Question

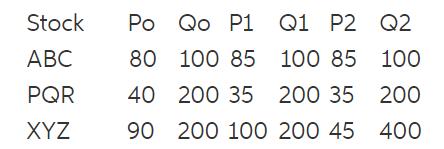

Consider the data in the table 1.1 for a hypothetical three-stock version of the Dow Jones Average. Pt represents price at time t, and Q

Consider the data in the table 1.1 for a hypothetical three-stock version of the Dow Jones Average. Pt represents price at time t, and Q represents shares outstanding at time t.

Table 1.1

Table 1.1

(a) Calculate the rate of return on a price-weighted index of the 3 stocks for the first period (t=0 to t=1).

(b) Calculate the rate of return on a market value-weighted index of the 3 stocks for the first period (t=0 to t=1).

(c) Calculate the rate of return on an equally weighted index of the 3 stocks for the first period (t=0 to t=1).

Stock Qo P1 Q1 P2 Q2 80 100 85 100 85 100 PQR 40 200 35 200 35 200 XYZ 90 200 100 200 45 400

Step by Step Solution

3.49 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

aFrom the given data The rate of return on a priceweigh...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Introduction To Statistical Quality Control

Authors: Douglas C Montgomery

7th Edition

1118146816, 978-1-118-3225, 978-1118146811

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App