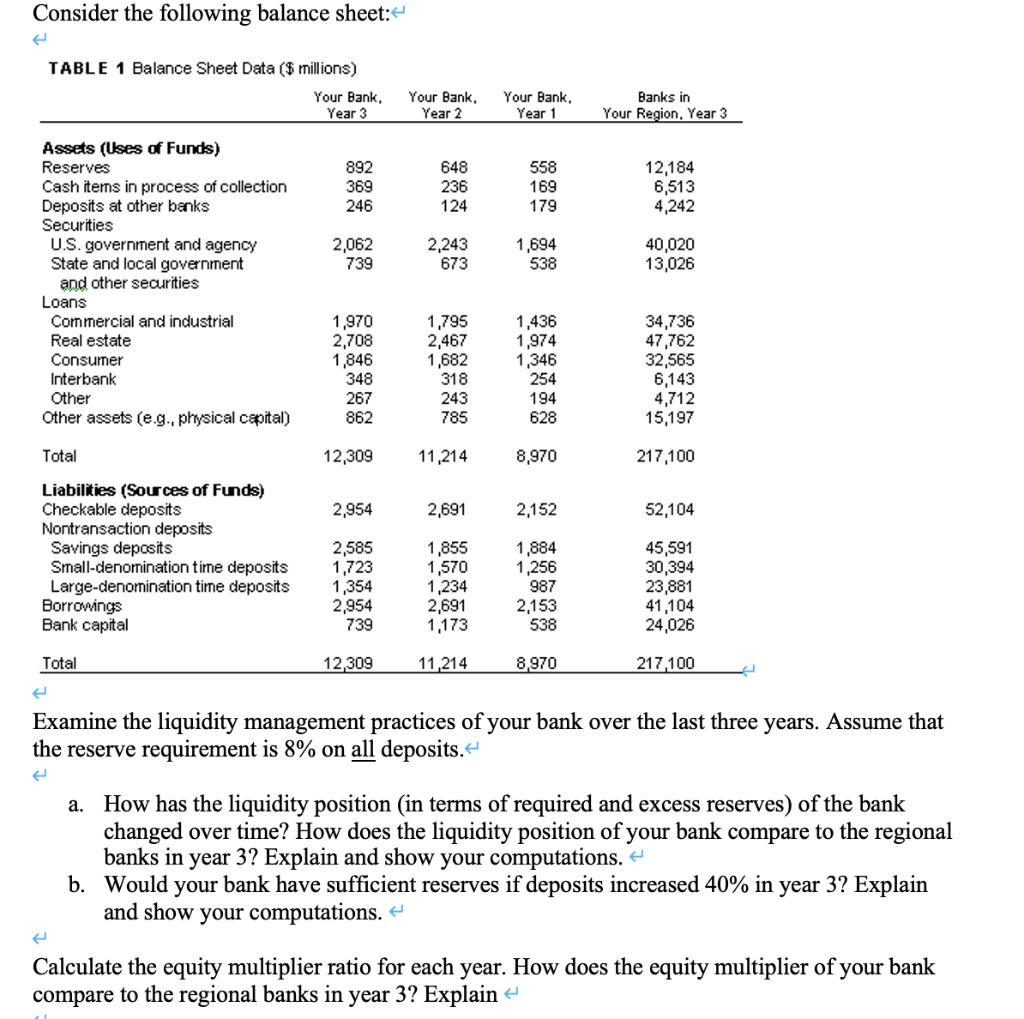

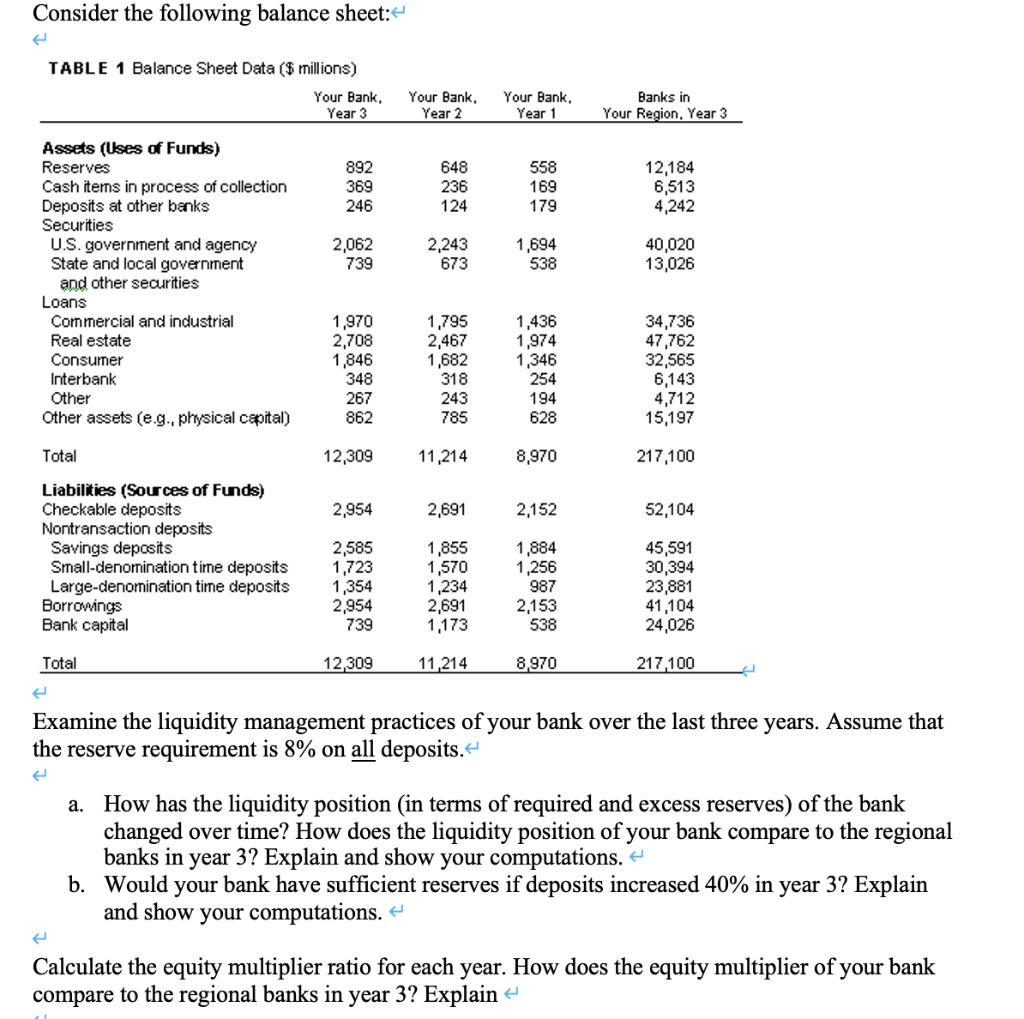

Consider the following balance sheet:- TABLE 1 Balance Sheet Data ($ millions) Your Bank, Year 3 Your Bank, Year 2 Your Bank Year 1 Banks in Your Region, Year 3 892 369 246 648 236 124 558 169 179 12,184 6,513 4,242 2,062 739 2,243 1,694 538 673 40,020 13,026 Assets (Uses of Funds) Reserves Cash items in process of collection Deposits at other banks Securities U.S. government and agency State and local government and other securities Loans Commercial and industrial Real estate Consumer Interbank Other Other assets (e.g., physical capital) 1,970 2,708 1,846 348 267 862 1,795 2,467 1,682 318 243 785 1,436 1,974 1,346 254 194 628 34,736 47,762 32,565 6,143 4,712 15,197 Total 12,309 11,214 8,970 217,100 2,954 2,691 2,152 52,104 Liabilities (Sources of Funds) Checkable deposits Nontransaction deposits Savings deposits Small-denomination time deposits Large-denomination time deposits Borrowings Bank capital 2,585 1,723 1,354 2,954 739 1,855 1,570 1,234 2,691 1,173 1,884 1,256 987 2,153 538 45,591 30,394 23,881 41,104 24,026 Total 12.309 11,214 8,970 217100 Examine the liquidity management practices of your bank over the last three years. Assume that the reserve requirement is 8% on all deposits. a. How has the liquidity position (in terms of required and excess reserves) of the bank changed over time? How does the liquidity position of your bank compare to the regional banks in year 3? Explain and show your computations. + b. Would your bank have sufficient reserves if deposits increased 40% in year 3? Explain and show your computations. Calculate the equity multiplier ratio for each year. How does the equity multiplier of your bank compare