreement. The RP is, in the mind of the negotiator, the worst-case scenario for the negotiated outcome. Q4: Goals 1. What are your goals? 2. What are the goals for the other party? Q5: Problems and Planning 1. What potential problems and deadlocks can you envision? What are your plans to deal to with any deadlocks? 2. Thinking out of the box, which is the proposal that both sides would accept? 3. What are potential questions that must be addressed during the negotiation process and what kind of contingencies may arise during the negotiation

Consider the case study described below. TESSERA SA owns a warehouse building with a surface of 3 square kilometers. On top of this building there is an equal size roof. The owner of TESSERA has a project to install photovoltaic panels on the roof. The cost of the project is EUR300.000. After installation TESSERA will be able to sell electricity to the grid at the fixed price of EUR0,36 per KWh for the next 10 years making a net profit of EUR50.000 per year. TESSERA lacks the necessary capital to implement the project, so the company may apply for a bank loan with 6% interest rate, paying EUR40.760 every year for the next 10 years, according to the following amortization schedule, paying a total interest of EUR107.603. Amortization Schedule Adjacent to the warehouse of TESSERA, a neighboring company WOODY S.A., is a wood processing plant, which is highly energy consuming. Instead of buying energy from the grid, TESSERA could supply electricity to WOODY at a price lower than market price and WOODY could save on average EUR60.000 per year for the next 10 years. TESSERA wants to negotiate with WOODY a joint investment where a new company called ELE S.A. would be created and owned by WOODY and TESSERA 50%50%. WOODY will contribute with EUR300.000 capital and TESSERA with renting the roof for free for the next 10 years, so that the photovoltaic installation can be realized. The profit of ELE will emerge from selling power to WOODY. It is calculated at about EUR40.000 per year. WOODY wants a 60%40% allocation of shares in the new company, and renewal of the roof rent for free for another 5 years. ( 15 is the lifespan of photovoltaic panels). WOODY also wants that any proceeds from extra electricity capacity that maybe sold to the grid, to be credited to WOODY not ELE, thus obtaining an extra profit of EUR10.000/year on average for WOODY. Suppose you are the leader of the negotiating team of TESSERA. Try to answer the following questions: Pre-Negotiation Plan Q1: Summary of Negotiation 1. Who are the participants in the negotiation? Mention their point of view. 2. What is the reason for the negotiation? Explain your understanding. Q2: Issues 1. What are the issues for you in this situation? 2. What might the issues be for the other party? Q3: Strategy 1. What is your BATNA(s) and why? 2. What is your Target Point and why? 3. What is your Reserve Point and why? Note: The Target Point (TP) is the aspirational point set by a negotiator during preplanning. The TP is, in the mind of the negotiator, the best-case scenario that he/she hopes to achieve during the negotiation process. The Reserve Point (RP) is the break-off point for negotiations, that is, the time when the negotiator will exit the negotiation without an agreement. The RP is, in the mind of the negotiator, the worst-case scenario for the negotiated outcome. Q4: Goals 1. What are your goals? 2. What are the goals for the other party? Q5: Problems and Planning 1. What potential problems and deadlocks can you envision? What are your plans to deal to with any deadlocks? 2. Thinking out of the box, which is the proposal that both sides would accept? 3. What are potential questions that must be addressed during the negotiation process and what kind of contingencies may arise during the negotiation Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started