Question

Consider the effect of an un-anticipated 1 basis point increase in the 5 year bond rate (x) at time t, which bersists at t+1,

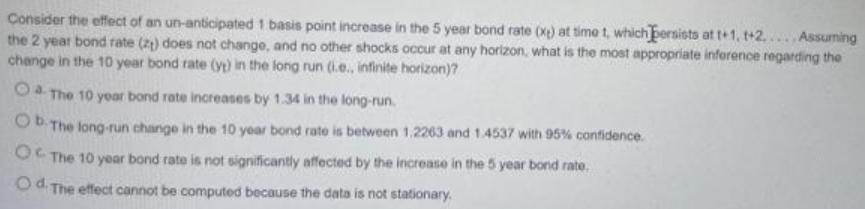

Consider the effect of an un-anticipated 1 basis point increase in the 5 year bond rate (x) at time t, which bersists at t+1, t+2.... Assuming the 2 year bond rate (2) does not change, and no other shocks occur at any horizon, what is the most appropriate inference regarding the change in the 10 year bond rate (yt) in the long run (i.e., infinite horizon)? O The 10 year bond rate increases by 1.34 in the long-run. O The long-run change in the 10 year bond rate is between 1.2263 and 1.4537 with 95% confidence. OC The 10 year bond rate is not significantly affected by the increase in the 5 year bond rate. Od The effect cannot be computed because the data is not stationary.

Step by Step Solution

3.25 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

cA Mn andicipated basiv Point Increaie pce Syer and rate ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Mathematical Statistics With Applications In R

Authors: Chris P. Tsokos, K.M. Ramachandran

2nd Edition

124171133, 978-0124171138

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App