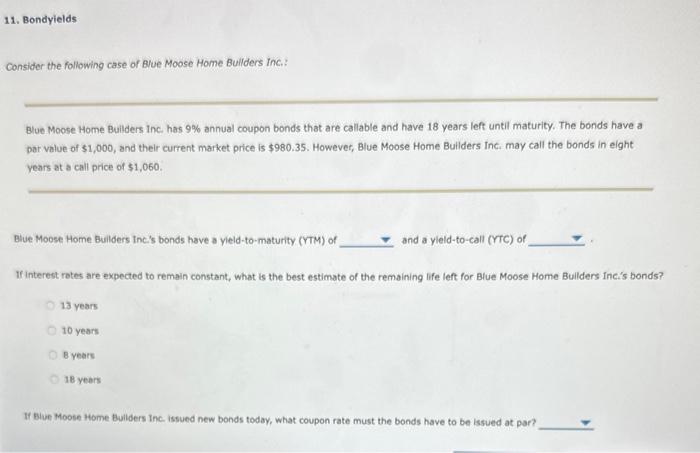

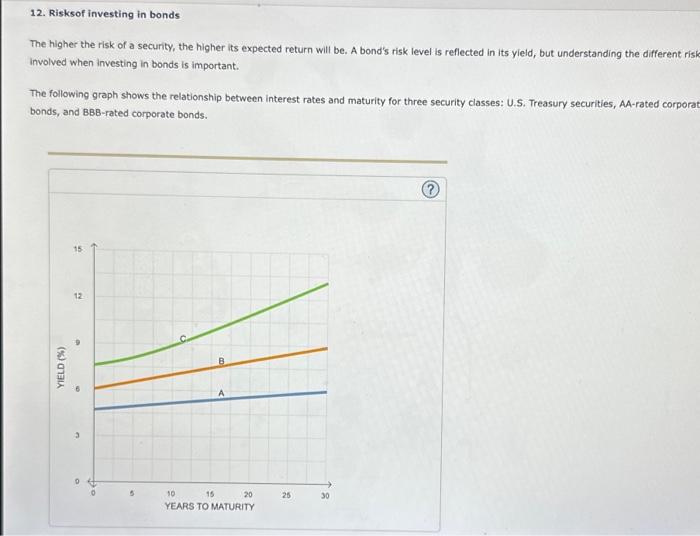

Consider the following case of Blue Moose Home Buliders inc: Blue Moose Home Builders inc has 9% annual coupon bonds that are callable and have 18 years left until maturity. The bonds have a par value of $1,000, and their current market price is $980.35. However, Blue Moose Home Builders Inc. may call the bonds in elght years at a call price of $1,060. Blue Moose Home Builders Inc's bonds have a yield-to-maturity (YTM) of and a yleld-to-call (YTC) of If interest rotes are expected to remain constant, what is the best estimate of the remaining life left for Blue Moose Home Builders incis bonds? 13 years 10 years B years 18 years If Blue Moose Home Bullders inc. issued new bonds today, what coupon rate must the bonds have to be issued at par? 12. Risks of investing in bonds The higher the risk of a security, the higher its expected return will be. A bond's risk level is reflected in its yield, but understanding the different ris involved when investing in bonds is important. The following graph shows the relationship between interest rates and maturity for three security classes: U.S. Treasury securities, AA-rated corpora bonds, and BBB-rated corporate bonds. Use the dropdown menus to identify the group of securities that correspond to each yieid curve. Curve A Curve B Curve C Clancy Garcia is retiring soon, so he is concerned about his investments providing him steady income every year. He is aware that if interest rates , the potential earnings power of the cash flow from his investments will increase. In particular, he is concerned that a decline in interest rates might lead to annual income from his investments. What kind of risk is Clancy most concerned about protecting against? Interest rate reinvestment risk Interest rate price risk Consider the following case of Blue Moose Home Buliders inc: Blue Moose Home Builders inc has 9% annual coupon bonds that are callable and have 18 years left until maturity. The bonds have a par value of $1,000, and their current market price is $980.35. However, Blue Moose Home Builders Inc. may call the bonds in elght years at a call price of $1,060. Blue Moose Home Builders Inc's bonds have a yield-to-maturity (YTM) of and a yleld-to-call (YTC) of If interest rotes are expected to remain constant, what is the best estimate of the remaining life left for Blue Moose Home Builders incis bonds? 13 years 10 years B years 18 years If Blue Moose Home Bullders inc. issued new bonds today, what coupon rate must the bonds have to be issued at par? 12. Risks of investing in bonds The higher the risk of a security, the higher its expected return will be. A bond's risk level is reflected in its yield, but understanding the different ris involved when investing in bonds is important. The following graph shows the relationship between interest rates and maturity for three security classes: U.S. Treasury securities, AA-rated corpora bonds, and BBB-rated corporate bonds. Use the dropdown menus to identify the group of securities that correspond to each yieid curve. Curve A Curve B Curve C Clancy Garcia is retiring soon, so he is concerned about his investments providing him steady income every year. He is aware that if interest rates , the potential earnings power of the cash flow from his investments will increase. In particular, he is concerned that a decline in interest rates might lead to annual income from his investments. What kind of risk is Clancy most concerned about protecting against? Interest rate reinvestment risk Interest rate price risk