Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Consider the first generation currency crisis model in which fiscal dominance creates the crisis. Assume that home country's government debt grows at rate u

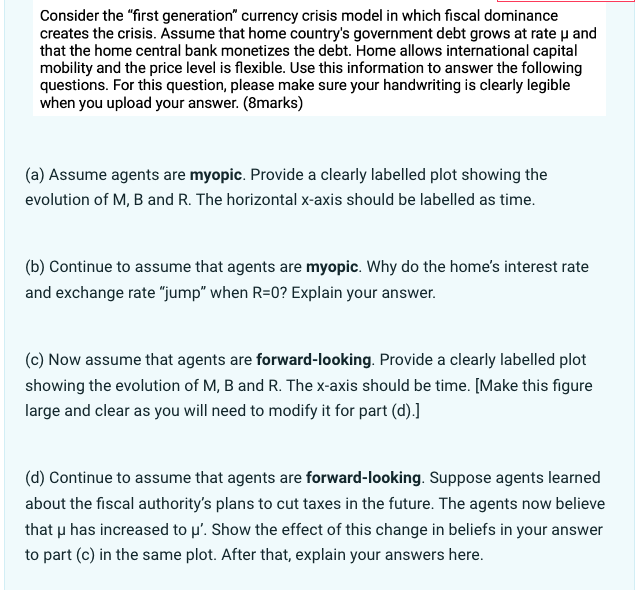

Consider the "first generation" currency crisis model in which fiscal dominance creates the crisis. Assume that home country's government debt grows at rate u and that the home central bank monetizes the debt. Home allows international capital mobility and the price level is flexible. Use this information to answer the following questions. For this question, please make sure your handwriting is clearly legible when you upload your answer. (8marks) (a) Assume agents are myopic. Provide a clearly labelled plot showing the evolution of M, B and R. The horizontal x-axis should be labelled as time. (b) Continue to assume that agents are myopic. Why do the home's interest rate and exchange rate "jump" when R=0? Explain your answer. (c) Now assume that agents are forward-looking. Provide a clearly labelled plot showing the evolution of M, B and R. The x-axis should be time. [Make this figure large and clear as you will need to modify it for part (d).] (d) Continue to assume that agents are forward-looking. Suppose agents learned about the fiscal authority's plans to cut taxes in the future. The agents now believe that u has increased to u'. Show the effect of this change in beliefs in your answer to part (c) in the same plot. After that, explain your answers here.

Step by Step Solution

★★★★★

3.43 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Certainly Lets address each part of the questions a Assume agents are myopic Provide a clearly label...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started