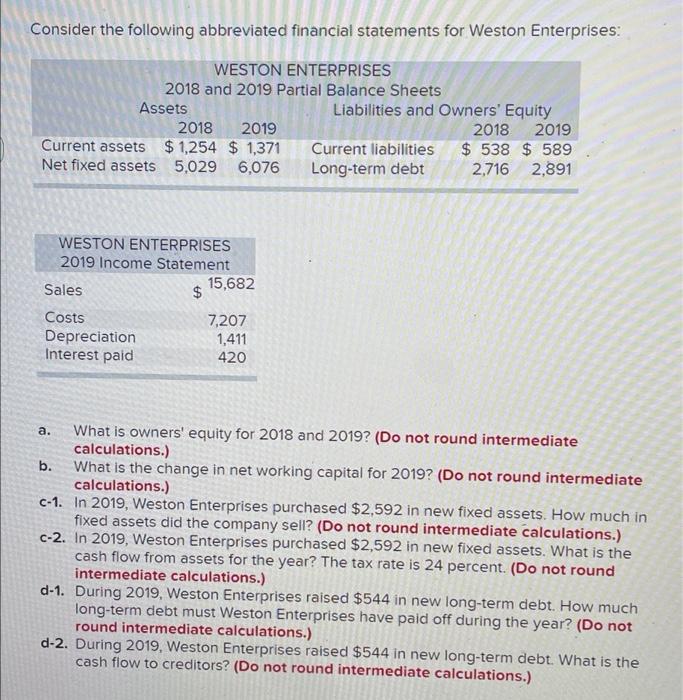

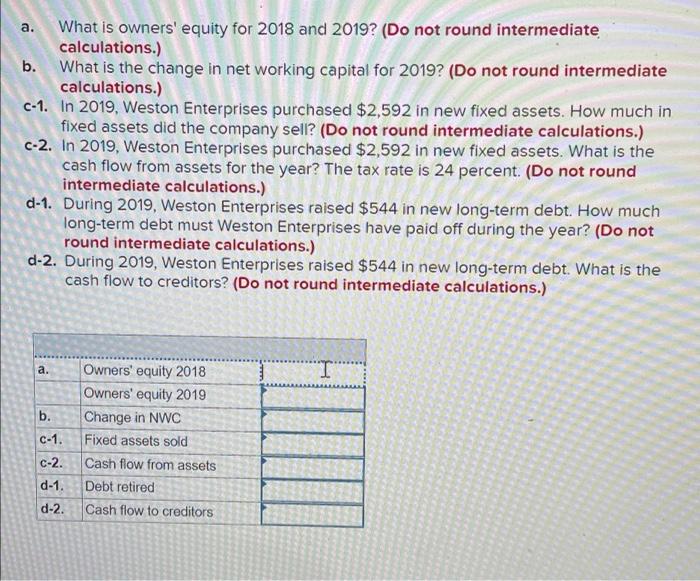

Consider the following abbreviated financial statements for Weston Enterprises: WESTON ENTERPRISES 2018 and 2019 Partial Balance Sheets Assets Liabilities and Owners' Equity 2018 2019 2018 2019 Current assets $ 1,254 $ 1,371 Current liabilities $ 538 $ 589 Net fixed assets 5,029 6,076 Long-term debt 2,716 2,891 WESTON ENTERPRISES 2019 Income Statement 15,682 Sales $ Costs 7,207 Depreciation 1,411 Interest paid 420 a. b. What is owners' equity for 2018 and 2019? (Do not round intermediate calculations.) What is the change in net working capital for 2019? (Do not round intermediate calculations.) c-1. In 2019, Weston Enterprises purchased $2,592 in new fixed assets. How much in fixed assets did the company sell? (Do not round intermediate calculations.) c-2. In 2019, Weston Enterprises purchased $2,592 in new fixed assets. What is the cash flow from assets for the year? The tax rate is 24 percent. (Do not round intermediate calculations.) d-1. During 2019, Weston Enterprises raised $544 in new long-term debt. How much long-term debt must Weston Enterprises have paid off during the year? (Do not round intermediate calculations.) d-2. During 2019, Weston Enterprises raised $544 in new long-term debt. What is the cash flow to creditors? (Do not round intermediate calculations.) a. . What is owners' equity for 2018 and 2019? (Do not round intermediate calculations.) b. What is the change in net working capital for 2019? (Do not round intermediate calculations.) c-1. In 2019, Weston Enterprises purchased $2,592 in new fixed assets. How much in fixed assets did the company sell? (Do not round intermediate calculations.) c-2. In 2019, Weston Enterprises purchased $2,592 in new fixed assets. What is the cash flow from assets for the year? The tax rate is 24 percent. (Do not round intermediate calculations.) d-1. During 2019, Weston Enterprises raised $544 in new long-term debt. How much long-term debt must Weston Enterprises have paid off during the year? (Do not round intermediate calculations.) d-2. During 2019, Weston Enterprises raised $544 in new long-term debt. What is the cash flow to creditors? (Do not round intermediate calculations.) a. b. C-1. C-2. Owners' equity 2018 Owners' equity 2019 Change in NWC Fixed assets sold Cash flow from assets Debt retired Cash flow to creditors d-1 d-2