Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Consider the following balance sheet of a financial institution (FI): a. Assume that 40 in loan commitments are exercised so that the total value of

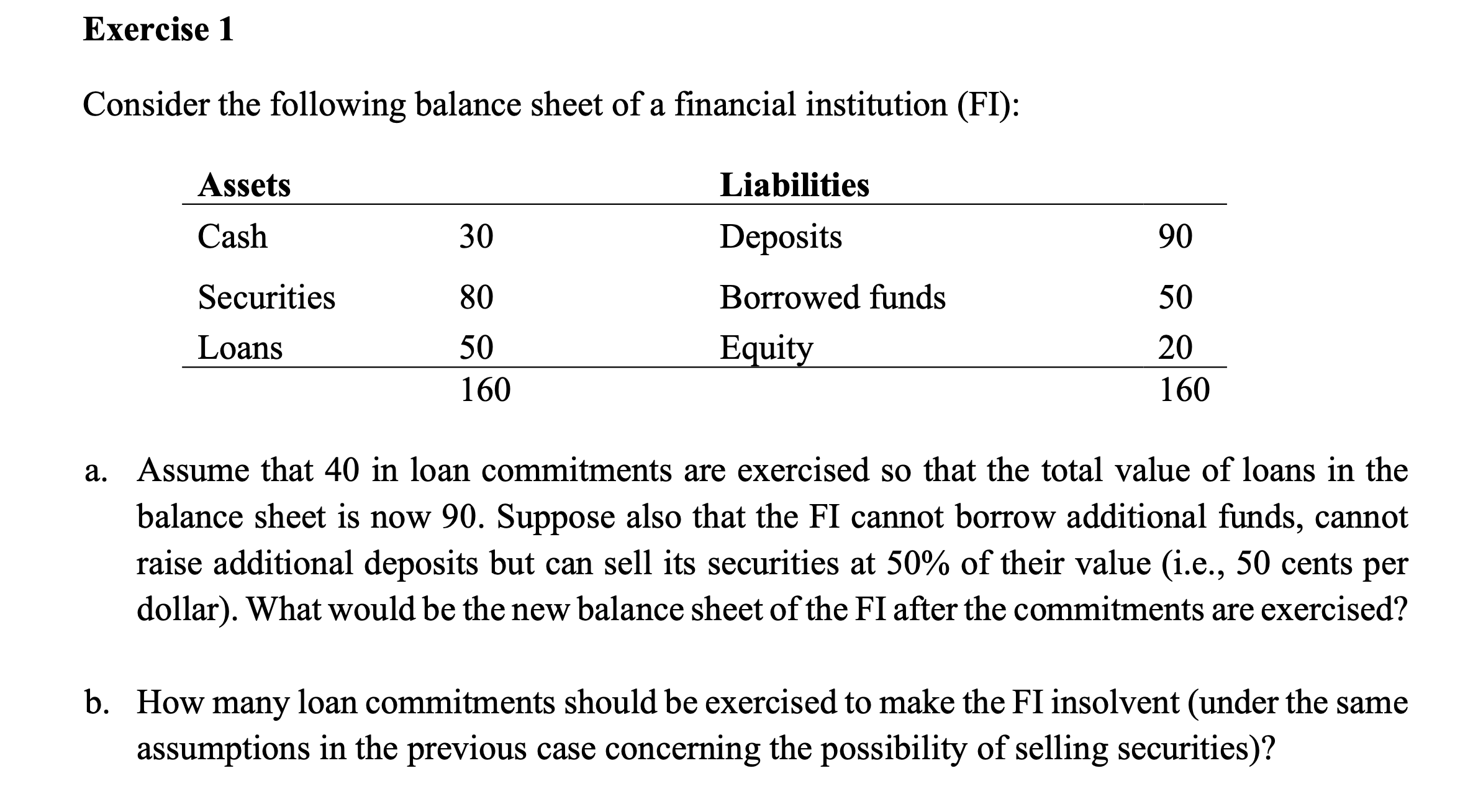

Consider the following balance sheet of a financial institution (FI): a. Assume that 40 in loan commitments are exercised so that the total value of loans in the balance sheet is now 90. Suppose also that the FI cannot borrow additional funds, cannot raise additional deposits but can sell its securities at 50\% of their value (i.e., 50 cents per dollar). What would be the new balance sheet of the FI after the commitments are exercised? b. How many loan commitments should be exercised to make the FI insolvent (under the same assumptions in the previous case concerning the possibility of selling securities)

Consider the following balance sheet of a financial institution (FI): a. Assume that 40 in loan commitments are exercised so that the total value of loans in the balance sheet is now 90. Suppose also that the FI cannot borrow additional funds, cannot raise additional deposits but can sell its securities at 50\% of their value (i.e., 50 cents per dollar). What would be the new balance sheet of the FI after the commitments are exercised? b. How many loan commitments should be exercised to make the FI insolvent (under the same assumptions in the previous case concerning the possibility of selling securities) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started