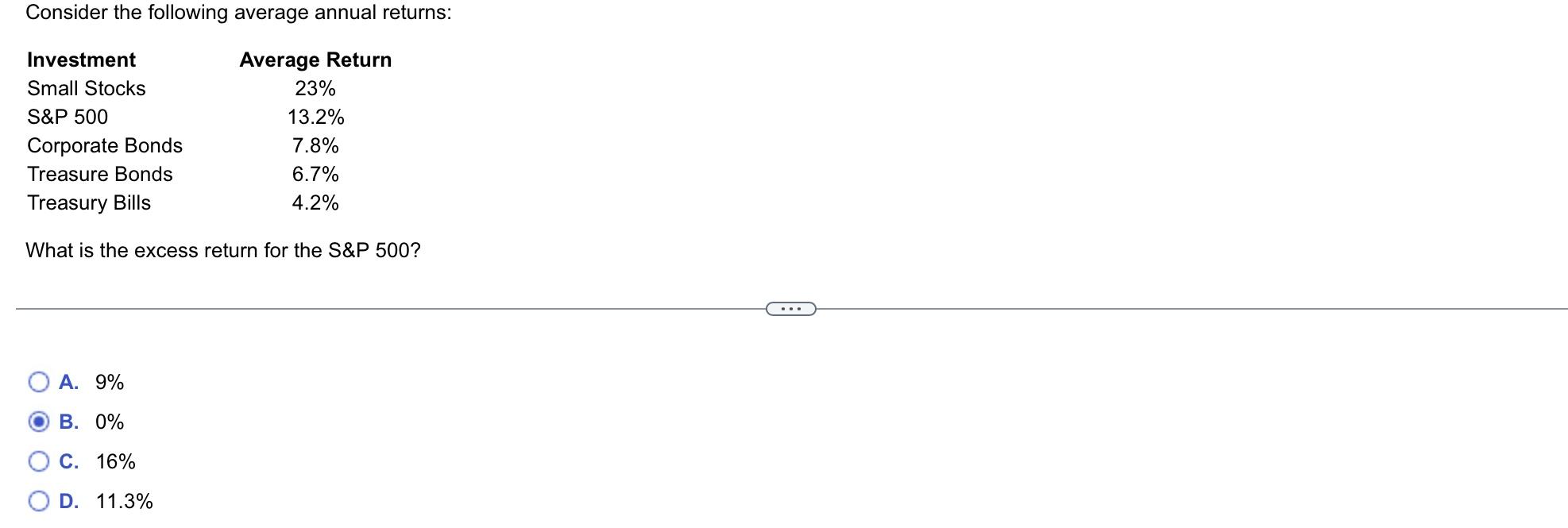

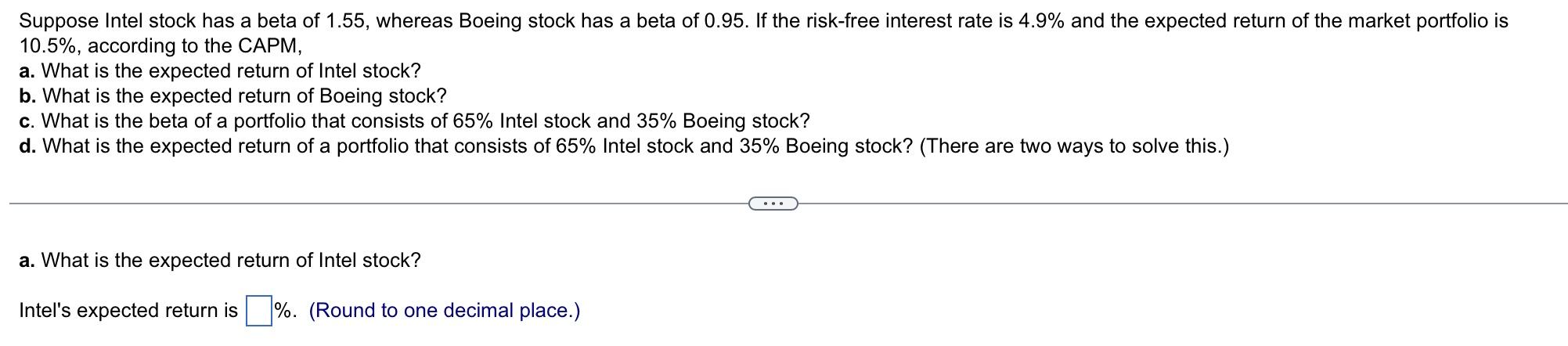

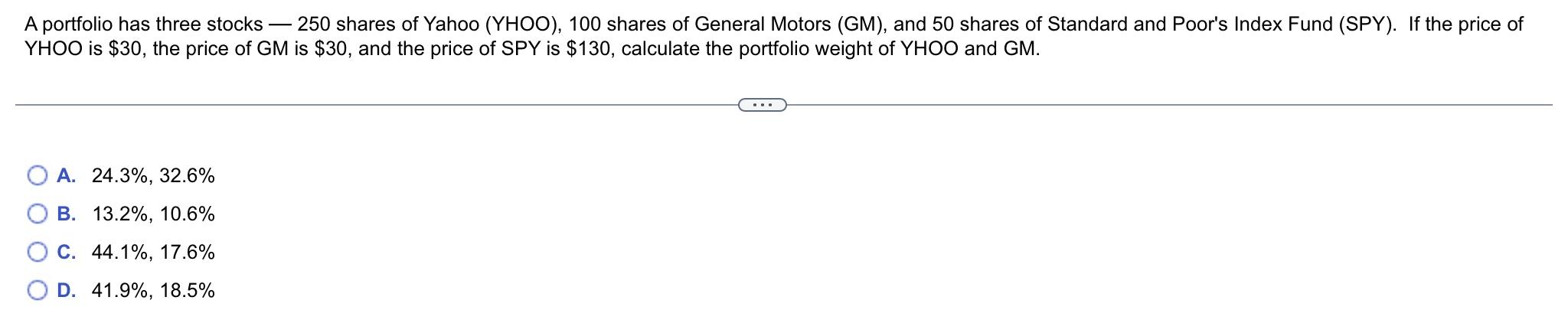

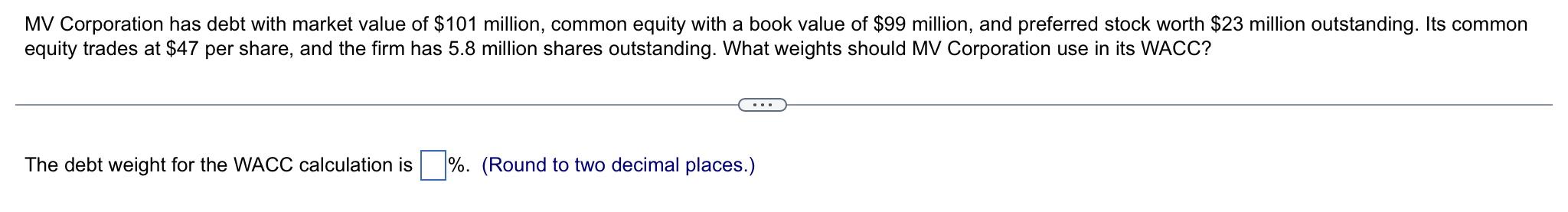

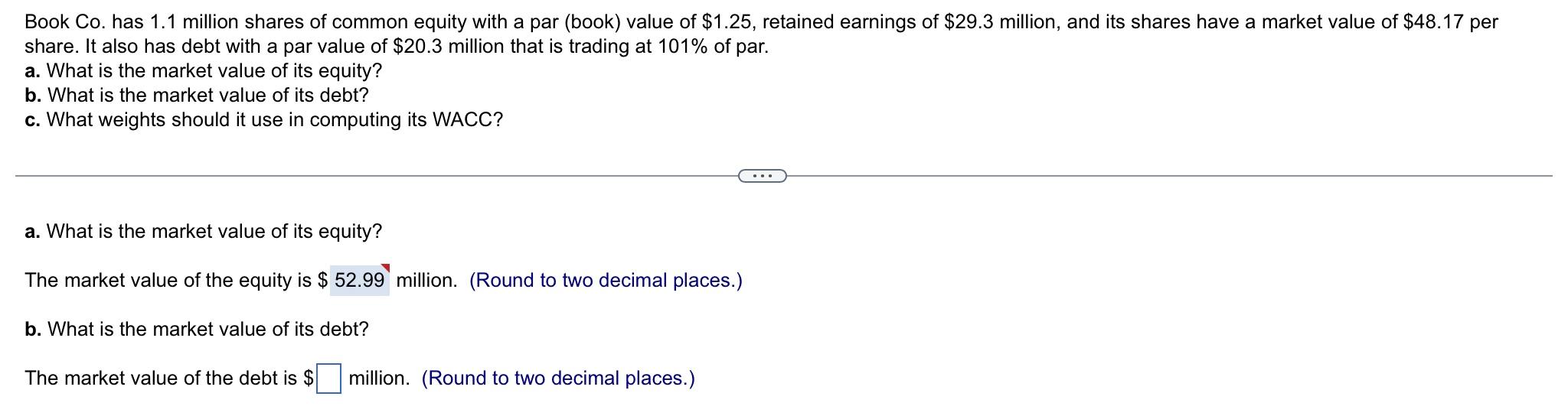

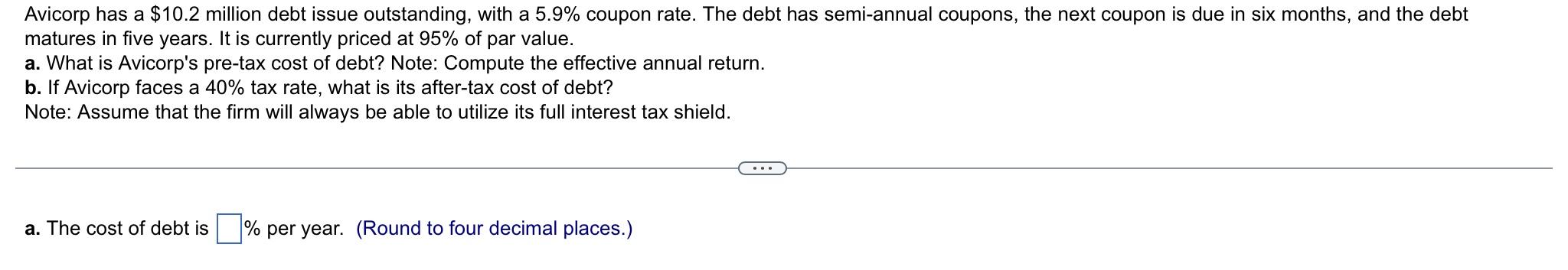

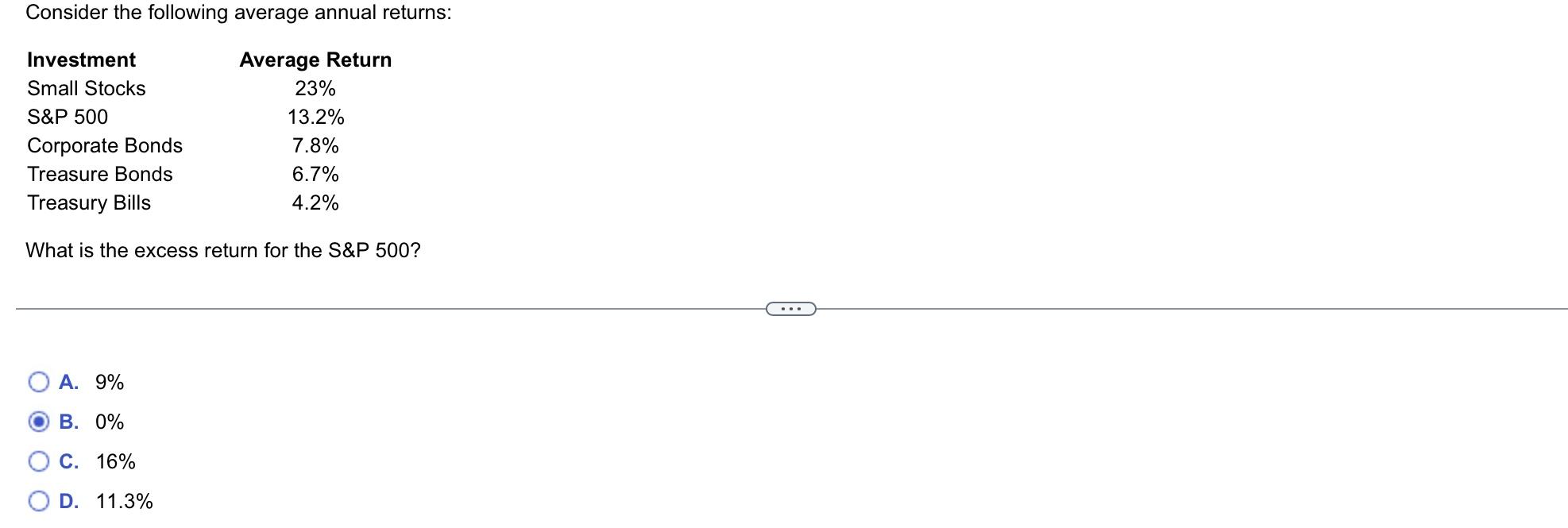

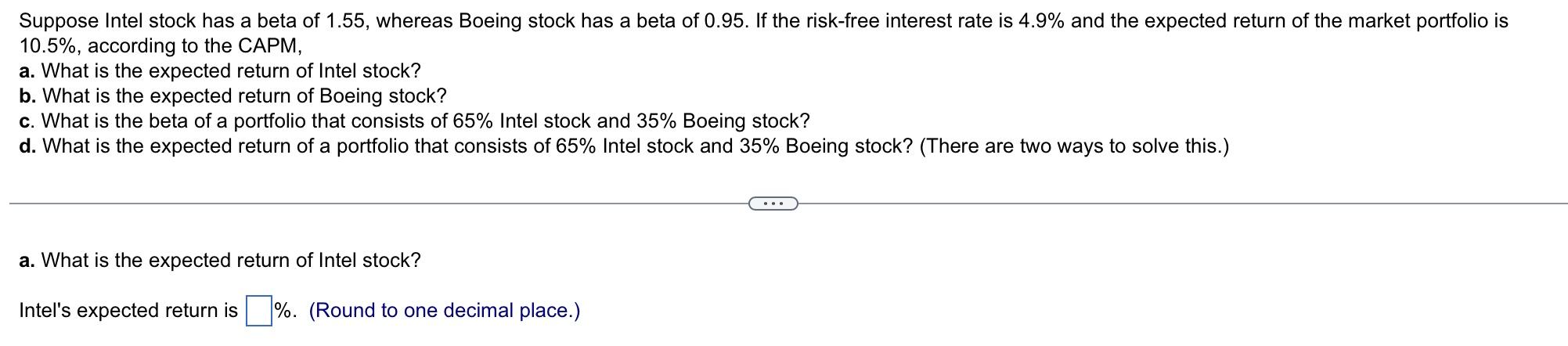

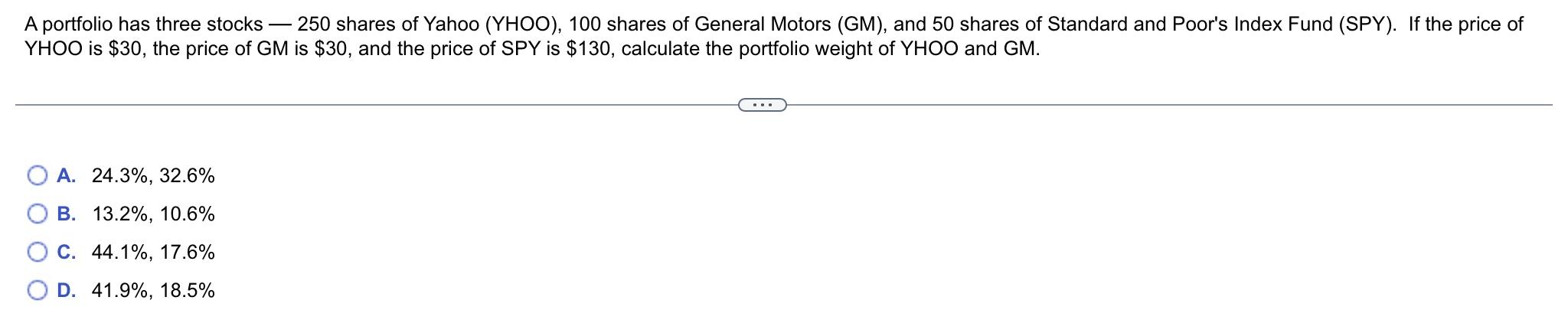

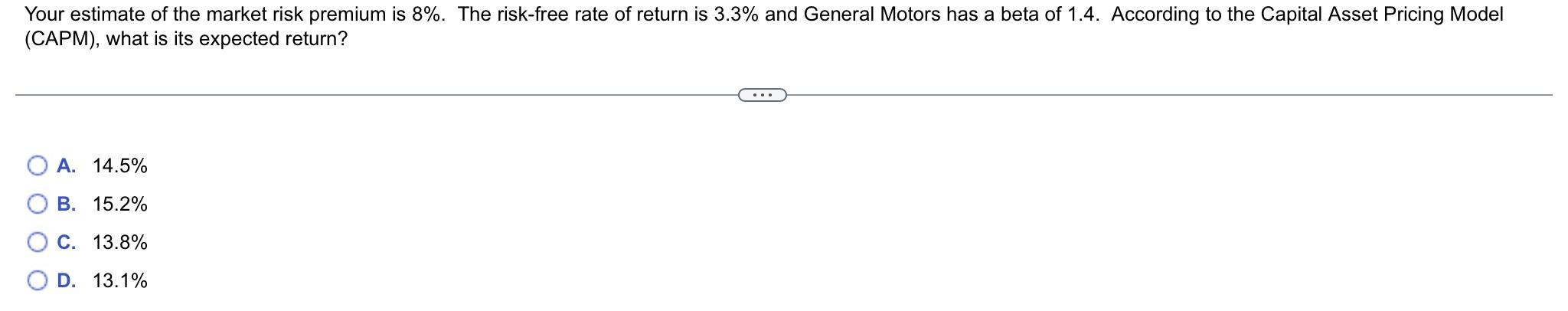

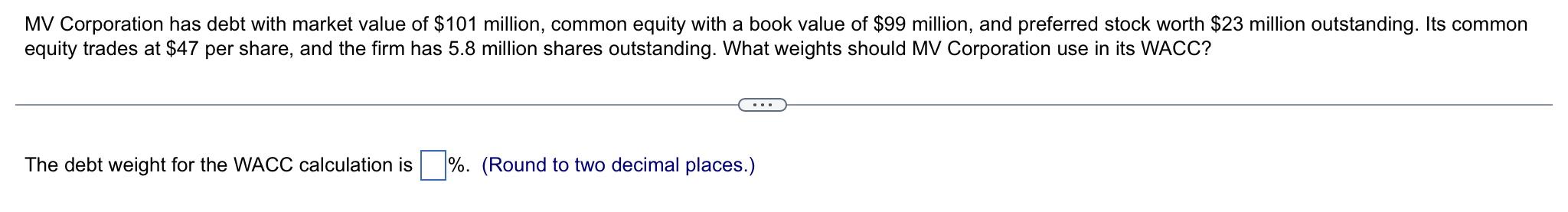

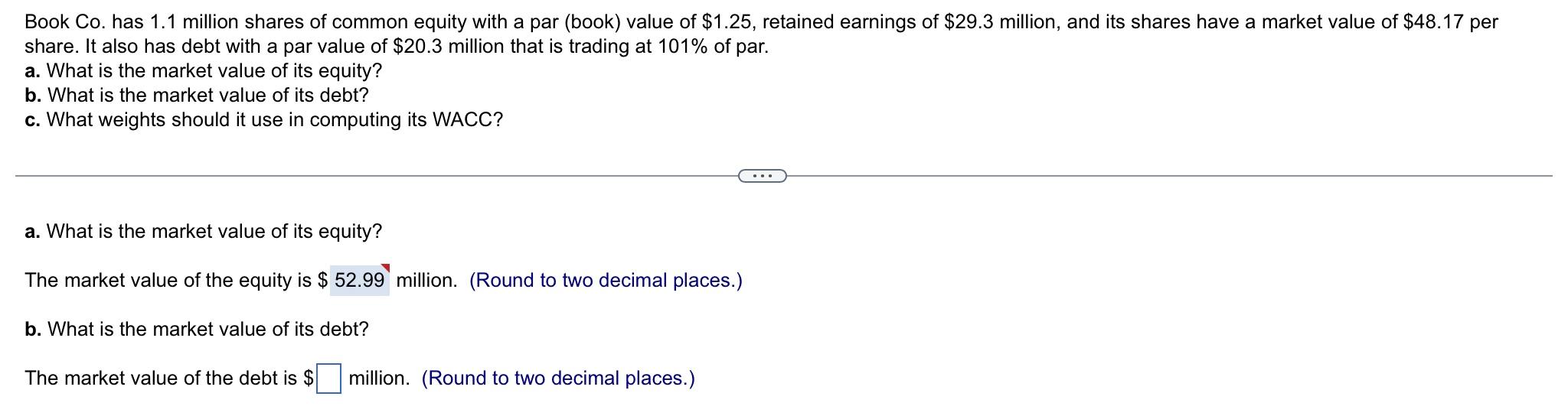

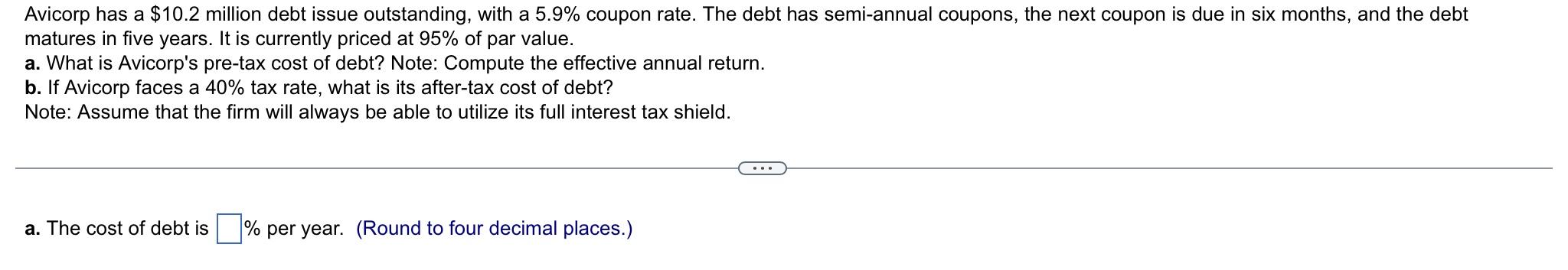

