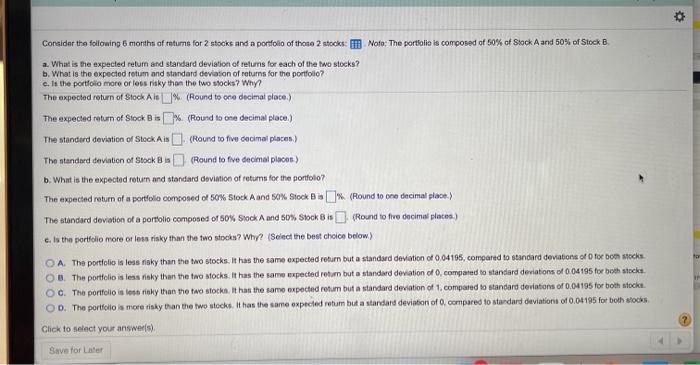

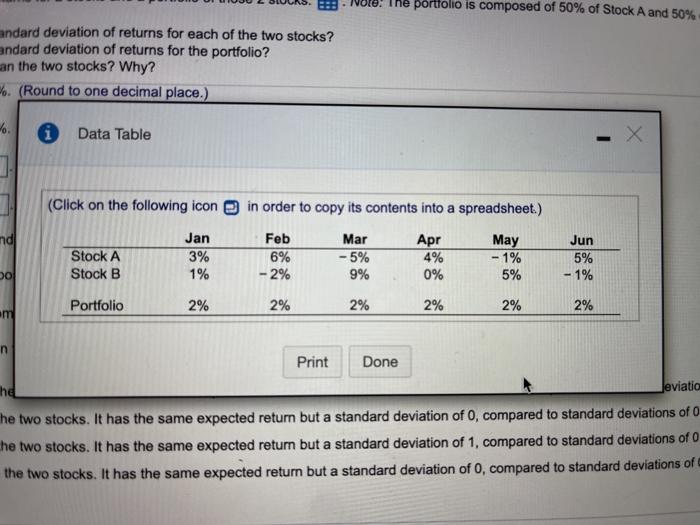

Consider the following 6 months of retums for 2 stocks and a portfolio of those 2 stock: Noto: The portfolio is composed of 50% of Stock A and 50% of Stock B a. What is the expected return and standard deviation of returns for each of the two stocks? b. What is the expected retum and standard deviation of returns for the portfolio e. In the portfolio more or less risky then the two stocks? Why? The expected return of Stock Ais L% (Round to one decimal place) The expected return of Stock B is % (Round to one decimal place) The standard deviation of Stock As (Round to five decimal places) The standard deviation of Stock Bis Round to five decimal place) b. What is the expected return and standard deviation of returns for the portfolo? The expected return of a portfolio composed of 50% Stock Aand 50% Stock % (Round to one decimal place The standard deviation of a portfolio composed of 50% Stock A and 60% Stock BisRound to five decimal places) c. Is the portfolio more or less risky than the two stocks? Why? Select the best choice below) OA. The portfolio is less roky than the two stocks. It has the same expected return but a standard deviation of004195, compared to standard deviations of O for bon stock OB. The portfolio is less risky than the two stocks. It has the same expected rotum but a standard deviation of compared to standard deviations of 0.04195 for both stocks OO. The portfolio is los rinky than the two stock. It has the same expected retum but a standard deviation of 1. compared to standard deviations of 0.04195 for both stock OD. The portfolio is more risky than the two stock. It has the same expected return but a standard deviation of compared to stardard deviations of 0.01195 for both looks to Click to select your answers) Save for Later . Note! The portfolio is composed of 50% of Stock A and 50% andard deviation of returns for each of the two stocks? andard deviation of returns for the portfolio? an the two stocks? Why? 6. (Round to one decimal place.) 1 Data Table (Click on the following icon in order to copy its contents into a spreadsheet.) nd Jan 3% 1% Stock A Stock B Feb 6% -2% Mar -5% 9% Apr 4% 0% May - 1% 5% Jun 5% Do - 1% Portfolio 2% 2% 2% 2% 2% 2% am Print Done Jeviatio the two stocks. It has the same expected return but a standard deviation of o, compared to standard deviations of 0 he two stocks. It has the same expected return but a standard deviation of 1, compared to standard deviations of o the two stocks. It has the same expected return but a standard deviation of 0, compared to standard deviations of