Answered step by step

Verified Expert Solution

Question

1 Approved Answer

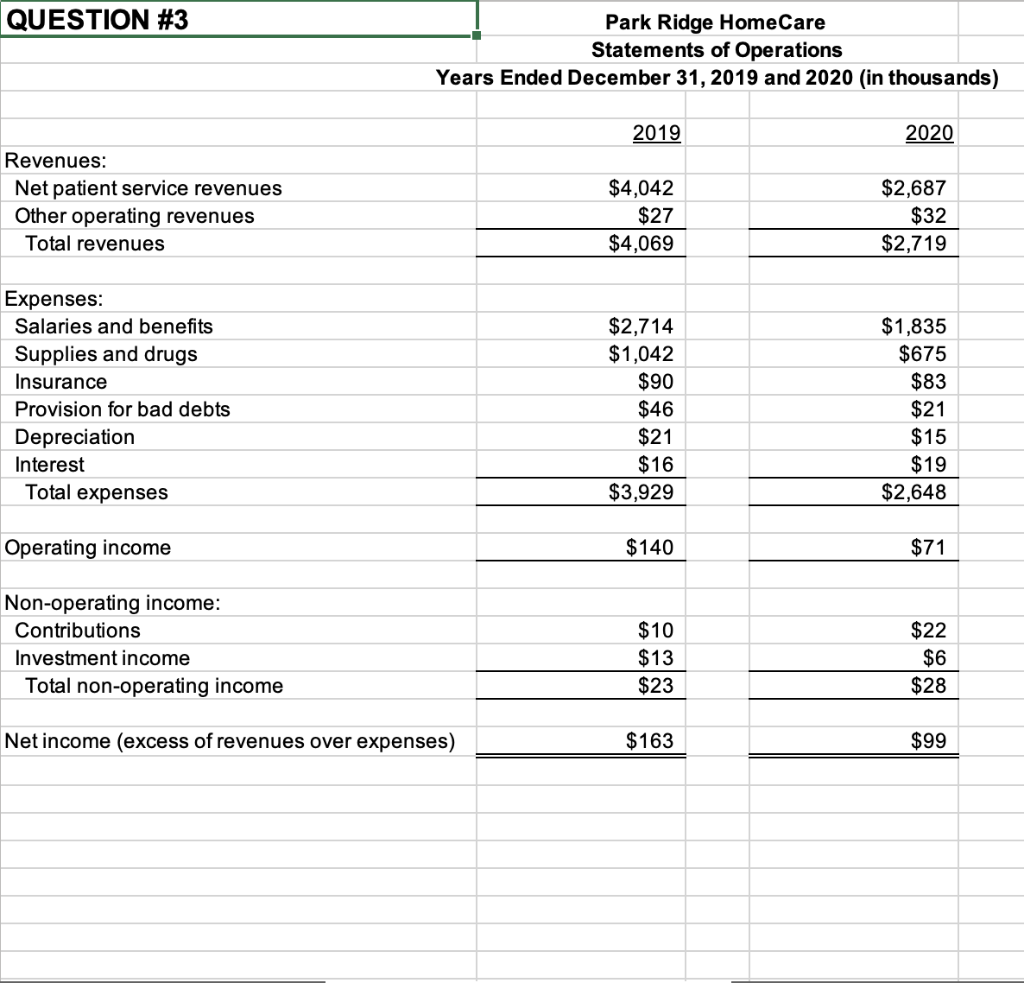

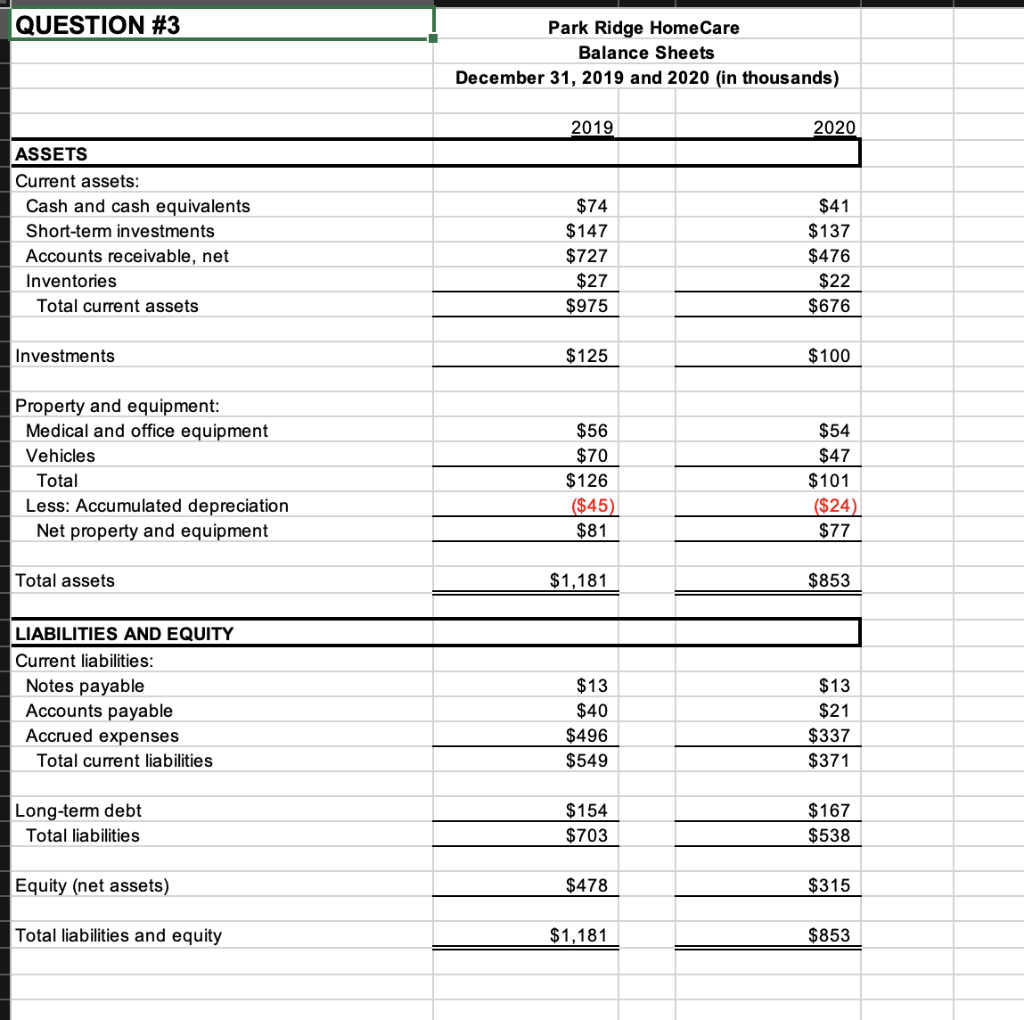

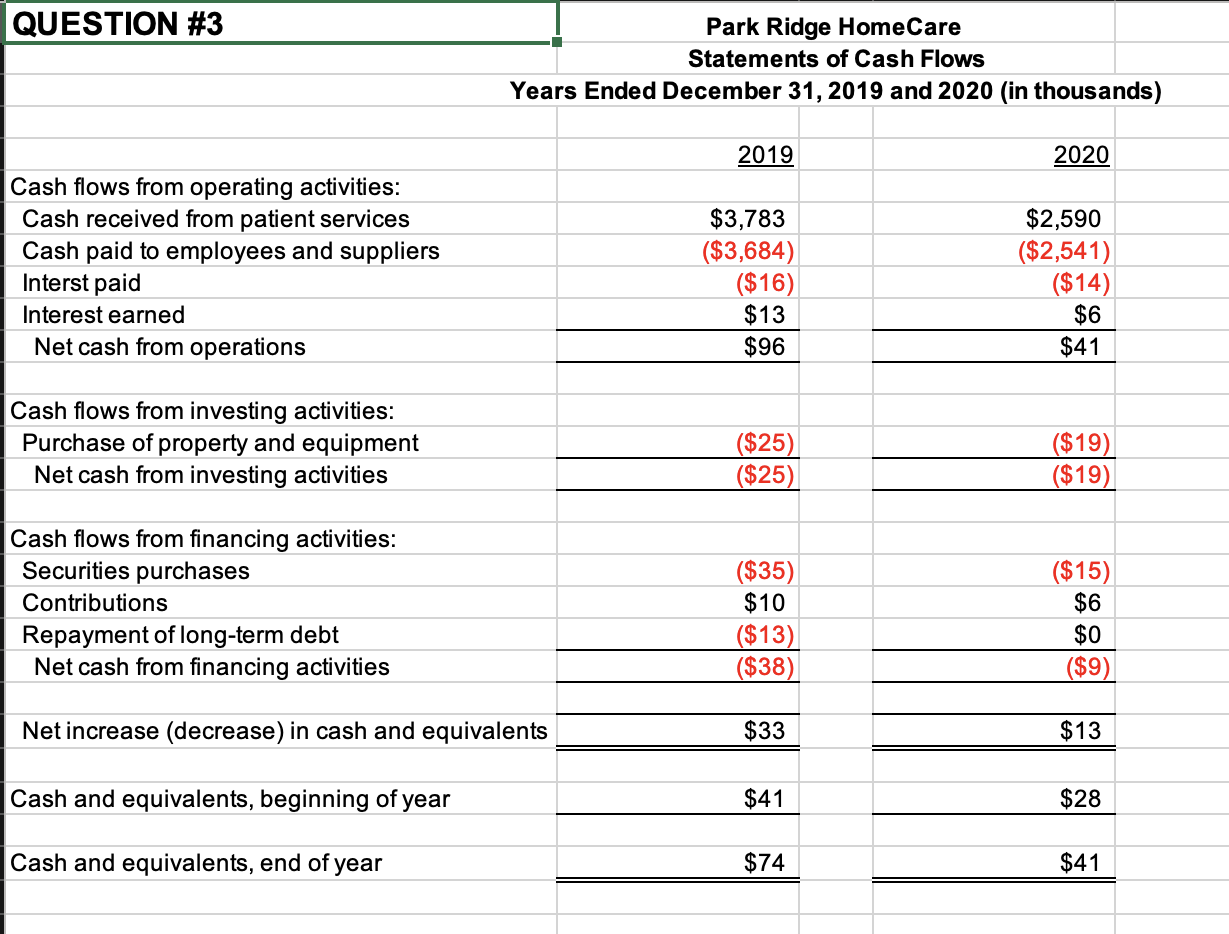

Consider the financial statements for Park Ridge Homecare (a non-profit, home health organization) included in the Excel file Exam 3 Support. The following are industry

- Consider the financial statements for Park Ridge Homecare (a non-profit, home health organization) included in the Excel file Exam 3 Support.

The following are industry average ratios:

Total margin 5.20%

Total asset turnover 3.84 times

Equity multiplier 1.87 times

Return on equity 28.35%

Return on assets 14.50%

Current ratio 2.0 times

Days cash on hand 18.50 days

Average collection period 52 days

Debt ratio 55.0%

Debt-to-equity ratio 1.32

Times interest earned 2.20 times

Fixed asset turnover ratio 25.75 times

- Calculate the 2019 and 2020 ratios for Park Ridge. Interpret each of the 2020 ratios, comparing them to 2019 performance and the industry average.

- Return on assets

- Current ratio

- Days cash on hand

- Average collection period

- Debt ratio

- Debt-to-equity ratio

- Times interest earned ratio

- Fixed asset turnover ratio

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started