Answered step by step

Verified Expert Solution

Question

1 Approved Answer

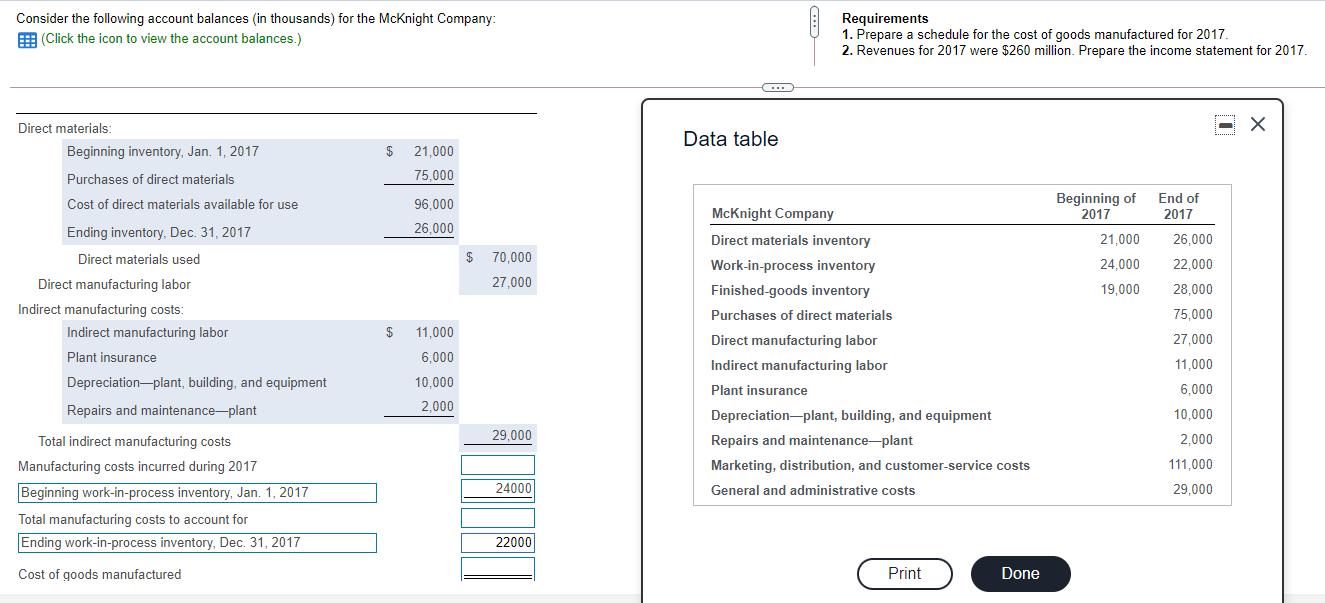

Consider the following account balances (in thousands) for the McKnight Company: (Click the icon to view the account balances.) Direct materials: Beginning inventory, Jan.

Consider the following account balances (in thousands) for the McKnight Company: (Click the icon to view the account balances.) Direct materials: Beginning inventory, Jan. 1, 2017 Purchases of direct materials Cost of direct materials available for use Ending inventory, Dec. 31, 2017 Direct materials used Direct manufacturing labor Indirect manufacturing costs: Indirect manufacturing labor Plant insurance Depreciation-plant, building, and equipment Repairs and maintenance-plant Total indirect manufacturing costs Manufacturing costs incurred during 2017 Beginning work-in-process inventory, Jan. 1, 2017 Total manufacturing costs to account for Ending work-in-process inventory, Dec. 31, 2017 Cost of goods manufactured $ 21,000 75,000 96,000 26,000 $ 11,000 6,000 10,000 2,000 $ 70,000 27,000 29,000 24000 22000 ... Data table Requirements 1. Prepare a schedule for the cost of goods manufactured for 2017. 2. Revenues for 2017 were $260 million. Prepare the income statement for 2017. McKnight Company Direct materials inventory Work-in-process inventory Finished-goods inventory Purchases of direct materials Direct manufacturing labor Indirect manufacturing labor Plant insurance Depreciation-plant, building, and equipment Repairs and maintenance-plant Marketing, distribution, and customer-service costs General and administrative costs Print Done Beginning of 2017 21,000 24,000 19,000 End of 2017 26,000 22,000 28,000 75,000 27,000 11.000 6,000 10,000 2,000 111.000 29,000 X

Step by Step Solution

★★★★★

3.41 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION To prepare the schedule for the cost of goods manufactured for 2017 we need to calculate the various components involved Heres the breakdown ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started