Question

Consider the following assets available for investment: 1. A stock index fund 2. A corporate bond fund 3. A utility fund 4. A global fund

Consider the following assets available for investment:

1. A stock index fund

2. A corporate bond fund

3. A utility fund

4. A global fund

5. A treasury fund

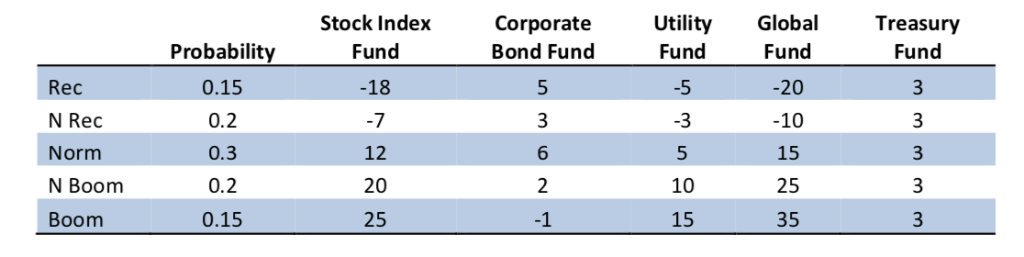

You have research on the funds that has projected out the expected returns (in percent) for the funds

along with the probabilities of those returns occurring. The following table shows the expectations:

Your assignment is to analyze the risk and return metrics of these assets and answer the following questions:

Your assignment is to analyze the risk and return metrics of these assets and answer the following questions:

1. What is the expected return of each asset?

2. What is the standard deviation of each asset?

3. What is the Sharpe Ratio of each asset, using the treasury fund as the risk free asset? (Note, the treasury fund will not have Sharpe ratio because it is the risk free asset)

4. Using the stock index fund as the market, what is the Beta of each asset?

5. If you were only going to invest in one of these assets, would it be more appropriate to use standard deviation or Beta as your measure of risk, and why?

6. Which asset, if held as a single investment, gives you the best reward for the risk you have taken?

7. Diagram the Security Market Line (assuming the stock index fund is the market and the treasury fund is the risk free asset), plotting the assets in their appropriate places.

8. Which assets are considered underpriced and which are considered overpriced based on the SML?

9. Consider three portfolios:

60-40 Stock-Treasury Portfolio 70-30 Utility-Corporate Bond Portfolio

75-25 Global-Treasury Portfolio

-

For the three portfolios listed, calculate the expected return, standard deviation and Beta.

-

Add the three portfolios to your SML chart.

-

Which if these portfolios would you prefer to invest in, and why?

-

If you were choosing between the three portfolios and any single asset, what would you

invest in, and why?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started