Consider the following average annual returns: Investment Small Stocks S&P 500 Corporate Bonds Treasure Bonds Treasury Bills Average Return 23% 13.2% 7.8% 6.7% 4.2% What is the excess return for the S&P 500? A. 9% B. 0% C. 16% OD. 11.3% Suppose Intel stock has a beta of 1.55, whereas Boeing stock has a beta of 0.95. If the risk-free interest rate is 4.9% and the expected return of the market portfolio is 10.5%, according to the CAPM, a. What is the expected return of Intel stock? b. What is the expected return of Boeing stock? c. What is the beta of a portfolio that consists of 65% Intel stock and 35% Boeing stock? d. What is the expected return of a portfolio that consists of 65% Intel stock and 35% Boeing stock? (There are two ways to solve this.) a. What is the expected return of Intel stock? Intel's expected return is %. (Round to one decimal place.) A portfolio has three stocks 250 shares of Yahoo (YHOO), 100 shares of General Motors (GM), and 50 shares of Standard and Poor's Index Fund (SPY). If the price of YHOO is $30, the price of GM is $30, and the price of SPY is $130, calculate the portfolio weight of YHOO and GM. O A. 24.3%, 32.6% B. 13.2%, 10.6% C. 44.1%, 17.6% O D. 41.9%, 18.5% Your estimate of the