Answered step by step

Verified Expert Solution

Question

1 Approved Answer

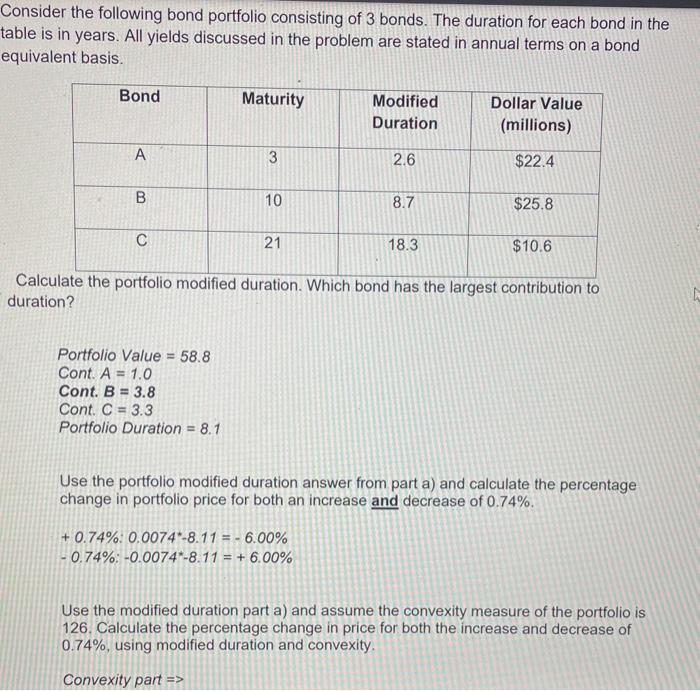

Consider the following bond portfolio consisting of 3 bonds. The duration for each bond in the table is in years. All yields discussed in

Consider the following bond portfolio consisting of 3 bonds. The duration for each bond in the table is in years. All yields discussed in the problem are stated in annual terms on a bond equivalent basis. Bond A B C Portfolio Value = 58.8 Cont. A 1.0 = Maturity Cont. B = 3.8 Cont. C = 3.3 Portfolio Duration = 8.1 3 10 21 Modified Duration 2.6 +0.74%: 0.0074-8.11=- 6.00% -0.74%: -0.0074*-8.11 = +6.00% 8.7 18.3 Dollar Value (millions) $22.4 Calculate the portfolio modified duration. Which bond has the largest contribution to duration? $25.8 $10.6 Use the portfolio modified duration answer from part a) and calculate the percentage change in portfolio price for both an increase and decrease of 0.74%. Use the modified duration part a) and assume the convexity measure of the portfolio is 126. Calculate the percentage change in price for both the increase and decrease of 0.74%, using modified duration and convexity. Convexity part =>

Step by Step Solution

★★★★★

3.49 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started