to the regional banks in year 3? Explain Consider the following balance sheet:- TABLE 1 Balance Sheet Data ($ millions) Your Bank, Year 3 Your Bank, Year 2 Your Bank Year 1 Banks in Your Region, Year 3 892 369 246 648 236 124 558 169 179 12,184 6,513 4,242 2,062 739 2,243 1,694 538 673 40,020 13,026 Assets (Uses of Funds) Reserves Cash items in process of collection Deposits at other banks Securities U.S. government and agency State and local government and other securities Loans Commercial and industrial Real estate Consumer Interbank Other Other assets (e.g., physical capital) 1,970 2,708 1,846 348 267 862 1,795 2,467 1,682 318 243 785 1,436 1,974 1,346 254 194 628 34,736 47,762 32,565 6,143 4,712 15,197 Total 12,309 11,214 8,970 217,100 2,954 2,691 2,152 52,104 Liabilities (Sources of Funds) Checkable deposits Nontransaction deposits Savings deposits Small-denomination time deposits Large-denomination time deposits Borrowings Bank capital 2,585 1,723 1,354 2,954 739 1,855 1,570 1,234 2,691 1,173 1,884 1,256 987 2,153 538 45,591 30,394 23,881 41,104 24,026 Total 12.309 11,214 8,970 217100 Examine the liquidity management practices of your bank over the last three years. Assume that the reserve requirement is 8% on all deposits. a. How has the liquidity position (in terms of required and excess reserves) of the bank changed over time? How does the liquidity position of your bank compare to the regional banks in year 3? Explain and show your computations. + b. Would your bank have sufficient reserves if deposits increased 40% in year 3? Explain and show your computations. Calculate the equity multiplier ratio for each year. How does the equity multiplier of your bank compare to the regional banks in year 3? Explain