Question

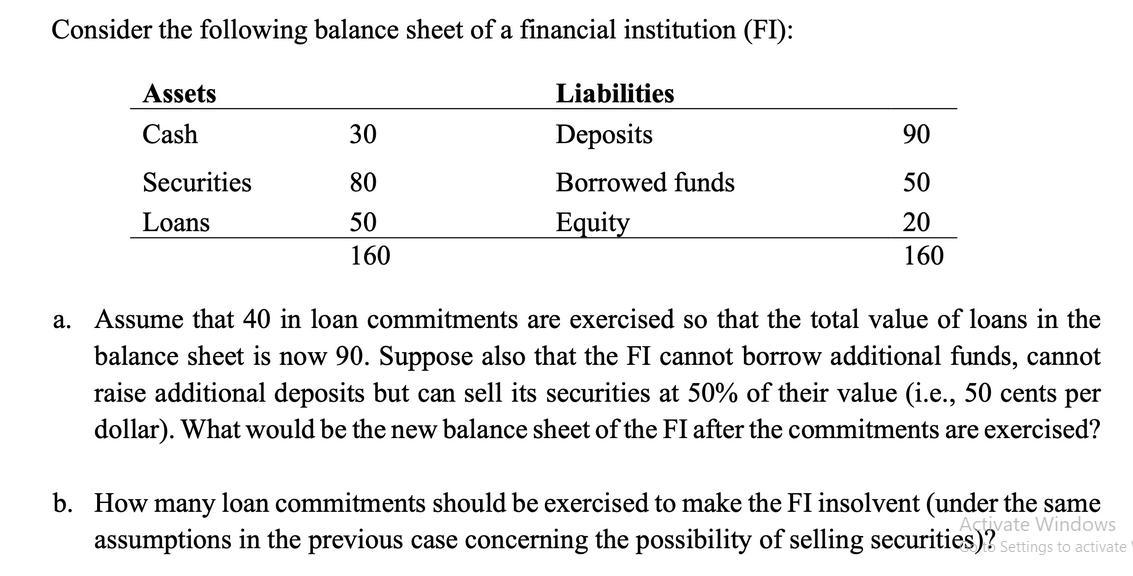

Consider the following balance sheet of a financial institution (FI): Assets Cash 30 Liabilities Deposits 90 Securities 80 Loans 50 160 Borrowed funds Equity

Consider the following balance sheet of a financial institution (FI): Assets Cash 30 Liabilities Deposits 90 Securities 80 Loans 50 160 Borrowed funds Equity 50 20 160 a. Assume that 40 in loan commitments are exercised so that the total value of loans in the balance sheet is now 90. Suppose also that the FI cannot borrow additional funds, cannot raise additional deposits but can sell its securities at 50% of their value (i.e., 50 cents per dollar). What would be the new balance sheet of the FI after the commitments are exercised? b. How many loan commitments should be exercised to make the FI insolvent (under the same Activate Windows assumptions in the previous case concerning the possibility of selling securities)? Settings to activate

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Money Banking and Financial Markets

Authors: Stephen Cecchetti, Kermit Schoenholtz

5th edition

77536320, 77536329, 1259746747, 978-1259746741

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App