Question

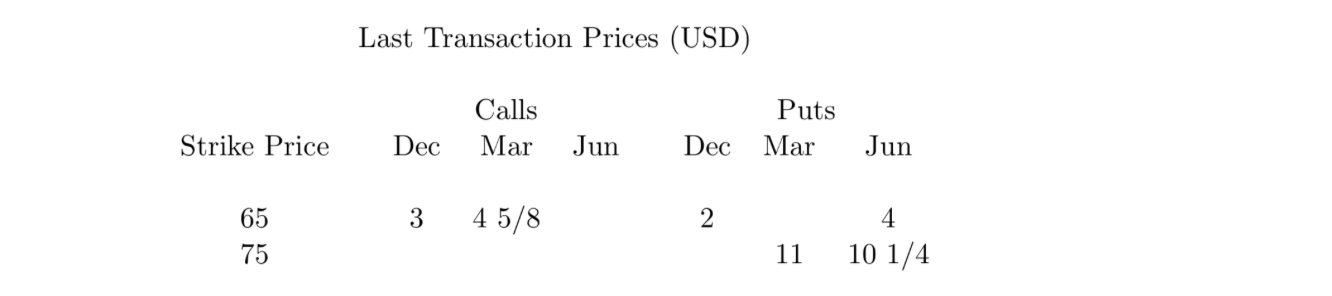

Consider the following are call and put prices for a stock on November 9, 2000 (today): The maturity dates of the options are on Fridays

Consider the following are call and put prices for a stock on November 9, 2000 (today):

The maturity dates of the options are on Fridays preceding the third Saturday in each month which is 37 days from now (for the December options). The annual risk free interest rate is 7% and the stock closed at 65 1/4 on November 9. Ignore transactions costs and taxes. Assuming that trading is costless, identify arbitrage opportunities clearly describing your trading strategy (which securities to buy and short sell) and calculating the amount of your risk-free arbitrage profit in the following two cases:

(a) A violation of the put-call parity condition.

(b) A violation of the time to maturity condition.

Last Transaction Prices (USD) Strike Price Calls Dec Mar Jun Puts Dec Mar Jun 3 4 5/8 2 11 10 1/4Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started