market risk premium is 8%. The risk-free rate of return is 3.3% and General Motors has a beta of 1.4. According to the Capital Asset Pricing Model (CAPM), what is its expected return? A. 14.5% B. 15.2% O C. 13.8% OD. 13.1% MV Corporation has debt with market value of $101 million, common equity with a book value of $99 million, and preferred stock worth $23 million outstanding. Its common equity trades at $47 per share, and the firm has 5.8 million shares outstanding. What weights should MV Corporation use in its WACC? The debt weight for the WACC calculation is %. (Round to two decimal places.) Book Co. has 1.1 million shares of common equity with a par (book) value of $1.25, retained earnings of $29.3 million, and its shares have a market value of $48.17 per share. It also has debt with a par value of $20.3 million that is trading at 101% of par. a. What is the market value of its equity? b. What is the market value of its debt? c. What weights should it use in computing its WACC? a. What is the market value of its equity? The market value of the equity is $ 52.99 million. (Round to two decimal places.) b. What is the market value of its debt? The market value of the debt is $ million. (Round to two decimal places.) Avicorp has a $10.2 million debt issue outstanding, with a 5.9% coupon rate. The debt has semi-annual coupons, the next coupon is due in six months, and the debt matures in five years. It is currently priced at 95% of par value. a. What is Avicorp's pre-tax cost of debt? Note: Compute the effective annual return. b. If Avicorp faces a 40% tax rate, what is its after-tax cost of debt? Note: Assume that the firm will always be able to utilize its full interest tax shield. a. The cost of debt is % per year. (Round to four decimal places.)