Answered step by step

Verified Expert Solution

Question

1 Approved Answer

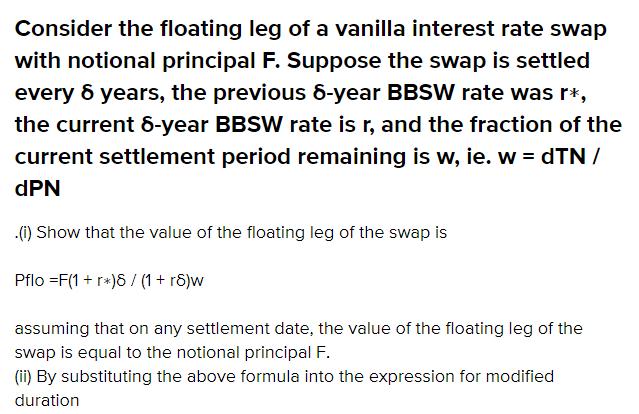

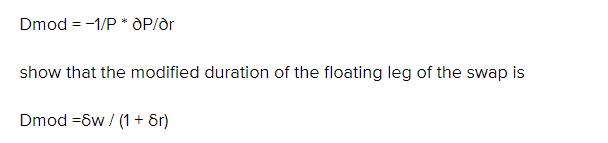

Consider the floating leg of a vanilla interest rate swap with notional principal F. Suppose the swap is settled every 6 years, the previous

Consider the floating leg of a vanilla interest rate swap with notional principal F. Suppose the swap is settled every 6 years, the previous 8-year BBSW rate was r*, the current 8-year BBSW rate is r, and the fraction of the current settlement period remaining is w, ie. w = dTN / dPN .(i) Show that the value of the floating leg of the swap is Pflo F(1 + r)6 / (1 + r8)w assuming that on any settlement date, the value of the floating leg of the swap is equal to the notional principal F. (ii) By substituting the above formula into the expression for modified duration Dmod = -1/P * OP/or show that the modified duration of the floating leg of the swap is Dmod=8w/ (1+ 8r)

Step by Step Solution

★★★★★

3.43 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

i This is shown in the previous question Pflo F1rw ii Using the formula for modified dura...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started