Answered step by step

Verified Expert Solution

Question

1 Approved Answer

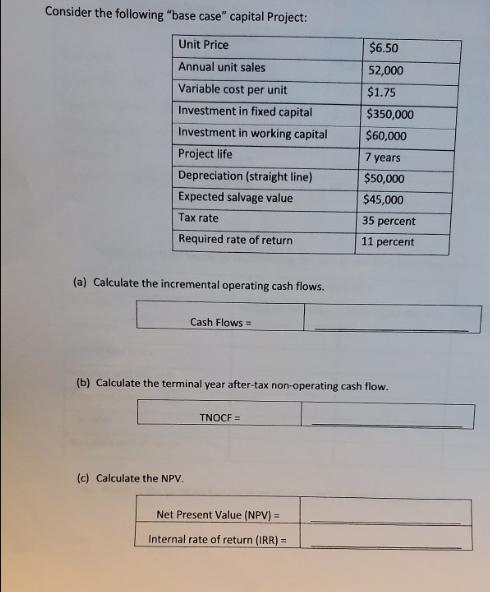

Consider the following base case capital Project: Unit Price Annual unit sales Variable cost per unit Investment in fixed capital Investment in working capital

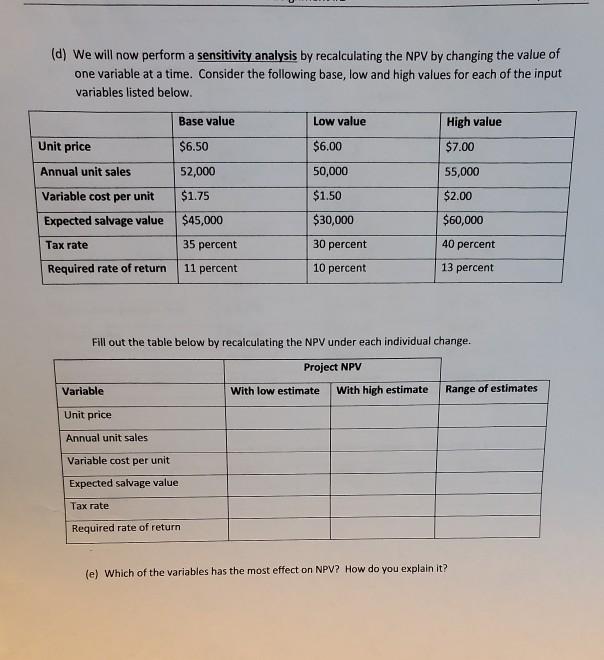

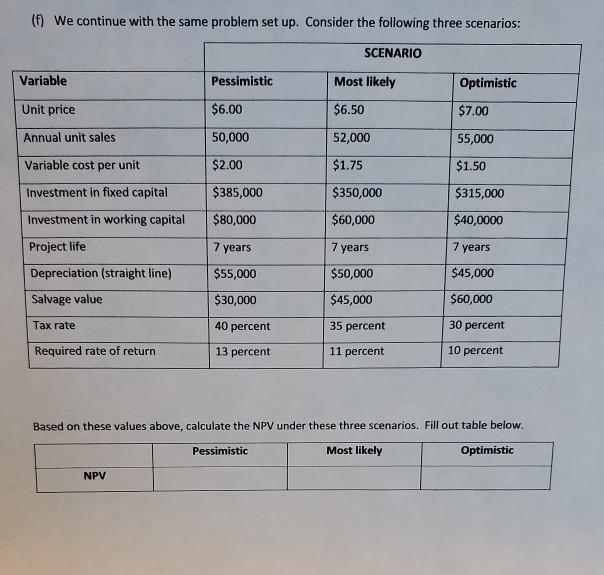

Consider the following "base case" capital Project: Unit Price Annual unit sales Variable cost per unit Investment in fixed capital Investment in working capital Project life Depreciation (straight line) Expected salvage value Tax rate Required rate of return (a) Calculate the incremental operating cash flows. Cash Flows = (c) Calculate the NPV. TNOCF = $6.50 52,000 $1.75 (b) Calculate the terminal year after-tax non-operating cash flow. Net Present Value (NPV) = Internal rate of return (IRR) = $350,000 $60,000 7 years $50,000 $45,000 35 percent 11 percent (d) We will now perform a sensitivity analysis by recalculating the NPV by changing the value of one variable at a time. Consider the following base, low and high values for each of the input variables listed below. Unit price Annual unit sales Variable cost per unit Expected salvage value Tax rate Required rate of return. Base value $6.50 52,000 $1.75 $45,000 Variable 35 percent 11 percent Unit price Annual unit sales Variable cost per unit Expected salvage value Tax rate Required rate of return. Low value $6.00 50,000 $1.50 $30,000 30 percent 10 percent High value $7.00 55,000 $2.00 $60,000 Fill out the table below by recalculating the NPV under each individual change. Project NPV With low estimate With high estimate 40 percent 13 percent Range of estimates (e) Which of the variables has the most effect on NPV? How do you explain it? (f) We continue with the same problem set up. Consider the following three scenarios: Variable Unit price Annual unit sales Variable cost per unit Investment in fixed capital Investment in working capital Project life Depreciation (straight line) Salvage value Tax rate Required rate of return Pessimistic $6.00 50,000 $2.00 $385,000 $80,000 7 years $55,000 $30,000 NPV 40 percent 13 percent SCENARIO Most likely $6.50 52,000 $1.75 $350,000 $60,000 7 years $50,000 $45,000 35 percent 11 percent Optimistic $7.00 55,000 $1.50 $315,000 $40,0000 7 years $45,000 $60,000 30 percent 10 percent Based on these values above, calculate the NPV under these three scenarios. Fill out table below. Pessimistic Most likely Optimistic

Step by Step Solution

★★★★★

3.30 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

To address the problem well take it step by step Starting with the incremental operating cash flows this is the formula well need to use Incremental Operating Cash Flow Unit Price Variable Cost per Un...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started