Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Consider the following binomial option situation: An option with eight months left to maturity has a strike price of 250. The underlying stock's current price

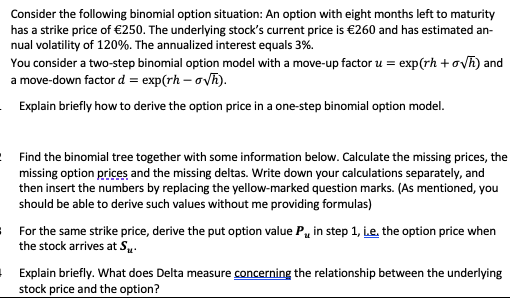

Consider the following binomial option situation: An option with eight months left to maturity has a strike price of 250. The underlying stock's current price is 260 and has estimated annual volatility of 120%. The annualized interest equals 3%. You consider a two-step binomial option model with a move-up factor u=exp(rh+h) and a move-down factor d=exp(rhh). Explain briefly how to derive the option price in a one-step binomial option model. Find the binomial tree together with some information below. Calculate the missing prices, the missing option prices and the missing deltas. Write down your calculations separately, and then insert the numbers by replacing the yellow-marked question marks. (As mentioned, you should be able to derive such values without me providing formulas) For the same strike price, derive the put option value Pu in step 1 , i.e. the option price when the stock arrives at Su. Explain briefly. What does Delta measure concerning the relationship between the underlying stock price and the option

Consider the following binomial option situation: An option with eight months left to maturity has a strike price of 250. The underlying stock's current price is 260 and has estimated annual volatility of 120%. The annualized interest equals 3%. You consider a two-step binomial option model with a move-up factor u=exp(rh+h) and a move-down factor d=exp(rhh). Explain briefly how to derive the option price in a one-step binomial option model. Find the binomial tree together with some information below. Calculate the missing prices, the missing option prices and the missing deltas. Write down your calculations separately, and then insert the numbers by replacing the yellow-marked question marks. (As mentioned, you should be able to derive such values without me providing formulas) For the same strike price, derive the put option value Pu in step 1 , i.e. the option price when the stock arrives at Su. Explain briefly. What does Delta measure concerning the relationship between the underlying stock price and the option Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started