Answered step by step

Verified Expert Solution

Question

1 Approved Answer

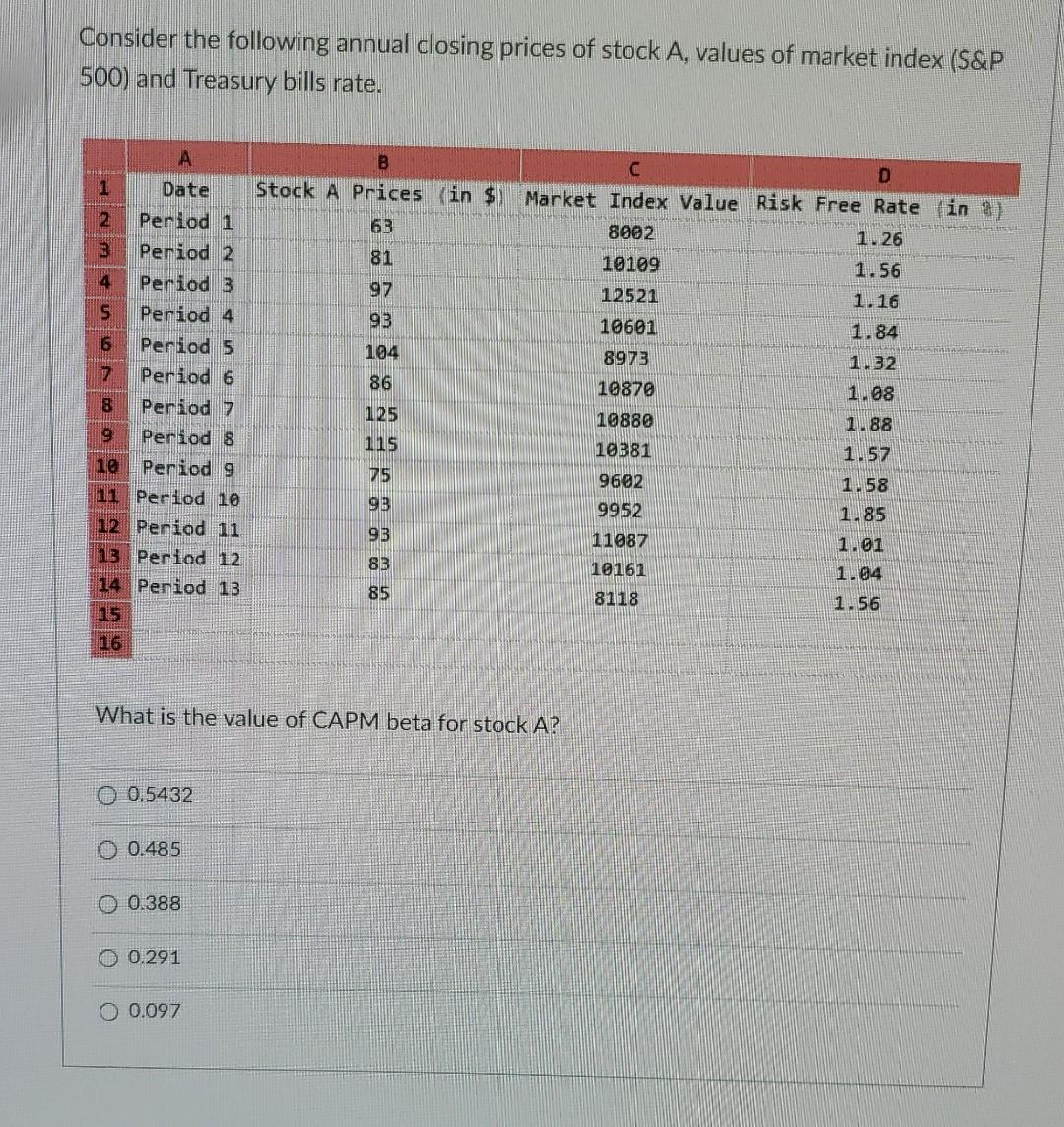

Consider the following annual closing prices of stock A, values of market index (S&P 500) and Treasury bills rate. D Market Index Value Risk Free

Consider the following annual closing prices of stock A, values of market index (S&P 500) and Treasury bills rate. D Market Index Value Risk Free Rate 8002 1.26 10109 1.56 12521 1.16 10601 1.84 8973 1.32 10870 A B 1 Date Stock A Prices in $ 22 Period 1 63 a Period 2 81 4 Period 3 97 S Period 4 93 6 Period 5 104 Period 6 86 8 Period 7 125 9 Period 8 115 ine Period 9 75 11 Period 10 9B 12 Period 11 93 13 Period 12 83 14 Period 13 85 115 16 10880 10381 108 1.88 1.57 1.58 9602 9952 1.85 ANAS 1.01 11087 10161 8118 1.04 1.56 What is the value of CAPM beta for stock A? O 0.5432 O 0.485 O 0.388 O 0.291 O 0.097

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started