Answered step by step

Verified Expert Solution

Question

1 Approved Answer

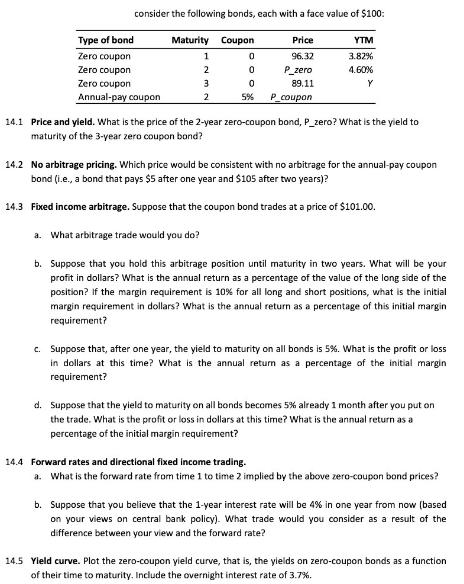

consider the following bonds, each with a face value of $100: Type of bond Zero coupon Zero coupon Zero coupon Annual-pay coupon Maturity Coupon

consider the following bonds, each with a face value of $100: Type of bond Zero coupon Zero coupon Zero coupon Annual-pay coupon Maturity Coupon 1 2 3 2 a. What arbitrage trade would you do? 0 0 0 5% Price 96.32 P_zero 89.11 P_coupon YTM 3.82% 4.60% Y 14.1 Price and yield. What is the price of the 2-year zero-coupon bond, P_zero? What is the yield to maturity of the 3-year zero coupon bond? 14.2 No arbitrage pricing. Which price would be consistent with no arbitrage for the annual-pay coupon bond (i.e., a bond that pays $5 after one year and $105 after two years)? 14.3 Fixed income arbitrage. Suppose that the coupon bond trades at a price of $101.00. b. Suppose that you hold this arbitrage position until maturity in two years. What will be your profit in dollars? What is the annual return as a percentage of the value of the long side of the position? If the margin requirement is 10% for all long and short positions, what is the initial margin requirement in dollars? What is the annual return as a percentage of this initial margin requirement? c. Suppose that, after one year, the yield to maturity on all bonds is 5%. What is the profit or loss in dollars at this time? What is the annual return as a percentage of the initial margin requirement? d. Suppose that the yield to maturity on all bonds becomes 5% already 1 month after you put on the trade. What is the profit or loss in dollars at this time? What is the annual return as a percentage of the initial margin requirement? 14.4 Forward rates and directional fixed income trading. a. What is the forward rate from time 1 to time 2 implied by the above zero-coupon bond prices? b. Suppose that you believe that the 1-year interest rate will be 4% in one year from now (based on your views on central bank policy). What trade would you consider as a result of the difference between your view and the forward rate? 14.5 Yield curve. Plot the zero-coupon yield curve, that is, the yields on zero-coupon bonds as a function of their time to maturity. Include the overnight interest rate of 3.7%.

Step by Step Solution

★★★★★

3.50 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

141 Price and yield a To find the price of the 2year zerocoupon bond Pzero we can use the formula Pzero 100 1 YTM2 Given Maturity 2 years Coupon 0 YTM ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started